Mondee Investor Presentation

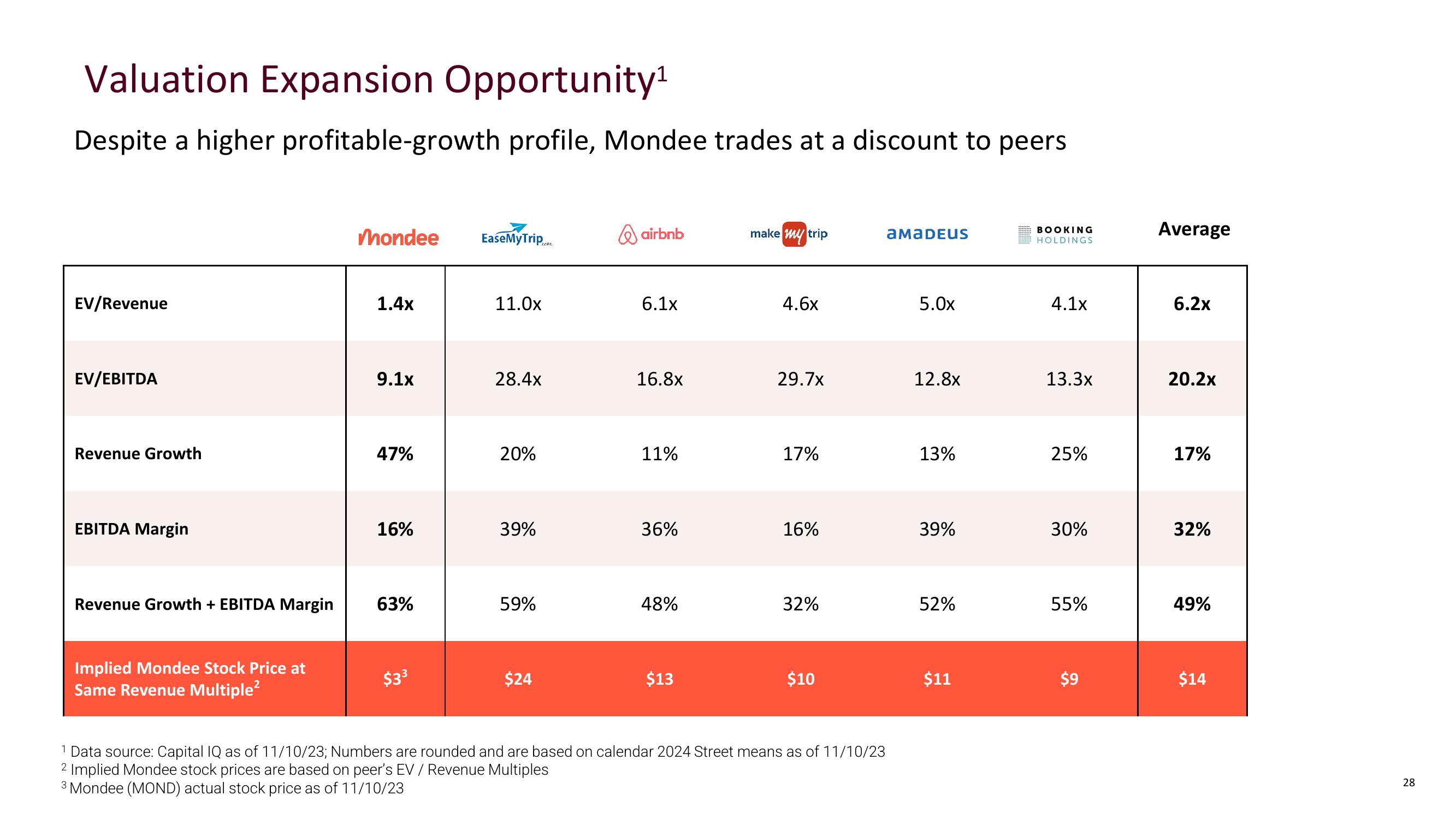

Valuation Expansion Opportunity¹

Despite a higher profitable-growth profile, Mondee trades at a discount to peers

EV/Revenue

EV/EBITDA

Revenue Growth

EBITDA Margin

Revenue Growth + EBITDA Margin

Implied Mondee Stock Price at

Same Revenue Multiple²

mondee

1.4x

9.1x

47%

16%

63%

$3³

EaseMyTrip.com

11.0x

28.4x

20%

39%

59%

$24

airbnb

6.1x

16.8x

11%

36%

48%

$13

make my trip

4.6x

29.7x

17%

16%

32%

$10

1 Data source: Capital IQ as of 11/10/23; Numbers are rounded and are based on calendar 2024 Street means as of 11/10/23

2 Implied Mondee stock prices are based on peer's EV / Revenue Multiples

3 Mondee (MOND) actual stock price as of 11/10/23

AMADEUS

5.0x

12.8x

13%

39%

52%

$11

BOOKING

HOLDINGS

4.1x

13.3x

25%

30%

55%

$9

Average

6.2x

20.2x

17%

32%

49%

$14

28View entire presentation