Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

Key Terms

Purchase Price / Consideration

Financing

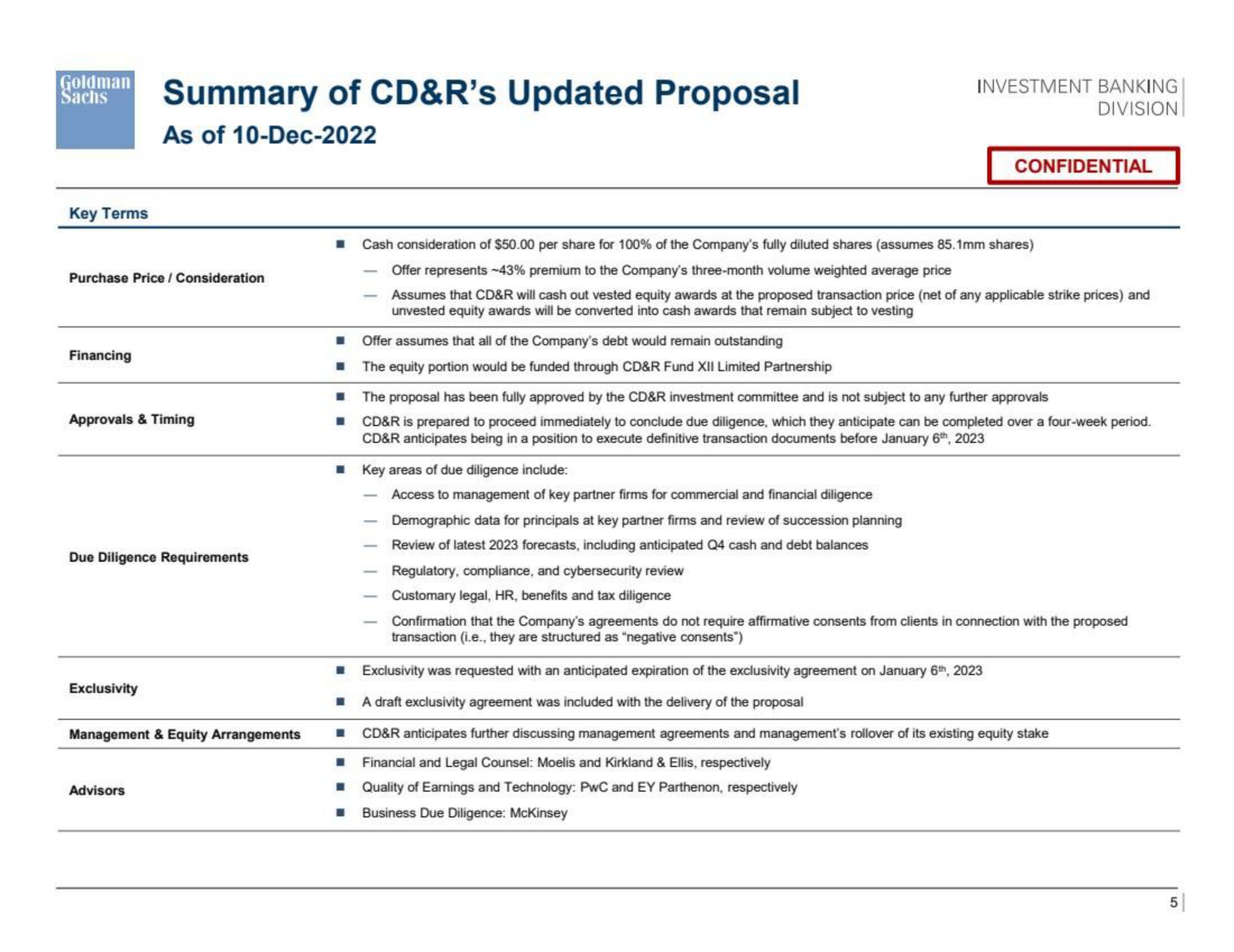

Summary of CD&R's Updated Proposal

As of 10-Dec-2022

Approvals & Timing

Due Diligence Requirements

Exclusivity

Management & Equity Arrangements

Advisors

■

■

I Cash consideration of $50.00 per share for 100% of the Company's fully diluted shares (assumes 85.1mm shares)

Offer represents -43% premium to the Company's three-month volume weighted average price

Assumes that CD&R will cash out vested equity awards at the proposed transaction price (net of any applicable strike prices) and

unvested equity awards will be converted into cash awards that remain subject to vesting

■

■

Offer assumes that all of the Company's debt would remain outstanding

The equity portion would be funded through CD&R Fund XII Limited Partnership

INVESTMENT BANKING

DIVISION

■ Key areas of due diligence include:

The proposal has been fully approved by the CD&R investment committee and is not subject to any further approvals

CD&R is prepared to proceed immediately to conclude due diligence, which they anticipate can be completed over a four-week period.

CD&R anticipates being in a position to execute definitive transaction documents before January 6th, 2023

Access to management of key partner firms for commercial and financial diligence

Demographic data for principals at key partner firms and review of succession planning

Review of latest 2023 forecasts, including anticipated Q4 cash and debt balances

Regulatory, compliance, and cybersecurity review

Customary legal, HR, benefits and tax diligence

CONFIDENTIAL

Confirmation that the Company's agreements do not require affirmative consents from clients in connection with the proposed

transaction (i.e., they are structured as "negative consents")

■ Exclusivity was requested with an anticipated expiration of the exclusivity agreement on January 6th, 2023

■

A draft exclusivity agreement was included with the delivery of the proposal

■

CD&R anticipates further discussing management agreements and management's rollover of its existing equity stake

Financial and Legal Counsel: Moelis and Kirkland & Ellis, respectively

■

■ Quality of Earnings and Technology: PwC and EY Parthenon, respectively

■ Business Due Diligence: McKinsey

5View entire presentation