Tudor, Pickering, Holt & Co Investment Banking

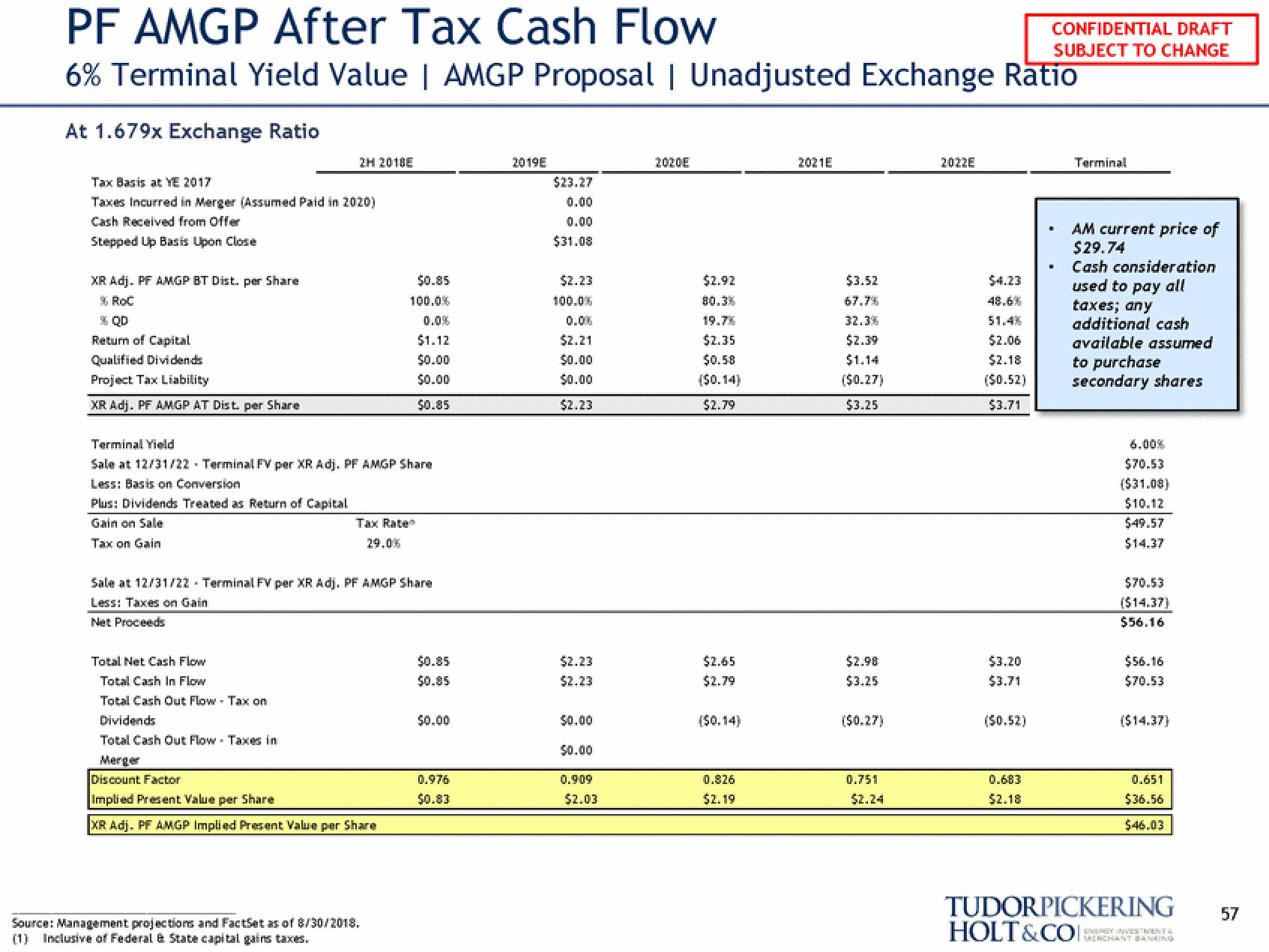

PF AMGP After Tax Cash Flow

6% Terminal Yield Value | AMGP Proposal | Unadjusted Exchange Ratio

At 1.679x Exchange Ratio

Tax Basis at YE 2017

Taxes Incurred in Merger (Assumed Paid in 2020)

Cash Received from Offer

Stepped Up Basis Upon Close

XR Adj. PF AMGP BT Dist. per Share

% RoC

% QD

Return of Capital

Qualified Dividends

Project Tax Liability

XR Adj. PF AMGP AT Dist. per Share

2H 2018E

Tax on Gain

Terminal Yield

Sale at 12/31/22 Terminal FV per XR Adj. PF AMGP Share

Less: Basis on Conversion

Plus: Dividends Treated as Return of Capital

Total Net Cash Flow

Total Cash In Flow

Total Cash Out Flow Tax on

Tax Rate

29.0%

Sale at 12/31/22 Terminal FV per XR Adj. PF AMGP Share

Less: Taxes on Gain

Net Proceeds

$0.85

100.0%

0.0%

$1.12

$0.00

$0.00

$0.85

Dividends

Total Cash Out Flow Taxes in

Merger

Discount Factor

Implied Present Value per Share

XR Adj. PF AMGP Implied Present Value per Share

Source: Management projections and FactSet as of 8/30/2018.

(1) Inclusive of Federal & State capital gains taxes.

$0.85

$0.85

$0.00

0.976

$0.83

2019E

$23.27

0.00

0.00

$31.08

$2.23

100.0%

0.0%

$2.21

$0.00

$0.00

$2.23

$2.23

$2.23

$0.00

$0.00

0.909

$2.03

2020E

$2.92

80.3%

19.7%

$2.35

$0.58

($0.14)

$2.79

$2.65

$2.79

($0.14)

0.826

$2.19

2021E

$3.52

67.7%

32.3%

$2.39

$1.14

($0.27)

$3.25

$2.98

$3.25

($0.27)

0.751

$2.24

2022E

$4.23

48.6%

51.4%

$2.06

$2.18

($0.52)

$3.71

$3.20

$3.71

($0.52)

0.683

$2.18

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

.

Terminal

AM current price of

$29.74

Cash consideration

used to pay all

taxes; any

additional cash

available assumed

to purchase

secondary shares

$70.53

($31.08)

$10.12

$49.57

$14.37

$70.53

($14.37)

$56.16

$56.16

$70.53

($14.37)

0.651

$36.56

$46.03

TUDORPICKERING

HOLT&COI:

SNEAGY NYESTMENT &

MERCHANT BANKING

57View entire presentation