Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

MAERSK OIL

Contents

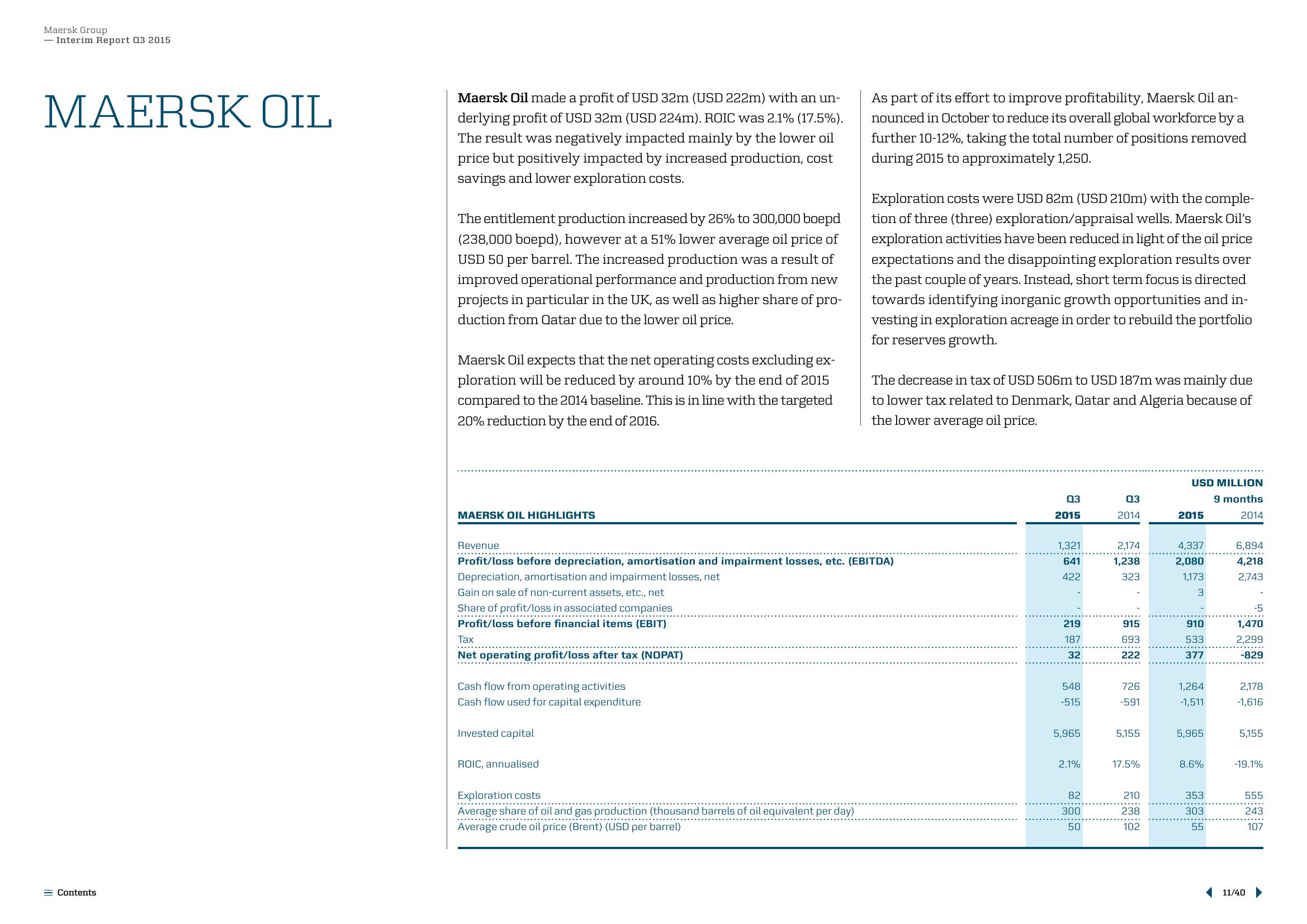

Maersk Oil made a profit of USD 32m (USD 222m) with an un-

derlying profit of USD 32m (USD 224m). ROIC was 2.1% (17.5%).

The result was negatively impacted mainly by the lower oil

price but positively impacted by increased production, cost

savings and lower exploration costs.

The entitlement production increased by 26% to 300,000 boepd

(238,000 boepd), however at a 51% lower average oil price of

USD 50 per barrel. The increased production was a result of

improved operational performance and production from new

projects in particular in the UK, as well as higher share of pro-

duction from Qatar due to the lower oil price.

Maersk Oil expects that the net operating costs excluding ex-

ploration will be reduced by around 10% by the end of 2015

compared to the 2014 baseline. This is in line with the targeted

20% reduction by the end of 2016.

MAERSK OIL HIGHLIGHTS

Share of profit/loss in associated companies

.............

Profit/loss before financial items (EBIT)

Tax

Net operating profit/loss after tax (NOPAT)

Revenue

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Cash flow from operating activities

Cash flow used for capital expenditure

Invested capital

ROIC, annualised

As part of its effort to improve profitability, Maersk Oil an-

nounced in October to reduce its overall global workforce by a

further 10-12%, taking the total number of positions removed

during 2015 to approximately 1,250.

Exploration costs

Average share of oil and gas production (thousand barrels of oil equivalent per day)

Average crude oil price (Brent) (USD per barrel)

Exploration costs were USD 82m (USD 210m) with the comple-

tion of three (three) exploration/appraisal wells. Maersk Oil's

exploration activities have been reduced in light of the oil price

expectations and the disappointing exploration results over

the past couple of years. Instead, short term focus is directed

towards identifying inorganic growth opportunities and in-

vesting in exploration acreage in order to rebuild the portfolio

for reserves growth.

The decrease in tax of USD 506m to USD 187m was mainly due

to lower tax related to Denmark, Qatar and Algeria because of

the lower average oil price.

03

2015

1,321

641

422

219

187

32

548

-515

5,965

2.1%

82

300

50

03

2014

2,174

1,238

323

915

693

222

726

-591

5,155

17.5%

210

238

102

USD MILLION

9 months

2014

2015

4,337

2,080

1,173

3

910

533

377

1,264

-1,511

5,965

8.6%

353

303

55

6,894

4,218

2,743

-5

1,470

2,299

-829

2,178

-1,616

5,155

-19.1%

555

243

107

11/40▶View entire presentation