Embracer Group Results Presentation Deck

EARNOUTS AND APM UPDATE

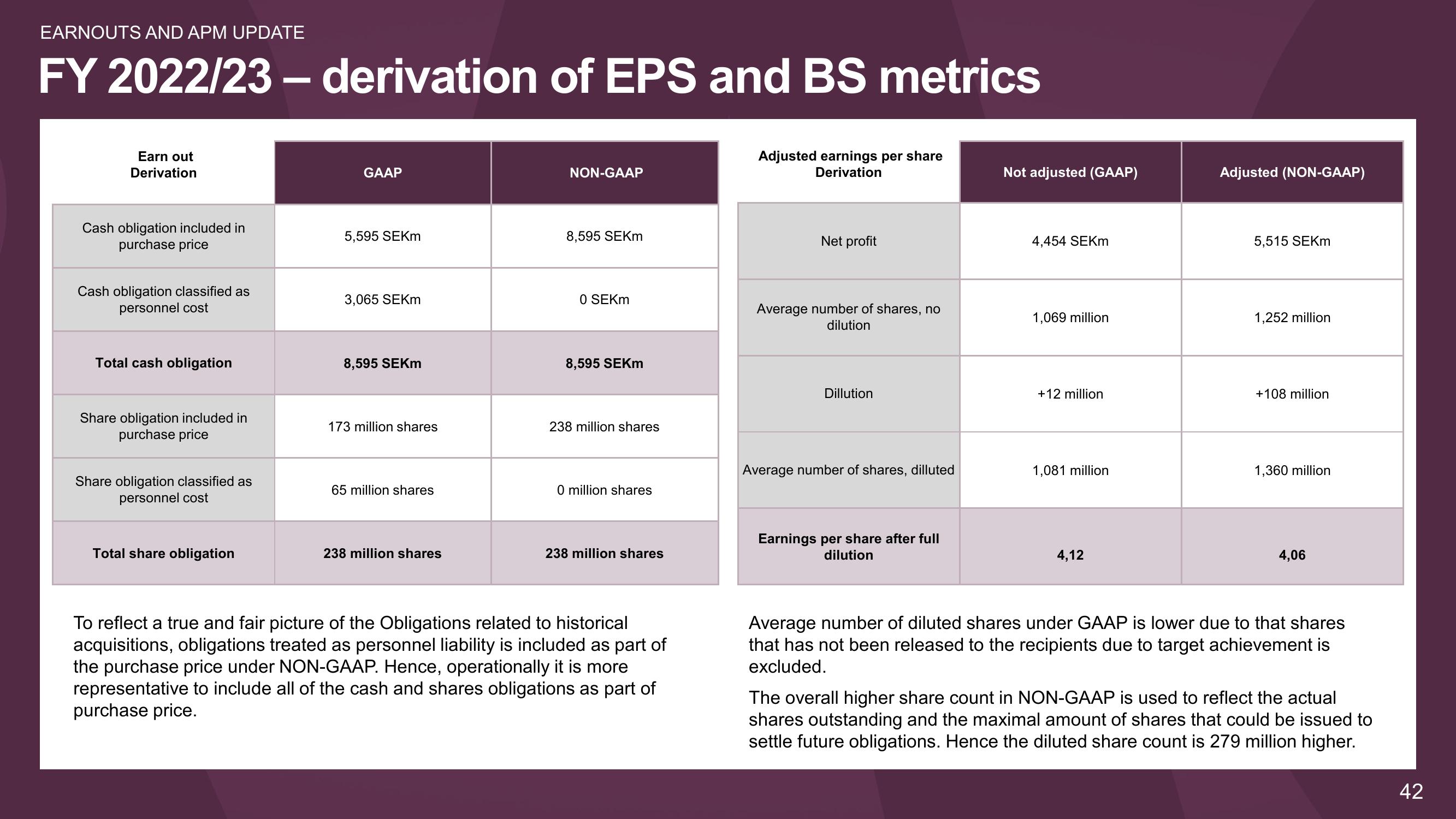

FY 2022/23 -– derivation of EPS and BS metrics

Earn out

Derivation

Cash obligation included in

purchase price

Cash obligation classified as

personnel cost

Total cash obligation

Share obligation included in

purchase price

Share obligation classified as

personnel cost

Total share obligation

GAAP

5,595 SEKM

3,065 SEKM

8,595 SEKM

173 million shares

65 million shares

238 million shares

NON-GAAP

8,595 SEKM

0 SEKM

8,595 SEKM

238 million shares

0 million shares

238 million shares

To reflect a true and fair picture of the Obligations related to historical

acquisitions, obligations treated as personnel liability is included as part of

the purchase price under NON-GAAP. Hence, operationally it is more

representative to include all of the cash and shares obligations as part of

purchase price.

Adjusted earnings per share

Derivation

Net profit

Average number of shares, no

dilution

Dillution

Average number of shares, dilluted

Earnings per share after full

dilution

Not adjusted (GAAP)

4,454 SEKM

1,069 million

+12 million

1,081 million

4,12

Adjusted (NON-GAAP)

5,515 SEKM

1,252 million

+108 million

1,360 million

4,06

Average number of diluted shares under GAAP is lower due to that shares

that has not been released to the recipients due to target achievement is

excluded.

The overall higher share count in NON-GAAP is used to reflect the actual

shares outstanding and the maximal amount of shares that could be issued to

settle future obligations. Hence the diluted share count is 279 million higher.

42View entire presentation