Truist Financial Corp Results Presentation Deck

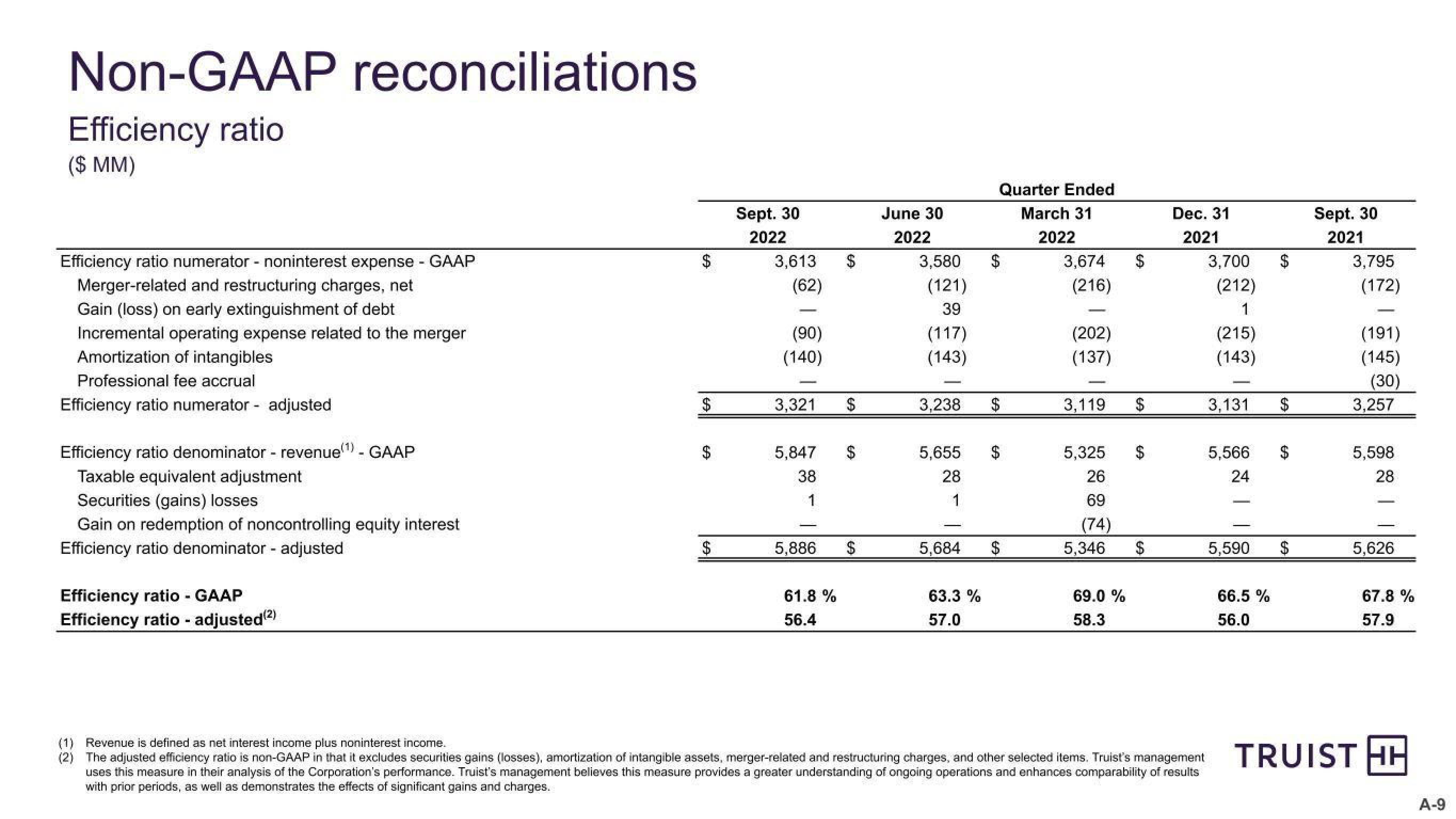

Non-GAAP reconciliations

Efficiency ratio

($ MM)

Efficiency ratio numerator - noninterest expense - GAAP

Merger-related and restructuring charges, net

Gain (loss) on early extinguishment of debt

Incremental operating expense related to the merger

Amortization of intangibles

Professional fee accrual

Efficiency ratio numerator - adjusted

Efficiency ratio denominator - revenue(¹) - GAAP

(1)_

Taxable equivalent adjustment

Securities (gains) losses

Gain on redemption of noncontrolling equity interest

Efficiency ratio denominator - adjusted

Efficiency ratio - GAAP

Efficiency ratio - adjusted (2)

GA

$

69

$

Sept. 30

2022

3,613

(62)

(90)

(140)

3,321

5,847

38

1

5,886

61.8 %

56.4

June 30

2022

3,580

(121)

39

(117)

(143)

5,655

28

3,238 $

5,684

Quarter Ended

March 31

2022

63.3 %

57.0

$

$

3,674

(216)

(202)

(137)

3,119

5,325

26

69

(74)

5,346

69.0 %

58.3

$

Dec. 31

2021

(1) Revenue is defined as net interest income plus noninterest income.

(2) The adjusted efficiency ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges, and other selected items. Truist's management

uses this measure in their analysis of the Corporation's performance. Truist's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results

with prior periods, as well as demonstrates the effects of significant gains and charges.

3,700

(212)

1

(215)

(143)

3,131

5,566

24

5,590

66.5%

56.0

$

$

$

Sept. 30

2021

3,795

(172)

(191)

(145)

(30)

3,257

5,598

28

5,626

67.8 %

57.9

TRUIST HE

A-9View entire presentation