SoftBank Results Presentation Deck

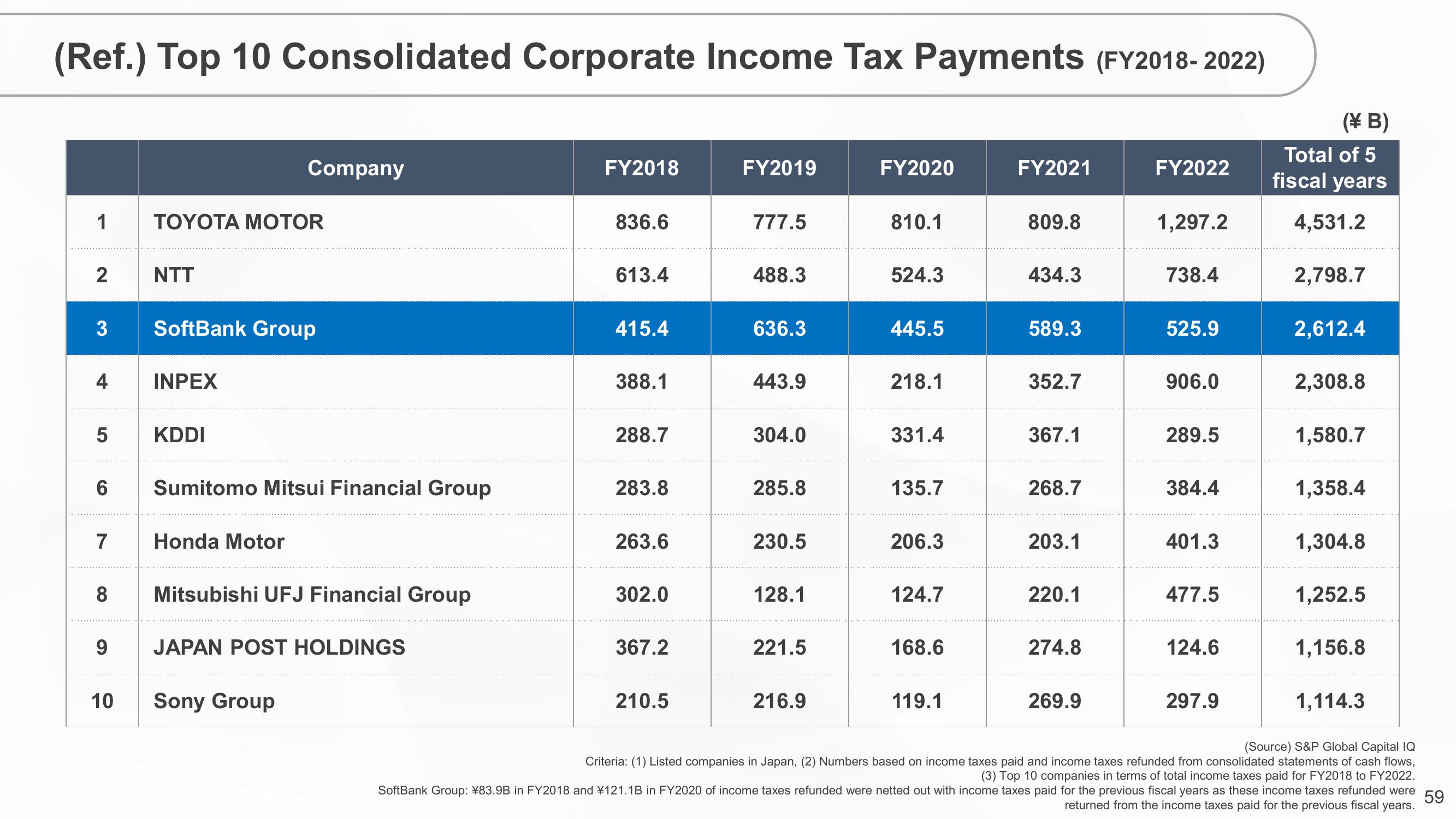

(Ref.) Top 10 Consolidated Corporate Income Tax Payments (FY2018-2022)

1 TOYOTA MOTOR

2

3

4

LO

5

7

8

9

NTT

10

6 Sumitomo Mitsui Financial Group

SoftBank Group

INPEX

KDDI

Company

Honda Motor

Mitsubishi UFJ Financial Group

JAPAN POST HOLDINGS

Sony Group

FY2018

836.6

613.4

415.4

388.1

288.7

283.8

263.6

302.0

367.2

210.5

FY2019

777.5

488.3

636.3

443.9

304.0

285.8

230.5

128.1

221.5

216.9

FY2020

810.1

524.3

445.5

218.1

331.4

135.7

206.3

124.7

168.6

119.1

FY2021

809.8

434.3

589.3

352.7

367.1

268.7

203.1

220.1

274.8

269.9

FY2022

1,297.2

738.4

525.9

906.0

289.5

384.4

401.3

477.5

124.6

297.9

(¥ B)

Total of 5

fiscal years

4,531.2

2,798.7

2,612.4

2,308.8

1,580.7

1,358.4

1,304.8

1,252.5

1,156.8

1,114.3

(Source) S&P Global Capital IQ

Criteria: (1) Listed companies in Japan, (2) Numbers based on income taxes paid and income taxes refunded from consolidated statements of cash flows,

(3) Top 10 companies in terms of total income taxes paid for FY2018 to FY2022.

SoftBank Group: ¥83.9B in FY2018 and ¥121.1B in FY2020 of income taxes refunded were netted out with income taxes paid for the previous fiscal years as these income taxes refunded were

59

returned from the income taxes paid for the previous fiscal years.View entire presentation