Babylon SPAC Presentation Deck

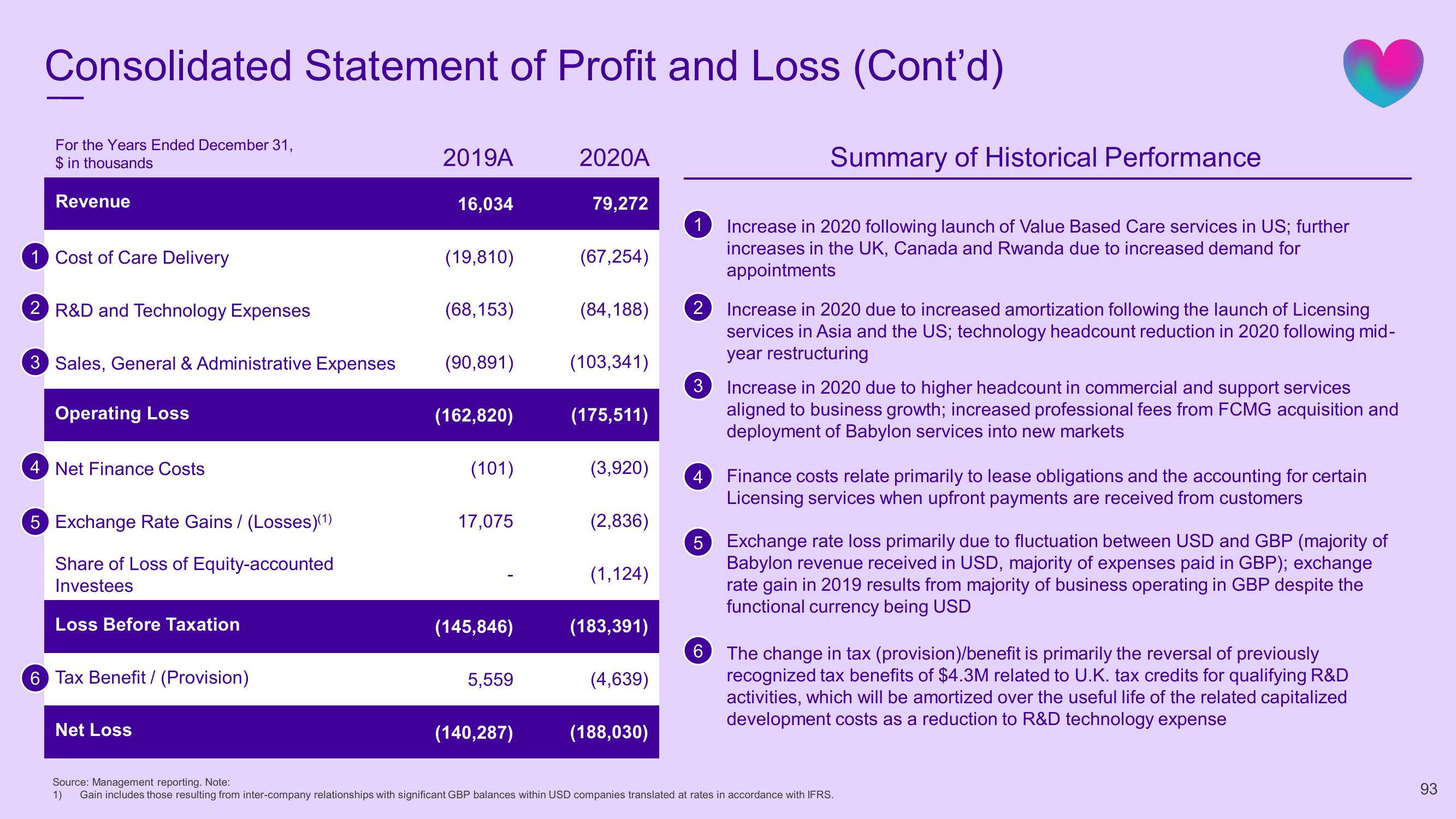

Consolidated Statement of Profit and Loss (Cont'd)

For the Years Ended December 31,

$ in thousands

Revenue

1 Cost of Care Delivery

2 R&D and Technology Expenses

3 Sales, General & Administrative Expenses

Operating Loss

4 Net Finance Costs

5 Exchange Rate Gains/ (Losses)(1)

Share of Loss of Equity-accounted

Investees

Loss Before Taxation

6 Tax Benefit / (Provision)

Net Loss

2019A

16,034

(19,810)

(68,153)

(90,891)

(162,820)

(101)

17,075

(145,846)

5,559

(140,287)

2020A

79,272

(67,254)

(84,188)

(103,341)

(175,511)

(3,920)

(2,836)

(1,124)

(183,391)

(4,639)

(188,030)

1 Increase in 2020 following launch of Value Based Care services in US; further

increases in the UK, Canada and Rwanda due to increased demand for

appointments

2

3

4

Summary of Historical Performance

6

Increase in 2020 due to increased amortization following the launch of Licensing

services in Asia and the US; technology headcount reduction in 2020 following mid-

year restructuring

Increase in 2020 due to higher headcount in commercial and support services

aligned to business growth; increased professional fees from FCMG acquisition and

deployment of Babylon services into new markets

Finance costs relate primarily to lease obligations and the accounting for certain

Licensing services when upfront payments are received from customers

5 Exchange rate loss primarily due to fluctuation between USD and GBP (majority of

Babylon revenue received in USD, majority of expenses paid in GBP); exchange

rate gain in 2019 results from majority of business operating in GBP despite the

functional currency being USD

The change in tax (provision)/benefit is primarily the reversal of previously

recognized tax benefits of $4.3M related to U.K. tax credits for qualifying R&D

activities, which will be amortized over the useful life of the related capitalized

development costs as a reduction to R&D technology expense

Source: Management reporting. Note:

1) Gain includes those resulting from inter-company relationships with significant GBP balances within USD companies translated at rates in accordance with IFRS.

93View entire presentation