J.P.Morgan Mergers and Acquisitions Presentation Deck

Transaction overview

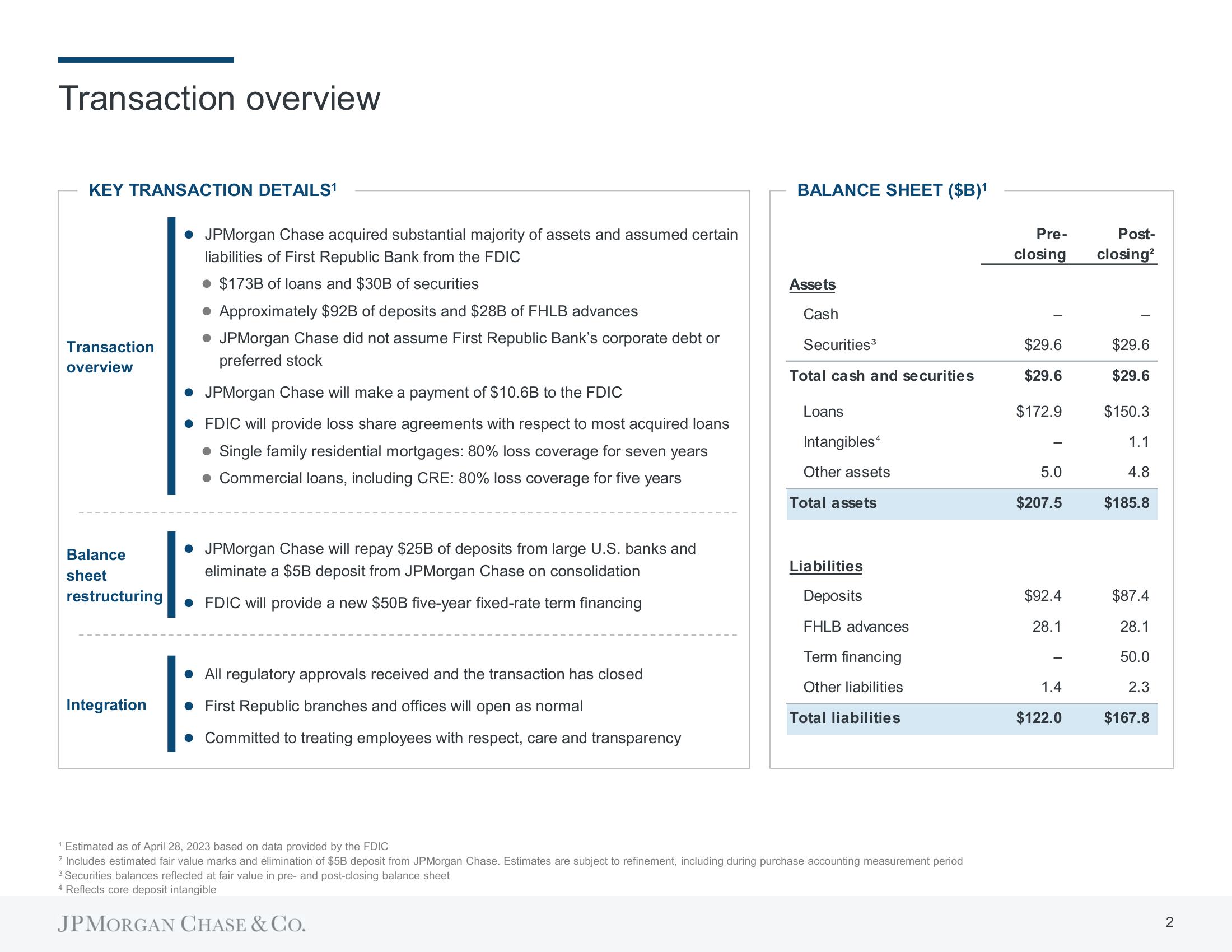

KEY TRANSACTION DETAILS¹

Transaction

overview

Balance

sheet

restructuring

Integration

• JPMorgan Chase acquired substantial majority of assets and assumed certain

liabilities of First Republic Bank from the FDIC

. $173B of loans and $30B of securities

• Approximately $92B of deposits and $28B of FHLB advances

• JPMorgan Chase did not assume First Republic Bank's corporate debt or

preferred stock

• JPMorgan Chase will make a payment of $10.6B to the FDIC

FDIC will provide loss share agreements with respect to most acquired loans

• Single family residential mortgages: 80% loss coverage for seven years

• Commercial loans, including CRE: 80% loss coverage for five years

• JPMorgan Chase will repay $25B of deposits from large U.S. banks and

eliminate a $5B deposit from JPMorgan Chase on consolidation

• FDIC will provide a new $50B five-year fixed-rate term financing

• All regulatory approvals received and the transaction has closed

• First Republic branches and offices will open as normal

• Committed to treating employees with respect, care and transparency

BALANCE SHEET($B)¹

Assets

Cash

Securities³

Total cash and securities

Loans

Intangibles

Other assets

Total assets

Liabilities

Deposits

FHLB advances

Term financing

Other liabilities

Total liabilities

¹ Estimated as of April 28, 2023 based on data provided by the FDIC

2 Includes estimated fair value marks and elimination of $5B deposit from JPMorgan Chase. Estimates are subject to refinement, including during purchase accounting measurement period

3 Securities balances reflected at fair value in pre- and post-closing balance sheet

4 Reflects core deposit intangible

JPMORGAN CHASE & CO.

Pre-

closing

$29.6

$29.6

$172.9

5.0

$207.5

$92.4

28.1

1.4

$122.0

Post-

closing²

$29.6

$29.6

$150.3

1.1

4.8

$185.8

$87.4

28.1

50.0

2.3

$167.8

2View entire presentation