Credit Suisse Results Presentation Deck

Swiss Bank

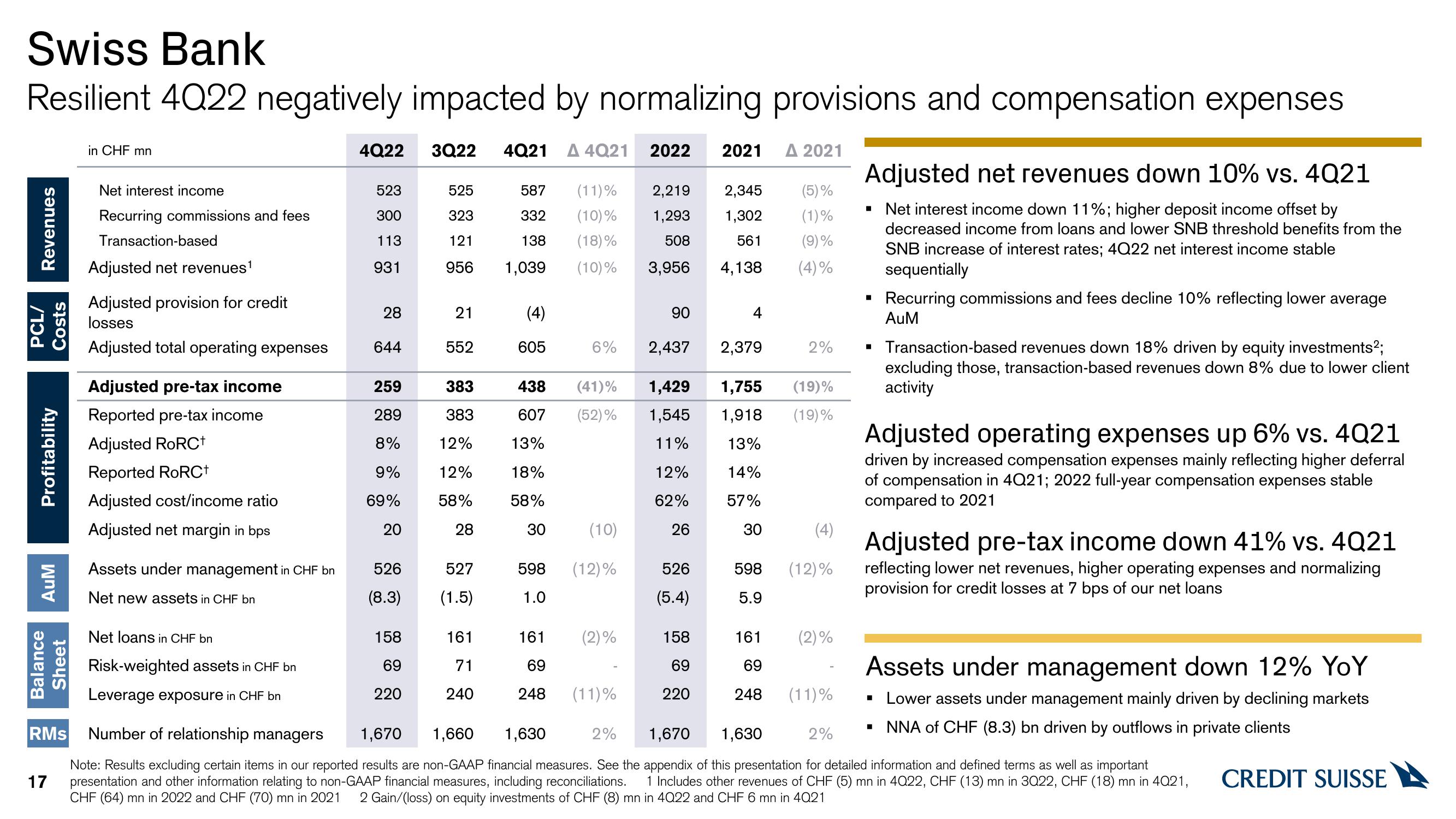

Resilient 4Q22 negatively impacted by normalizing provisions and compensation expenses

A 4Q21 2022 2021 A 2021

Revenues

PCL/

Costs

Profitability

AuM

Balance

Sheet

RMS

17

in CHF mn

Net interest income

Recurring commissions and fees

Transaction-based

Adjusted net revenues¹

Adjusted provision for credit

losses

Adjusted total operating expenses

Adjusted pre-tax income

Reported pre-tax income

Adjusted RoRC+

Reported RORC+

Adjusted cost/income ratio

Adjusted net margin in bps

Assets under management in CHF bn

Net new assets in CHF bn

Net loans in CHF bn

Risk-weighted assets in CHF bn

Leverage exposure in CHF bn

4Q22

523

300

113

931

28

644

259

289

8%

9%

69%

20

526

(8.3)

158

69

220

3Q22 4Q21

525

323

121

956

21

552

383

383

12%

12%

58%

28

527

(1.5)

161

71

240

587 (11)% 2,219 2,345

332 (10)% 1,293 1,302

508

561

3,956

4,138

138 (18)%

1,039 (10)%

(4)

605

6%

438 (41)%

607 (52)%

13%

18%

58%

30 (10)

598 (12)%

1.0

(2)%

161

69

248 (11)%

90

2,437

1,429

1,545

11%

12%

62%

26

526

(5.4)

158

69

220

2,379

30

1,755

(19)%

1,918 (19)%

13%

14%

57%

598

5.9

161

69

248

(5)%

(1)%

(9)%

(4)%

2%

1,630

(4)

(12)%

(2)%

(11)%

Adjusted net revenues down 10% vs. 4021

Net interest income down 11%; higher deposit income offset by

decreased income from loans and lower SNB threshold benefits from the

SNB increase of interest rates; 4Q22 net interest income stable

sequentially

■

■

■

Recurring commissions and fees decline 10% reflecting lower average

AuM

Transaction-based revenues down 18% driven by equity investments²;

excluding those, transaction-based revenues down 8% due to lower client

activity

Adjusted operating expenses up 6% vs. 4021

driven by increased compensation expenses mainly reflecting higher deferral

of compensation in 4Q21; 2022 full-year compensation expenses stable

compared to 2021

Adjusted pre-tax income down 41% vs. 4Q21

reflecting lower net revenues, higher operating expenses and normalizing

provision for credit losses at 7 bps of our net loans

■

Assets under management down 12% YoY

▪ Lower assets under management mainly driven by declining markets

NNA of CHF (8.3) bn driven by outflows in private clients

1,670 1,660 1,630

2%

1,670

2%

Number of relationship managers

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Includes other revenues of CHF (5) mn in 4Q22, CHF (13) mn in 3Q22, CHF (18) mn in 4021, CREDIT SUISSE

CHF (64) mn in 2022 and CHF (70) mn in 2021 2 Gain/(loss) on equity investments of CHF (8) mn in 4Q22 and CHF 6 mn in 4Q21View entire presentation