Bank of America Investment Banking Pitch Book

Opportunity

Opportunity

5

Opportunity

6

Opportunity

7

Source: Pioneer Forecast.

Note: Dollars in milions.

■

■

7

■

■

■

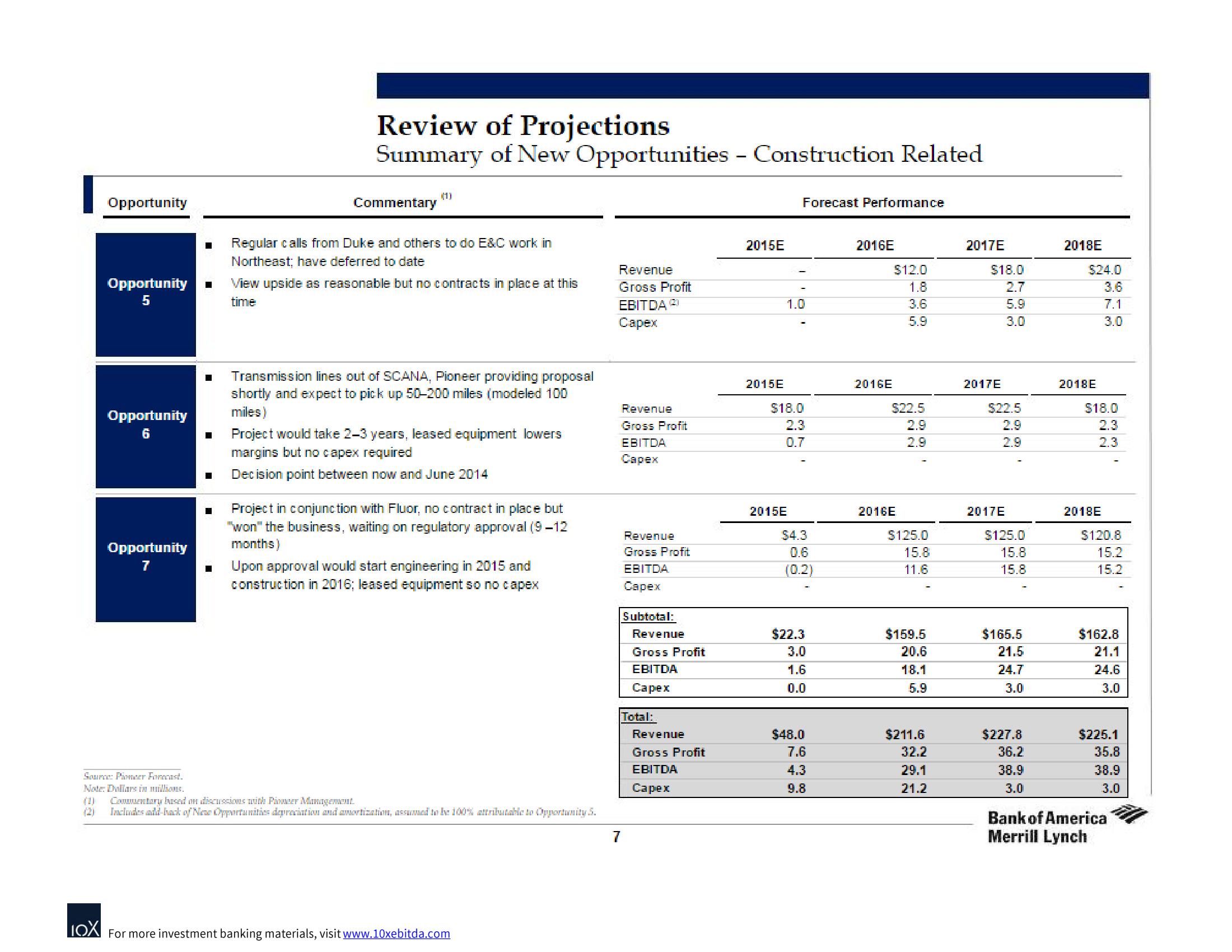

Review of Projections

Summary of New Opportunities - Construction Related

Commentary

Regular calls from Duke and others to do E&C work in

Northeast; have deferred to date

View upside as reasonable but no contracts in place at this

time

Transmission lines out of SCANA, Pioneer providing proposal

shortly and expect to pick up 50-200 miles (modeled 100

miles)

Project would take 2-3 years, leased equipment lowers

margins but no capex required

Decision point between now and June 2014

Project in conjunction with Fluor, no contract in place but

"won" the business, waiting on regulatory approval (9-12

months)

Upon approval would start engineering in 2015 and

construction in 2016; leased equipment so no capex

Commentary based on discussions with Pioneer Management.

Includes add-back of New Opportunities depreciation and amortization, assumed to be 100% attributable to Opportunity 5.

LOX For more investment banking materials, visit www.10xebitda.com

Revenue

Gross Profit

EBITDA 2

Capex

Revenue

Gross Profit

EBITDA

Capex

7

Revenue

Gross Profit

EBITDA

Capex

Subtotal:

Revenue

Gross Profit

EBITDA

Capex

Total:

Revenue

Gross Profit

EBITDA

Capex

2015E

2015E

Forecast Performance

2015E

1.0

$18.0

2.3

0.7

$4.3

0.6

(0.2)

$22.3

3.0

1.6

0.0

$48.0

7.6

4.3

9.8

2016E

2016E

$12.0

1.8

3.6

5.9

(00)

$22.5

2.9

2.9

2016E

$125.0

15.8

11.6

$159.5

20.6

18.1

5.9

$211.6

32.2

29.1

21.2

2017E

$18.0

2.7

5.9

3.0

2017E

$22.5

50

2.9

2.9

2017E

$125.0

15.8

15.8

$165.5

21.5

24.7

3.0

$227.8

36.2

38.9

3.0

2018E

$24.0

3.6

7.1

3.0

2018E

$18.0

2.3

2.3

2018E

$120.8

15.2

15.2

$162.8

21.1

24.6

3.0

$225.1

35.8

38.9

3.0

Bank of America

Merrill LynchView entire presentation