AngloAmerican Investor Presentation Deck

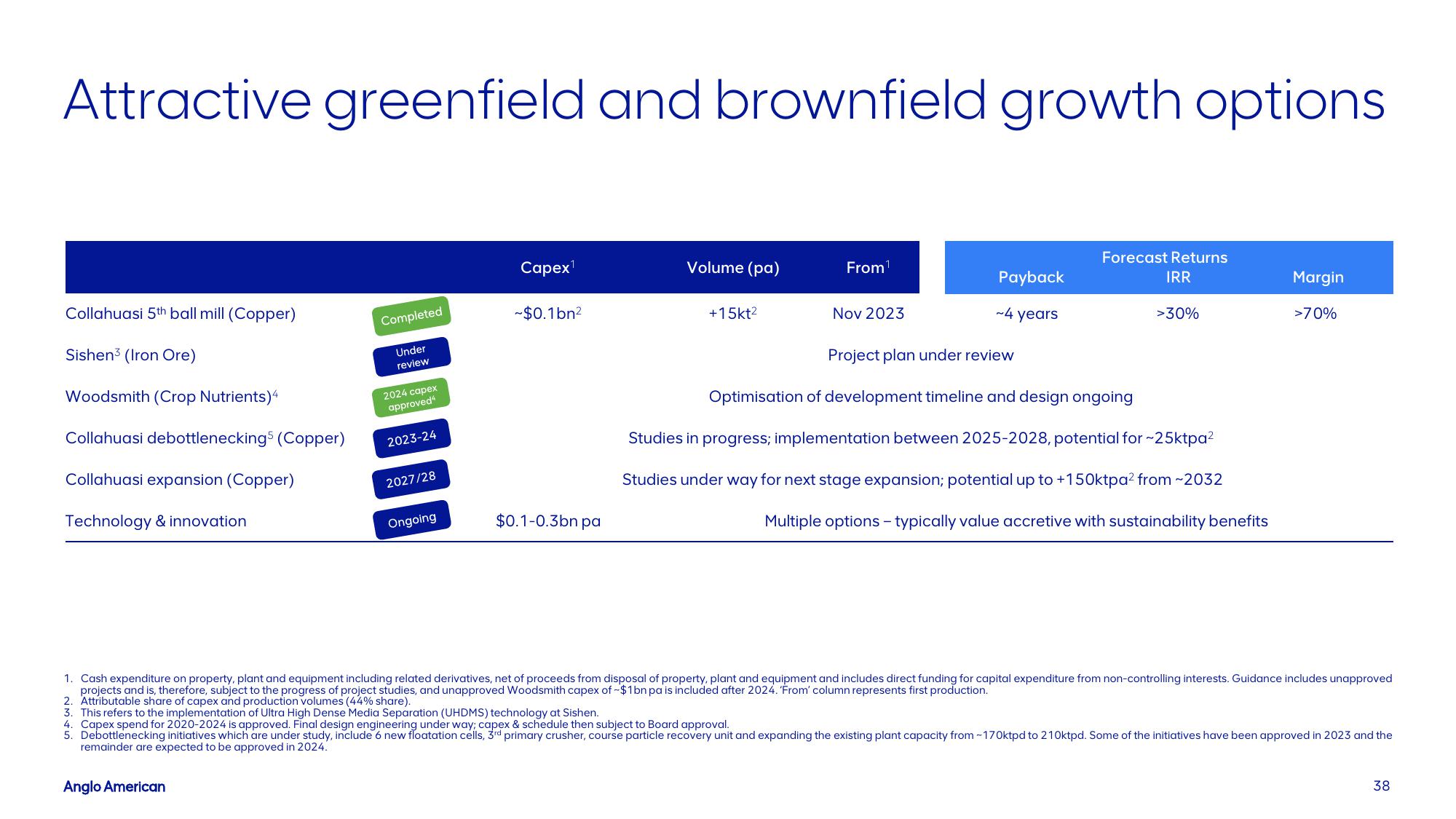

Attractive greenfield and brownfield growth options

Collahuasi 5th ball mill (Copper)

Sishen³ (Iron Ore)

Woodsmith (Crop Nutrients)<

Collahuasi debottleneckings (Copper)

Collahuasi expansion (Copper)

Technology & innovation

Completed

Under

review

Anglo American

2024 capex

approved

2023-24

2027/28

Ongoing

Capex¹

~$0.1bn²

$0.1-0.3bn pa

Volume (pa)

+15kt²

From¹

Nov 2023

Payback

~4 years

Forecast Returns

IRR

>30%

Project plan under review

Optimisation of development timeline and design ongoing

Studies in progress; implementation between 2025-2028, potential for ~25ktpa²

Studies under way for next stage expansion; potential up to +150ktpa² from ~2032

Multiple options - typically value accretive with sustainability benefits

Margin

>70%

1. Cash expenditure on property, plant and equipment including related derivatives, net of proceeds from disposal of property, plant and equipment and includes direct funding for capital expenditure from non-controlling interests. Guidance includes unapproved

projects and is, therefore, subject to the progress of project studies, and unapproved Woodsmith capex of -$1bn pa is included after 2024. 'From' column represents first production.

2. Attributable share of capex and production volumes (44% share).

3. This refers to the implementation of Ultra High Dense Media Separation (UHDMS) technology at Sishen.

4. Capex spend for 2020-2024 is approved. Final design engineering under way; capex & schedule then subject to Board approval.

5. Debottlenecking initiatives which are under study, include 6 new floatation cells, 3rd primary crusher, course particle recovery unit and expanding the existing plant capacity from - 170ktpd to 210ktpd. Some of the initiatives have been approved in 2023 and the

remainder are expected to be approved in 2024.

38View entire presentation