AMC Mergers and Acquisitions Presentation Deck

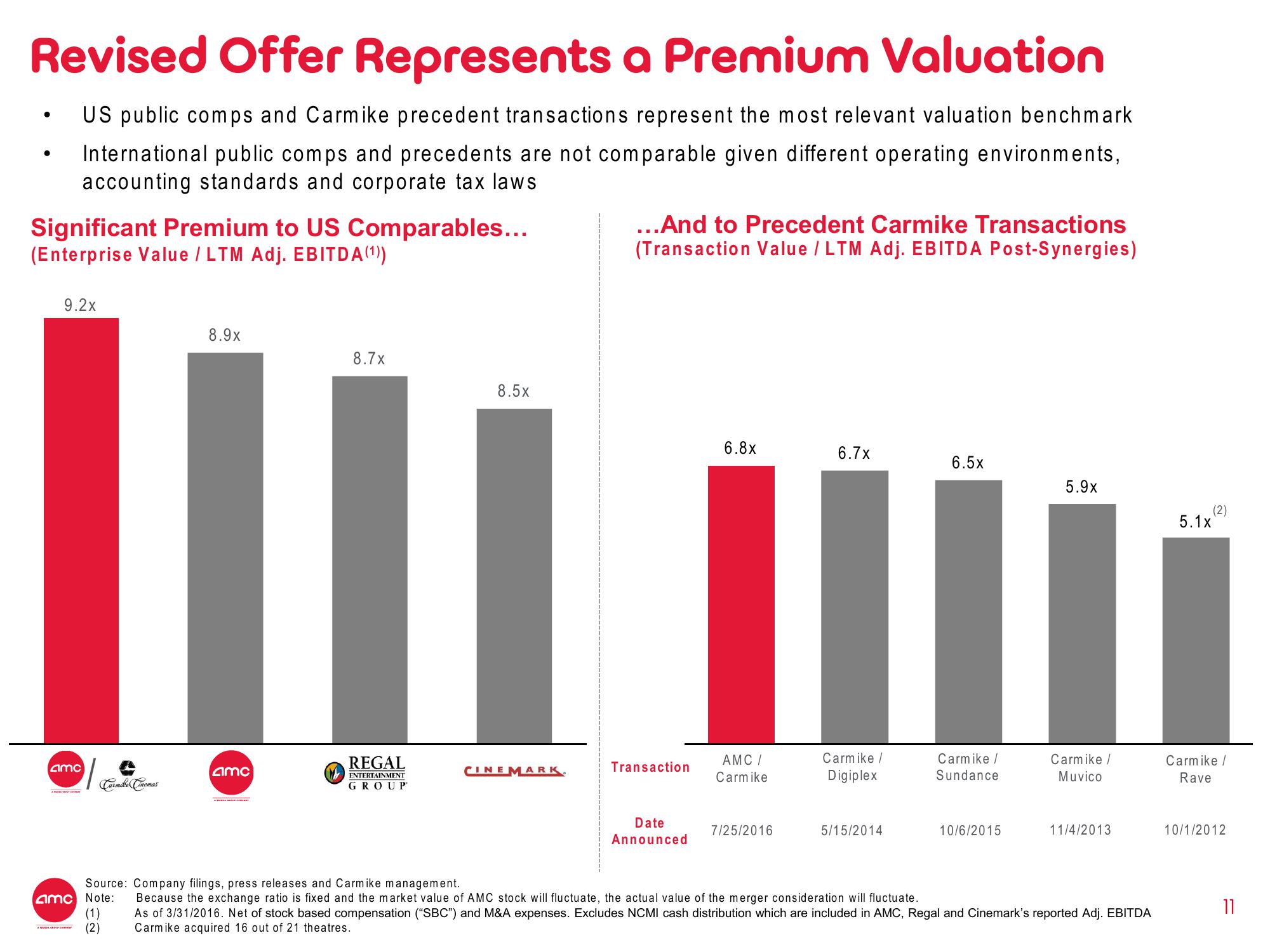

Revised Offer Represents a Premium Valuation

US public comps and Carmike precedent transactions represent the most relevant valuation benchmark

International public comps and precedents are not comparable given different operating environments,

accounting standards and corporate tax laws

●

Significant Premium to US Comparables...

(Enterprise Value / LTM Adj. EBITDA (¹))

9.2x

amc

Carmike Cinemas

8.9x

(1)

(2)

amc

8.7x

REGAL

ENTERTAINMENT

GROUP

8.5x

CINEMARK

...And to Precedent Carmike Transactions

(Transaction Value / LTM Adj. EBITDA Post-Synergies)

Transaction

Date

Announced

6.8x

AMC /

Carmike

7/25/2016

6.7x

Carmike /

Digiplex

5/15/2014

6.5x

Carmike /

Sundance

10/6/2015

5.9x

Carmike /

Muvico

11/4/2013

Source: Company filings, press releases and Carmike management.

amc Note: Because the exchange ratio is fixed and the market value of AMC stock will fluctuate, the actual value of the merger consideration will fluctuate.

As of 3/31/2016. Net of stock based compensation ("SBC") and M&A expenses. Excludes NCMI cash distribution which are included in AMC, Regal and Cinemark's reported Adj. EBITDA

Carmike acquired 16 out of 21 theatres.

(2)

5.1x

Carmike /

Rave

10/1/2012

11View entire presentation