Nauticus SPAC Presentation Deck

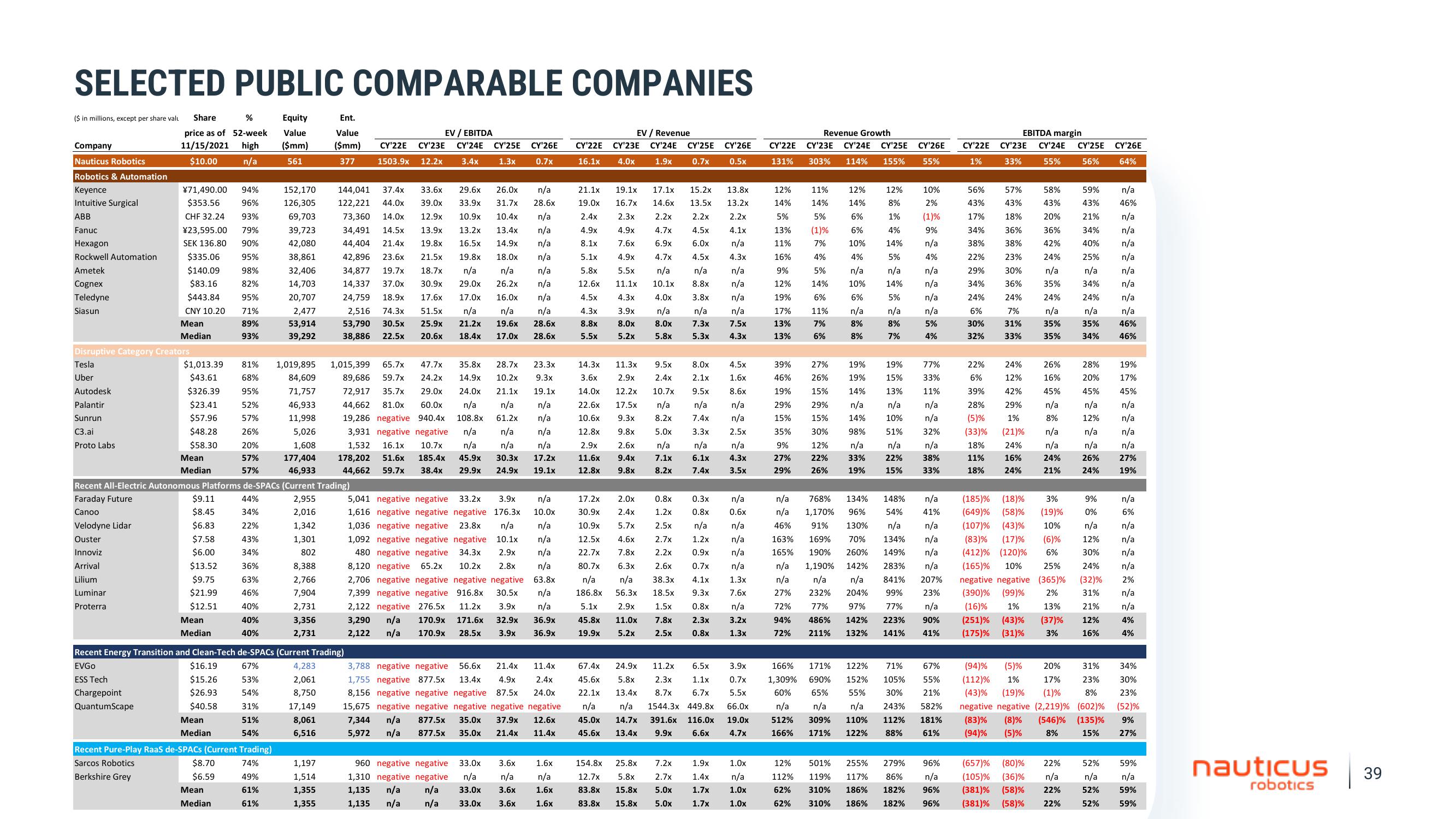

SELECTED PUBLIC COMPARABLE COMPANIES

%

Share

Equity

price as of 52-week Value

11/15/2021 high ($mm)

$10.00 n/a

561

($ in millions, except per share valu

Company

Nauticus Robotics

Robotics & Automation

Keyence

Intuitive Surgical

ABB

Fanuc

Hexagon

Rockwell Automation

Ametek

Cognex

Teledyne

Siasun

Disruptive Category Creators

Tesla

Uber

Autodesk

Palantir

Sunrun

C3.ai

Proto Labs

¥71,490.00 94%

$353.56 96%

CHF 32.24 93%

¥23,595.00 79%

SEK 136.80 90%

$335.06 95%

$140.09 98%

82%

95%

$83.16

$443.84

CNY 10.20 71%

Mean

Median

89%

93%

Velodyne Lidar

Ouster

Innoviz

Arrival

Lilium

Luminar

Proterra

ESS Tech

Chargepoint

QuantumScape

$1,013.39 81% 1,019,895

$43.61 68%

84,609

$326.39 95%

71,757

$23.41 52%

46,933

$57.96 57%

11,998

5,026

1,608

177,404

46,933

26%

20%

$48.28

$58.30

Mean

Median

57%

57%

$9.11

$8.45

$6.83

$7.58

$6.00

$13.52

$9.75

$21.99

$12.51

Recent All-Electric Autonomous Platforms de-SPACS (Current Trading)

Faraday Future

2,955

Canoo.

2,016

1,342

1,301

802

8,388

2,766

7,904

2,731

3,356

2,731

Mean

Median

$16.19

$15.26

$26.93

$40.58

Mean

Median

44%

34%

22%

43%

34%

36%

63%

46%

40%

$8.70

$6.59

40%

40%

Recent Pure-Play RaaS de-SPACs (Current Trading)

Sarcos Robotics

74%

Berkshire Grey

Mean

Median

152,170

126,305

69,703

39,723

42,080

38,861

32,406

14,703

20,707

2,477

53,914

39,292

Recent Energy Transition and Clean-Tech de-SPACS (Current Trading)

EVGO

67%

53%

54%

31%

51%

54%

49%

61%

61%

Ent.

Value

EV / EBITDA

($mm) CY'22E CY'23E CY'24E CY'25E CY'26E

1503.9x 12.2x

377

3.4x

1.3x

0.7x

4,283

2,061

8,750

17,149

8,061

6,516

144,041 37.4x 33.6x 29.6x 26.0x n/a

122,221 44.0x 39.0x 33.9x 31.7x 28.6x

73,360 14.0x 12.9x 10.9x 10.4x n/a

34,491 14.5x 13.9x 13.2x 13.4x n/a

44,404 21.4x 19.8x 16.5x 14.9x n/a

42,896 23.6x 21.5x 19.8x 18.0x n/a

34,877 19.7x 18.7x n/a n/a n/a

14,337 37.0x 30.9x 29.0x 26.2x n/a

24,759 18.9x 17.6x 17.0x 16.0x n/a

2,516 74.3x 51.5x n/a n/a n/a

53,790 30.5x 25.9x 21.2x 19.6x 28.6x

38,886 22.5x 20.6x 18.4x 17.0x 28.6x

1,197

1,514

1,355

1,355

1,015,399 65.7x 47.7x 35.8x 28.7x 23.3x

89,686 59.7x 24.2x 14.9x 10.2x 9.3x

72,917 35.7x

29.0x

24.0x 21.1x 19.1x

44,662 81.0x 60.0x n/a n/a n/a

19,286 negative 940.4x 108.8x

61.2x

n/a

3,931 negative negative n/a n/a n/a

n/a n/a

30.3x 17.2x

59.7x 38.4x 29.9x 24.9x 19.1x

1,532 16.1x 10.7x n/a

178,202 51.6x 185.4x 45.9x

44,662

5,041 negative negative

33.2x 3.9x n/a

1,616 negative negative negative 176.3x 10.0x

1,036 negative negative 23.8x n/a n/a

1,092 negative negative negative 10.1x n/a

480 negative negative 34.3x 2.9x n/a

8,120 negative 65.2x 10.2x 2.8x n/a

7,399 negative negative 916.8x 30.5x

2,706 negative negative negative negative 63.8x

n/a

n/a

36.9x

36.9x

2,122 negative 276.5x 11.2x 3.9x

3,290 n/a

2,122 n/a

170.9x 171.6x 32.9x

170.9x

28.5x 3.9x

21.4x

3,788 negative negative 56.6x

11.4x

1,755 negative 877.5x 13.4x 4.9x 2.4x

8,156 negative negative negative 87.5x 24.0x

15,675 negative negative negative negative negative

7,344 n/a 877.5x 35.0x 37.9x 12.6x

5,972 n/a 877.5x 35.0x 21.4x 11.4x

960 negative negative

33.0x

3.6x 1.6x

1,310 negative negative n/a n/a n/a

1,135 n/a n/a 33.0x 3.6x 1.6x

1,135 n/a n/a 33.0x 3.6x 1.6x

EV / Revenue

CY'22E CY'23E CY'24E CY'25E CY'26E

16.1x 4.0x 1.9x 0.7x

0.5x

21.1x 19.1x

19.0x 16.7x

2.4x 2.3x

4.9x

4.9x

8.1x

7.6x

5.1x

4.9x

4.7x

5.5x

n/a

11.1x 10.1x

5.8x

12.6x

4.5x

4.3x

8.8x

4.3x

4.0x

3.9x n/a

8.0x

8.0x

5.5x

5.2x

5.8x

17.1x 15.2x

14.6x 13.5x

2.2x 2.2x

13.8x

13.2x

2.2x

4.7x

4.5x

4.1x

6.9x

6.0x n/a

4.5x

4.3x

n/a

n/a

8.8x

n/a

14.3x

3.6x

14.0x

22.6x 17.5x

10.6x 9.3x

12.8x 9.8x

2.9x 2.6x

11.6x 9.4x

12.8x 9.8x

11.3x 9.5x

2.9x

2.4x

12.2x 10.7x

n/a

8.2x

5.0x

n/a

7.1x

8.2x

0.8x

1.2x

2.5x

2.7x

2.2x

3.8x

n/a

7.3x

5.3x

154.8x 25.8x

7.2x

12.7x 5.8x

2.7x

83.8x 15.8x 5.0x

83.8x 15.8x 5.0x

8.0x

4.5x

2.1x

1.6x

9.5x

8.6x

n/a

n/a

7.4x n/a

3.3x 2.5x

n/a

4.3x

3.5x

n/a

6.1x

7.4x

n/a

n/a

7.5x

4.3x

17.2x 2.0x

0.3x

0.8x

30.9x 2.4x

10.9x 5.7x

12.5x 4.6x

n/a

1.2x n/a

22.7x 7.8x

0.9x

n/a

2.6x

0.7x

n/a

1.3x

7.6x

80.7x 6.3x

n/a n/a 38.3x 4.1x

186.8x 56.3x 18.5x 9.3x

5.1x 2.9x 1.5x

45.8x 11.0x 7.8x

19.9x 5.2x 2.5x

0.8x n/a

2.3x 3.2x

1.3x

0.8x

n/a

0.6x

n/a

67.4x 24.9x 11.2x 6.5x 3.9x

45.6x 5.8x 2.3x 1.1x 0.7x

22.1x 13,4x 8.7x 6.7x 5.5x

n/a n/a 1544.3x 449.8x 66.0x

45.0x 14.7x 391.6x 116.0x 19.0x

45.6x 13.4x 9.9x 6.6x 4.7x

1.9x

1.4x

1.7x

1.7x

1.0x

n/a

1.0x

1.0x

CY'22E CY'23E CY'24E CY'25E CY'26E

131% 303% 114% 155% 55%

12%

14%

5%

13%

11%

16%

9%

12%

19%

17%

13%

13%

39%

46%

19%

Revenue Growth

29%

15%

35%

9%

27%

29%

11%

14%

5%

(1)%

7%

4%

5%

14%

6%

11%

7%

6%

27%

26%

15%

29%

15%

30%

12%

22%

26%

12%

8%

6%

1%

6%

4%

10%

14%

4%

5%

n/a n/a

10%

14%

6%

5%

n/a

n/a

8%

8%

8%

7%

12%

14%

19%

19%

14%

n/a

14%

98%

n/a

33%

19%

19%

15%

13%

n/a

10%

51%

n/a

22%

15%

10%

2%

(1)%

9%

n/a

4%

n/a

n/a

n/a

n/a

5%

4%

77%

33%

11%

n/a

n/a

32%

n/a

38%

33%

n/a

n/a

768% 134% 148%

n/a 1,170% 96% 54% 41%

46% 91% 130% n/a n/a

163% 169% 70% 134% n/a

165% 190% 260% 149% n/a

n/a 1,190% 142% 283% n/a

n/a n/a n/a 841% 207%

27% 232% 204% 99% 23%

72% 77% 97% 77% n/a

94% 486% 142% 223% 90%

72% 211% 132% 141% 41%

166% 171% 122% 71% 67%

1,309% 690% 152% 105% 55%

60% 65% 55% 30% 21%

n/a n/a n/a 243% 582%

512% 309% 110% 112% 181%

166% 171% 122% 88% 61%

12% 501% 255% 279% 96%

112% 119% 117% 86% n/a

62% 310% 186% 182% 96%

62% 310% 186% 182% 96%

CY'22E

1%

EBITDA margin

CY'23E

33%

56%

43%

17%

34%

57%

43%

18%

36%

38% 38%

23%

22%

29% 30%

34%

24%

6%

36%

24%

7%

31%

30%

32%

33%

CY'24E CY'25E

56%

55%

58%

43%

20%

36%

42%

24%

n/a

35%

24%

n/a

35%

35%

22%

6%

39%

28%

(5)%

24%

12%

42%

29%

1%

(33)% (21)% n/a

18%

24%

n/a

11%

16%

24%

18%

24%

21%

26%

16%

45%

n/a

8%

(185)% (18)%

(649)% (58)%

(107)% (43)%

(83)% (17)% (6)%

(412) % (120) % 6%

(165)% 10% 25%

negative negative (365) %

(390)% (99)% 2%

(16)% 1% 13%

(251)% (43)% (37)%

(175)% (31)% 3%

3%

(19) %

10%

(657)% (80)% 22%

(105)% (36)% n/a

(381)% (58)% 22%

(381)% (58)% 22%

59%

43%

21%

n/a

46%

n/a

34% n/a

40%

n/a

25%

n/a

n/a

n/a

34%

n/a

n/a

24%

n/a

35%

n/a

46%

46%

34%

28%

20%

45%

n/a

12%

n/a

n/a

26%

24%

31%

23%

(94)% (5)% 20%

(112)% 1% 17%

(43)% (19) % (1)% 8%

negative negative (2,219) % (602)%

(83)% (8)%

(94)% (5)%

(546) % (135)%

15%

8%

CY'26E

64%

9%

n/a

0%

6%

n/a

n/a

12% n/a

30% n/a

24% n/a

(32)% 2%

n/a

31%

21%

n/a

12%

4%

16%

4%

52%

n/a

52%

52%

19%

17%

45%

n/a

n/a

n/a

n/a

27%

19%

34%

30%

23%

(52)%

9%

27%

59%

n/a

59%

59%

nauticus

robotics

39View entire presentation