Bausch Health Companies Shareholder Engagement Presentation Deck

Overview of Bausch Health

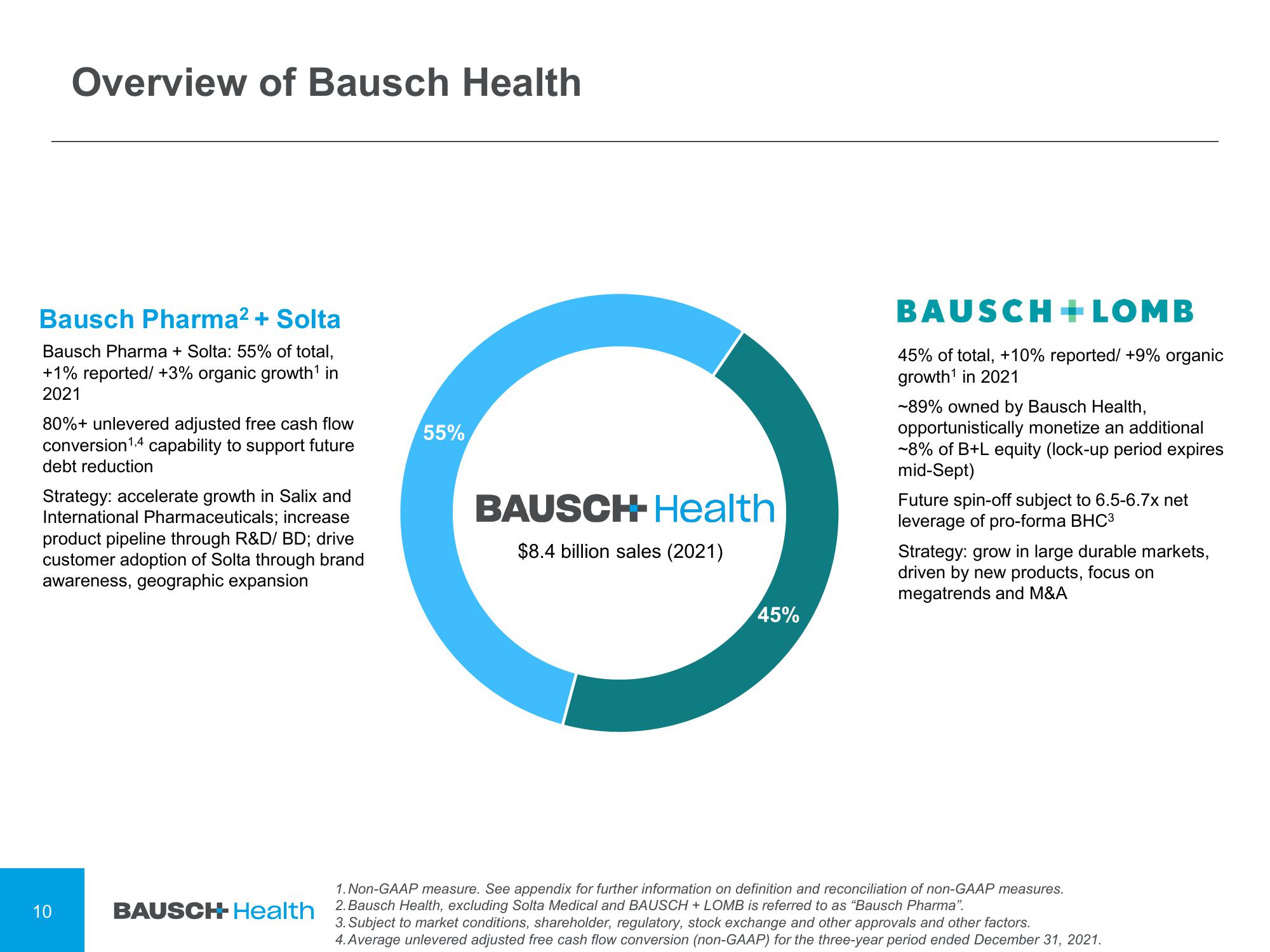

Bausch Pharma² + Solta

Bausch Pharma + Solta: 55% of total,

+1% reported/ +3% organic growth¹ in

2021

80%+ unlevered adjusted free cash flow

conversion¹,4 capability to support future

debt reduction

Strategy: accelerate growth in Salix and

International Pharmaceuticals; increase

product pipeline through R&D/BD; drive

customer adoption of Solta through brand

awareness, geographic expansion

10

BAUSCH- Health

55%

BAUSCH-Health

$8.4 billion sales (2021)

45%

BAUSCH + LOMB

45% of total, +10% reported/ +9% organic

growth¹ in 2021

-89% owned by Bausch Health,

opportunistically monetize an additional

-8% of B+L equity (lock-up period expires

mid-Sept)

Future spin-off subject to 6.5-6.7x net

leverage of pro-forma BHC3

Strategy: grow in large durable markets,

driven by new products, focus on

megatrends and M&A

1. Non-GAAP measure. See appendix for further information on definition and reconciliation of non-GAAP measures.

2. Bausch Health, excluding Solta Medical and BAUSCH + LOMB is referred to as "Bausch Pharma".

3. Subject to market conditions, shareholder, regulatory, stock exchange and other approvals and other factors.

4. Average unlevered adjusted free cash flow conversion (non-GAAP) for the three-year period ended December 31, 2021.View entire presentation