Paya SPAC Presentation Deck

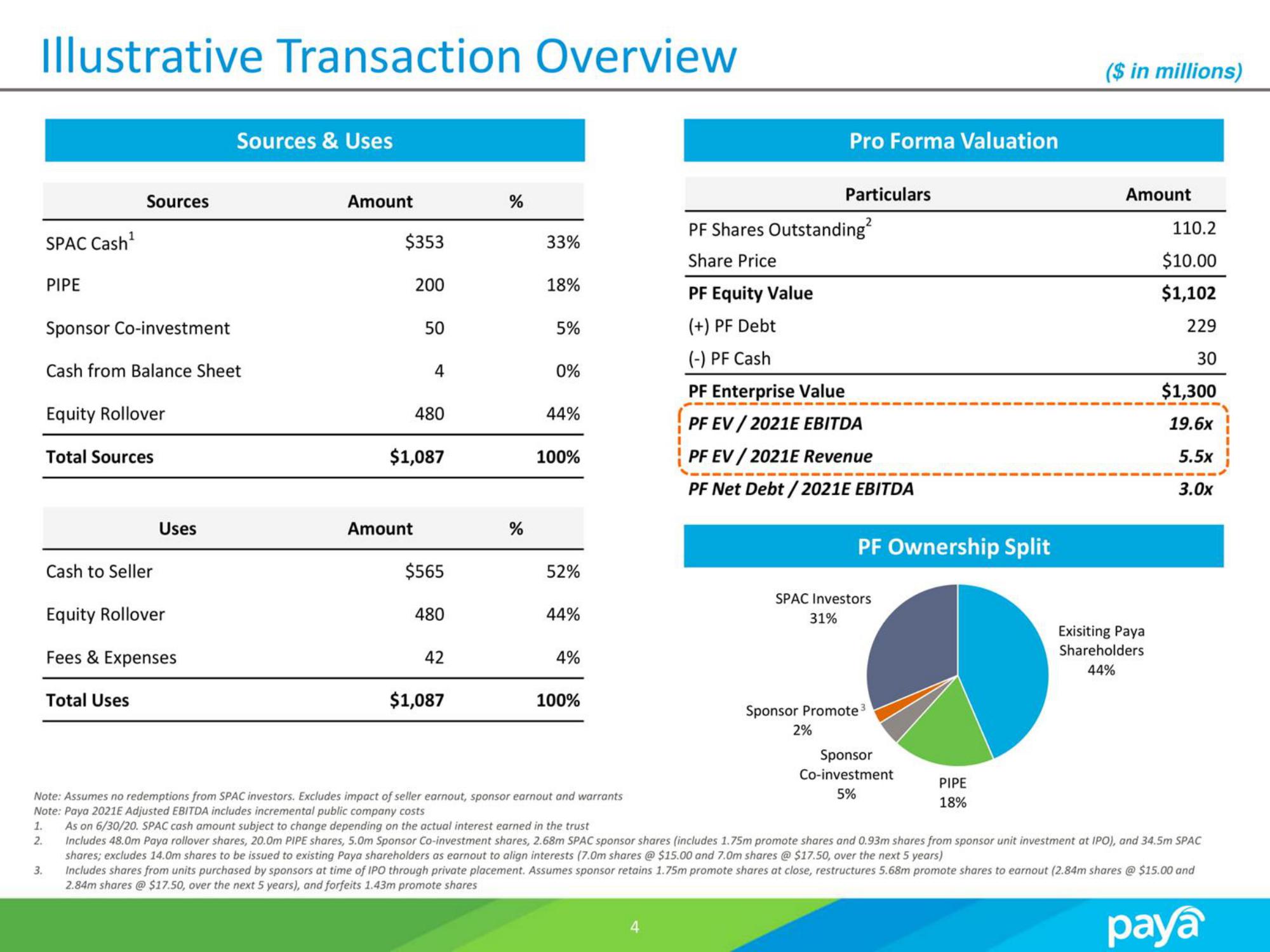

Illustrative Transaction Overview

SPAC Cash¹

PIPE

3.

Sources

Sponsor Co-investment

Cash from Balance Sheet

Equity Rollover

Total Sources

Cash to Seller

Total Uses

Uses

Equity Rollover

Fees & Expenses

Sources & Uses

Amount

$353

200

Amount

50

4

480

$1,087

$565

480

42

$1,087

%

%

33%

18%

5%

0%

44%

100%

52%

44%

4%

100%

Pro Forma Valuation

Particulars

PF Shares Outstanding²

Share Price

PF Equity Value

(+) PF Debt

(-) PF Cash

PF Enterprise Value

PF EV/2021E EBITDA

PF EV/2021E Revenue

PF Net Debt/2021E EBITDA

2%

PF Ownership Split

SPAC Investors

31%

Sponsor Promote ³

Sponsor

Co-investment

5%

PIPE

18%

($ in millions)

Amount

Exisiting Paya

Shareholders

44%

110.2

$10.00

$1,102

229

30

$1,300

19.6x

5.5x

3.0x

Note: Assumes no redemptions from SPAC investors. Excludes impact of seller earnout, sponsor earnout and warrants

Note: Paya 2021E Adjusted EBITDA includes incremental public company costs

1.

2.

As on 6/30/20. SPAC cash amount subject to change depending on the actual interest earned in the trust

Includes 48.0m Paya rollover shares, 20.0m PIPE shares, 5.0m Sponsor Co-investment shares, 2.68m SPAC sponsor shares (includes 1.75m promote shares and 0.93m shares from sponsor unit investment at IPO), and 34.5m SPAC

shares; excludes 14.0m shares to be issued to existing Paya shareholders as earnout to align interests (7.0m shares @ $15.00 and 7.0m shares @ $17.50, over the next 5 years)

Includes shares from units purchased by sponsors at time of IPO through private placement. Assumes sponsor retains 1.75m promote shares at close, restructures 5.68m promote shares to earnout (2.84m shares @ $15.00 and

2.84m shares @ $17.50, over the next 5 years), and forfeits 1.43m promote shares

payaView entire presentation