Blackwells Capital Activist Presentation Deck

Poor corporate governance

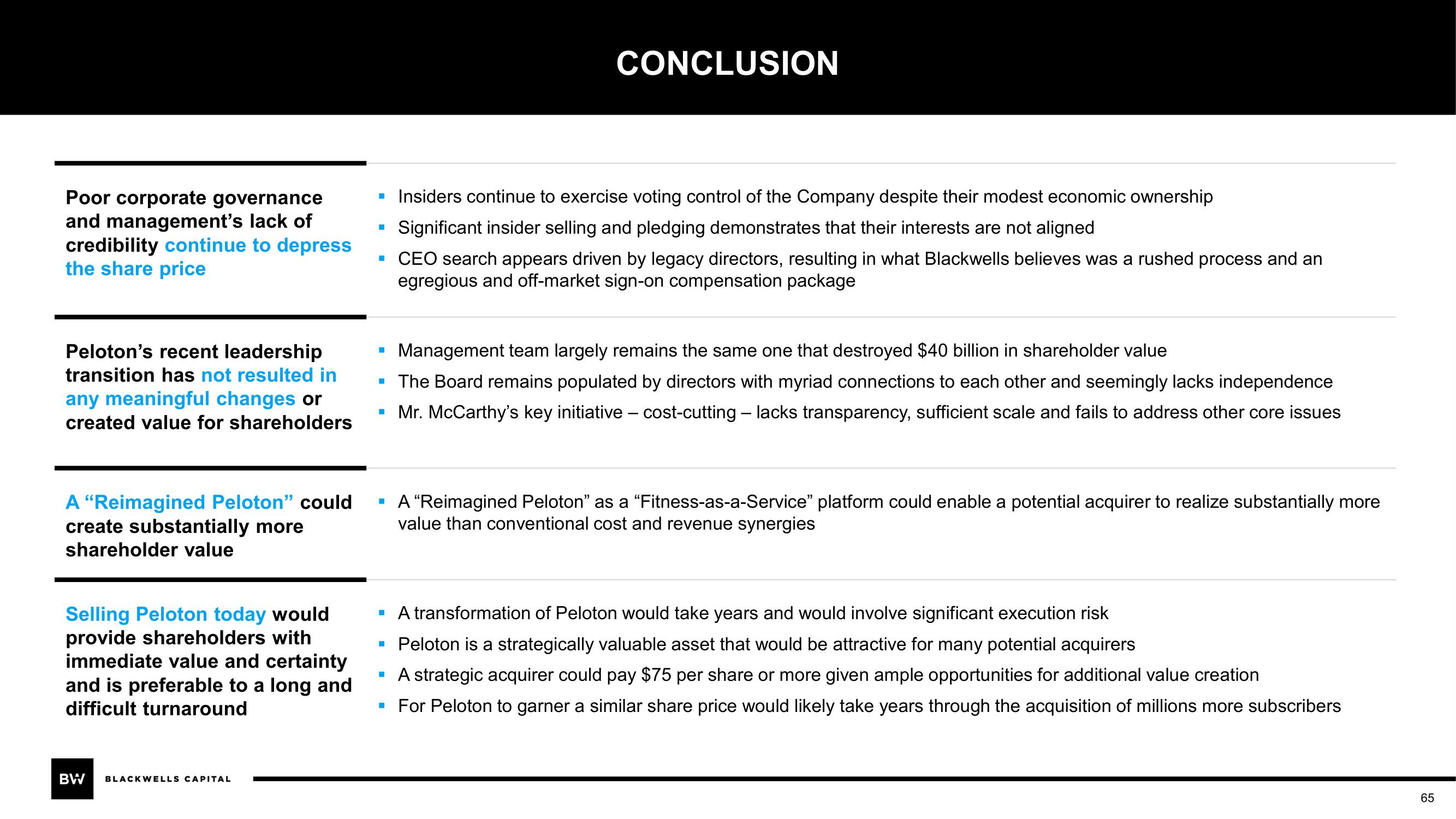

and management's lack of

credibility continue to depress

the share price

Peloton's recent leadership

transition has not resulted in

any meaningful changes or

created value for shareholders

A "Reimagined Peloton" could

create substantially more

shareholder value

Selling Peloton today would

provide shareholders with

immediate value and certainty

and is preferable to a long and

difficult turnaround

BW BLACKWELLS CAPITAL

■

■

■

■

CONCLUSION

Management team largely remains the same one that destroyed $40 billion in shareholder value

▪ The Board remains populated by directors with myriad connections to each other and seemingly lacks independence

Mr. McCarthy's key initiative - cost-cutting - lacks transparency, sufficient scale and fails to address other core issues

■

Insiders continue to exercise voting control of the Company despite their modest economic ownership

Significant insider selling and pledging demonstrates that their interests are not aligned

CEO search appears driven by legacy directors, resulting in what Blackwells believes was a rushed process and an

egregious and off-market sign-on compensation package

I

A "Reimagined Peloton" as a "Fitness-as-a-Service" platform could enable a potential acquirer to realize substantially more

value than conventional cost and revenue synergies

▪ A transformation of Peloton would take years and would involve significant execution risk

▪ Peloton is a strategically valuable asset that would be attractive for many potential acquirers

▪ A strategic acquirer could pay $75 per share or more given ample opportunities for additional value creation

▪ For Peloton to garner a similar share price would likely take years through the acquisition of millions more subscribers

65View entire presentation