Allwyn SPAC

Comparable company benchmarking (Continued)

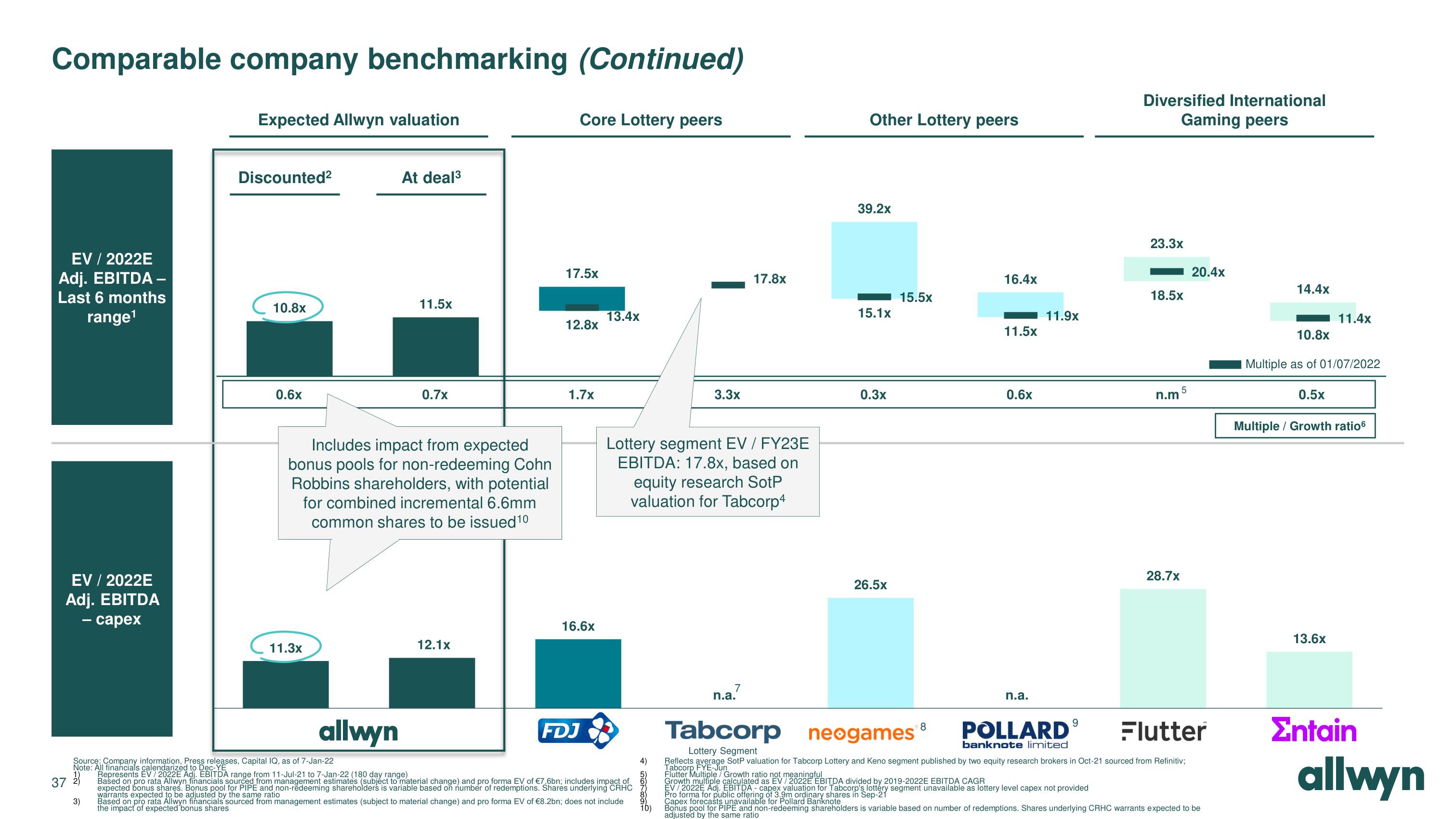

EV / 2022E

Adj. EBITDA –

Last 6 months

range¹

EV / 2022E

Adj. EBITDA

- capex

Expected Allwyn valuation

3)

Discounted²

10.8x

0.6x

11.3x

allwyn

Source: Company information, Press releases, Capital IQ, as of 7-Jan-22

Note: All financials calendarized to Dec-YE

37

At deal³

Includes impact from expected

bonus pools for non-redeeming Cohn

Robbins shareholders, with potential

for combined incremental 6.6mm

common shares to be issued 10

11.5x

0.7x

12.1x

Core Lottery peers

17.5x

12.8x

1.7x

16.6x

FDJ

13.4x

Represents EV / 2022E Adj. EBITDA range from 11-Jul-21 to 7-Jan-22 (180 day range)

Based on pro rata Allwyn financials sourced from management estimates (subject to material change) and pro forma EV of €7.6bn; includes impact of

expected bonus shares. Bonus pool for PIPE and non-redeeming shareholders is variable based on number of redemptions. Shares underlying CRHC

warrants expected to be adjusted by the same ratio

Based on pro rata Allwyn financials sourced from management estimates (subject to material change) and pro forma EV of €8.2bn; does not include

the impact of expected bonus shares

Lottery segment EV / FY23E

EBITDA: 17.8x, based on

equity research SotP

valuation for Tabcorp4

4)

KO

3.3x

9

10)

17.8x

Other Lottery peers

39.2x

15.1x

0.3x

26.5x

15.5x

16.4x

8

11.5x

0.6x

11.9x

n.a.

POLLARD

Diversified International

Gaming peers

9

23.3x

18.5x

n.m

n.a.7

Tabcorp neogames

Flutter

banknote limited

Lottery Segment

Reflects average SotP valuation for Tabcorp Lottery and Keno segment published by two equity research brokers in Oct-21 sourced from Refinitiv;

Tabcorp FYE-Jun

Flutter Multiple / Growth ratio not meaningful

Growth multiple calculated as EV/2022E EBITDA divided by 2019-2022E EBITDA CAGR

EV/2022E Adj. EBITDA- capex valuation for Tabcorp's lottery segment unavailable as lottery level capex not provided

Pro forma for public offering of 3.9m ordinary shares in Sep-21

Capex forecasts unavailable for Pollard Banknote

Bonus pool for PIPE and non-redeeming shareholders is variable based on number of redemptions. Shares underlying CRHC warrants expected to be

adjusted by the same ratio

28.7x

5

20.4x

14.4x

10.8x

Multiple as of 01/07/2022

0.5x

11.4x

Multiple / Growth ratio

13.6x

Entain

allwynView entire presentation