Allwyn Results Presentation Deck

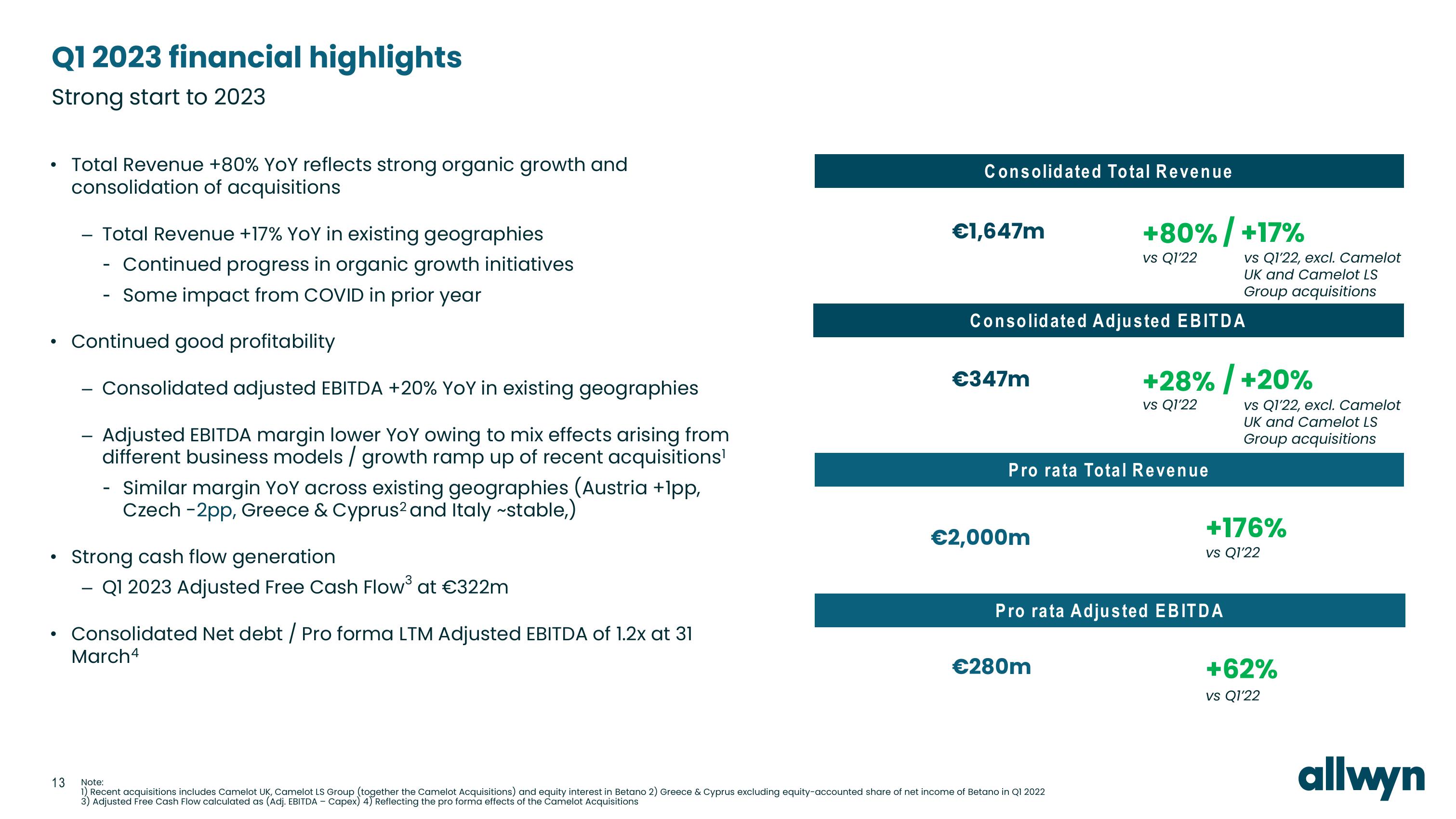

Q1 2023 financial highlights

Strong start to 2023

• Total Revenue +80% YoY reflects strong organic growth and

consolidation of acquisitions

●

- Total Revenue +17% YoY in existing geographies

Continued progress in organic growth initiatives

Some impact from COVID in prior year

Continued good profitability

- Consolidated adjusted EBITDA +20% YoY in existing geographies

- Adjusted EBITDA margin lower YoY owing to mix effects arising from

different business models/ growth ramp up of recent acquisitions¹

- Similar margin YoY across existing geographies (Austria +1pp,

Czech -2pp, Greece & Cyprus2 and Italy ~stable,)

Strong cash flow generation

Q1 2023 Adjusted Free Cash Flow³ at €322m

●

• Consolidated Net debt / Pro forma LTM Adjusted EBITDA of 1.2x at 31

March4

Consolidated Total Revenue

€1,647m

€347m

Consolidated Adjusted EBITDA

€2,000m

+80% / +17%

vs Q1'22

Pro rata Total Revenue

€280m

13

Note:

1) Recent acquisitions includes Camelot UK, Camelot LS Group (together the Camelot Acquisitions) and equity interest in Betano 2) Greece & Cyprus excluding equity-accounted share of net income of Betano in Q1 2022

3) Adjusted Free Cash Flow calculated as (Adj. EBITDA - Capex) 4) Reflecting the pro forma effects of the Camelot Acquisitions

vs Q1'22, excl. Camelot

UK and Camelot LS

Group acquisitions

+28% / +20%

vs Q1'22

Pro rata Adjusted EBITDA

vs Q1'22, excl. Camelot

UK and Camelot LS

Group acquisitions

+176%

vs Q1'22

+62%

vs Q1'22

allwynView entire presentation