Cerberus Global NPL Fund, L.P.

Cerberus Investment Platform

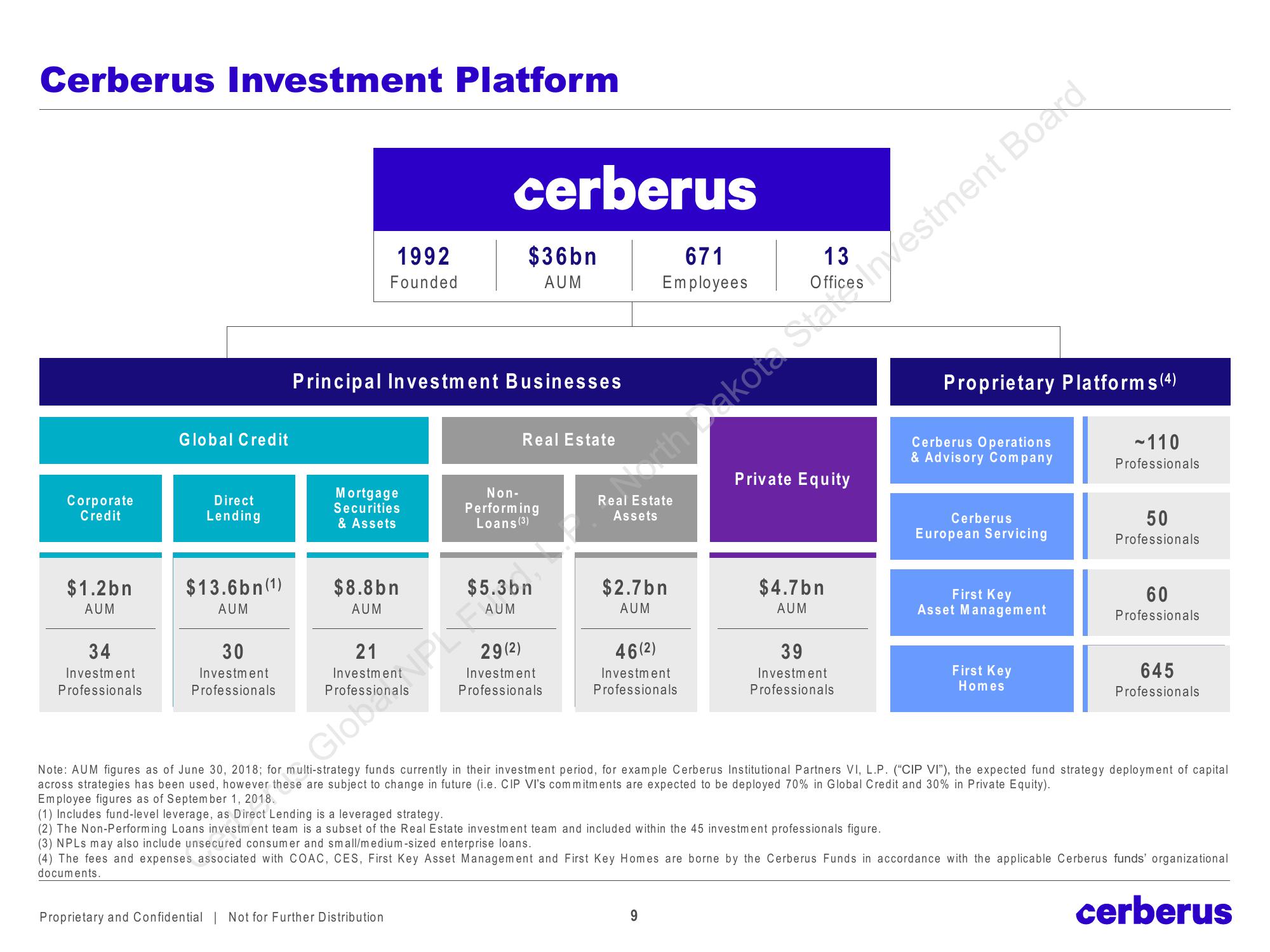

Corporate

Credit

$1.2bn

AUM

34

Investment

Professionals

Global Credit

Direct

Lending

$13.6bn (1)

AUM

30

Investment

Professionals

1992

Founded

Mortgage

Securities

& Assets

Principal Investment Businesses

$8.8bn

AUM

21

cerberus

$36bn

AUM

Proprietary and Confidential | Not for Further Distribution

GlobNPLY

Real Estate

Non-

Performing

Loans (3)

$5.3bn

AUM

29(2)

Investment

Professionals

671

Employees

Real Estate

Assets

$2.7bn

AUM

46(2)

Investment

Professionals

13

9

thakota Stars Investment Board

Private Equity

$4.7bn

AUM

Proprietary Platforms (4)

39

Investment

Professionals

Cerberus Operations

& Advisory Company

Cerberus

European Servicing

First Key

Asset Management

-110

Professionals

First Key

Homes

50

Professionals

60

Professionals

Note: AUM figures as of June 30, 2018; for multi-strategy funds currently in their investment period, for example Cerberus Institutional Partners VI, L.P. ("CIP VI"), the expected fund strategy deployment of capital

across strategies has been used, however these are subject to change in future (i.e. CIP VI's commitments are expected to be deployed 70% in Global Credit and 30% in Private Equity).

Employee figures as of September 1, 2018.

645

Professionals

(1) Includes fund-level leverage, as Direct Lending is a leveraged strategy.

(2) The Non-Performing Loans investment team is a subset of the Real Estate investment team and included within the 45 investment professionals figure.

(3) NPLs may also include unsecured consumer and small/medium-sized enterprise loans.

(4) The fees and expenses associated with COAC, CES, First Key Asset Management and First Key Homes are borne by the Cerberus Funds in accordance with the applicable Cerberus funds' organizational

documents.

cerberusView entire presentation