Ready Capital Investor Presentation Deck

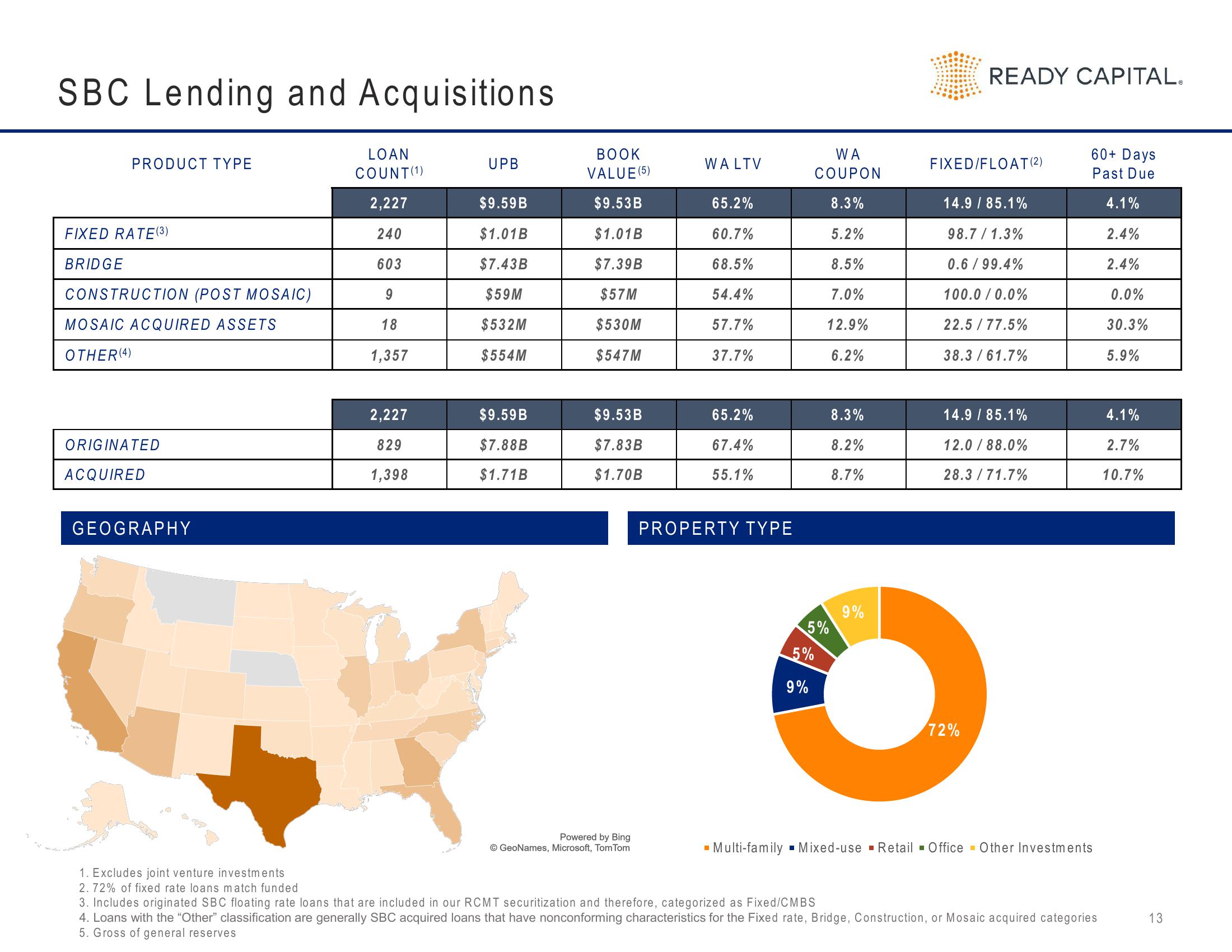

SBC Lending and Acquisitions

PRODUCT TYPE

FIXED RATE (3)

BRIDGE

CONSTRUCTION (POST MOSAIC)

MOSAIC ACQUIRED ASSETS

OTHER (4)

ORIGINATED

ACQUIRED

GEOGRAPHY

$30

LOAN

COUNT(1)

2,227

240

603

9

18

1,357

2,227

829

1,398

UPB

$9.59B

$1.01B

$7.43B

$59M

$532M

$554M

$9.59B

$7.88B

$1.71B

BOOK

VALUE (5)

$9.53B

$1.01B

$7.39B

$57M

$530M

$547M

$9.53B

$7.83B

$1.70B

Powered by Bing

GeoNames, Microsoft, TomTom

WALTV

65.2%

60.7%

68.5%

54.4%

57.7%

37.7%

■

65.2%

67.4%

55.1%

PROPERTY TYPE

5%

5%

9%

WA

COUPON

8.3%

5.2%

8.5%

7.0%

12.9%

6.2%

I

8.3%

8.2%

8.7%

9%

READY CAPITAL.

FIXED/FLOAT (2)

14.9 / 85.1%

98.7/1.3%

0.6/99.4%

100.0/0.0%

22.5/77.5%

38.3 / 61.7%

14.9 / 85.1%

12.0/88.0%

28.3/71.7%

72%

60+ Days

Past Due

Multi-family Mixed-use Retail Office Other Investments

1. Excludes joint venture investments

2.72% of fixed rate loans match funded

3. Includes originated SBC floating rate loans that are included in our RCMT securitization and therefore, categorized as Fixed/CMBS

4. Loans with the "Other" classification are generally SBC acquired loans that have nonconforming characteristics for the Fixed rate, Bridge, Construction, or Mosaic acquired categories

5. Gross of general reserves

4.1%

2.4%

2.4%

0.0%

30.3%

5.9%

4.1%

2.7%

10.7%

13View entire presentation