Zegna SPAC Presentation Deck

ZEGNA GROUP

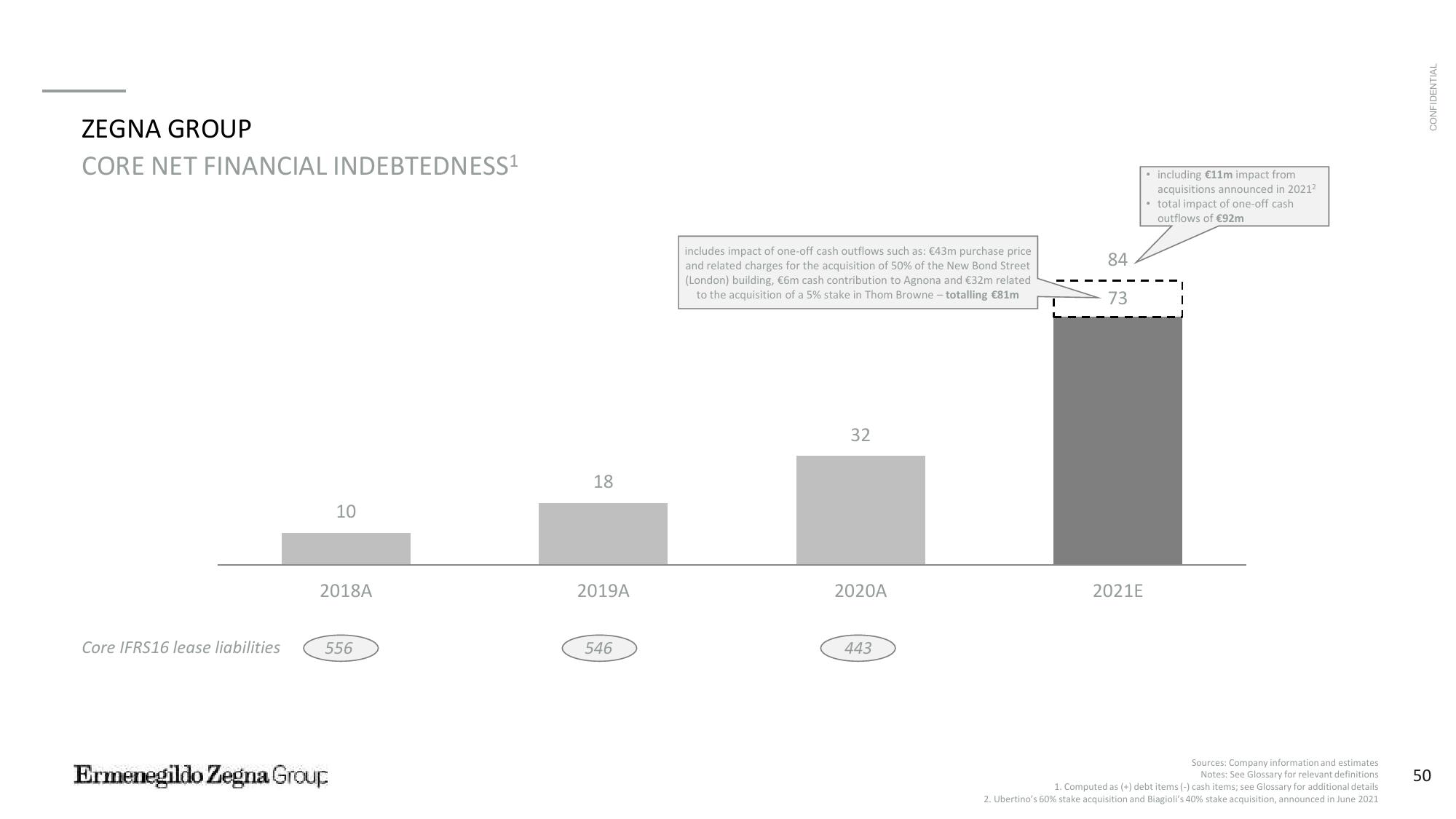

CORE NET FINANCIAL INDEBTEDNESS¹

Core IFRS16 lease liabilities

10

2018A

556

Ermenegildo Zegna Group

18

2019A

546

includes impact of one-off cash outflows such as: €43m purchase price

and related charges for the acquisition of 50% of the New Bond Street

(London) building, €6m cash contribution to Agnona and €32m related

to the acquisition of a 5% stake in Thom Browne - totalling €81m

32

2020A

443

84

73

2021E

including €11m impact from

acquisitions announced in 2021²

• total impact of one-off cash

outflows of €92m

Sources: Company information and estimates

Notes: See Glossary for relevant definitions.

1. Computed as (+) debt items (-) cash items; see Glossary for additional details

2. Ubertino's 60% stake acquisition and Biagioli's 40% stake acquisition, announced in June 2021

CONFIDENTIAL

50View entire presentation