BlackRock Results Presentation Deck

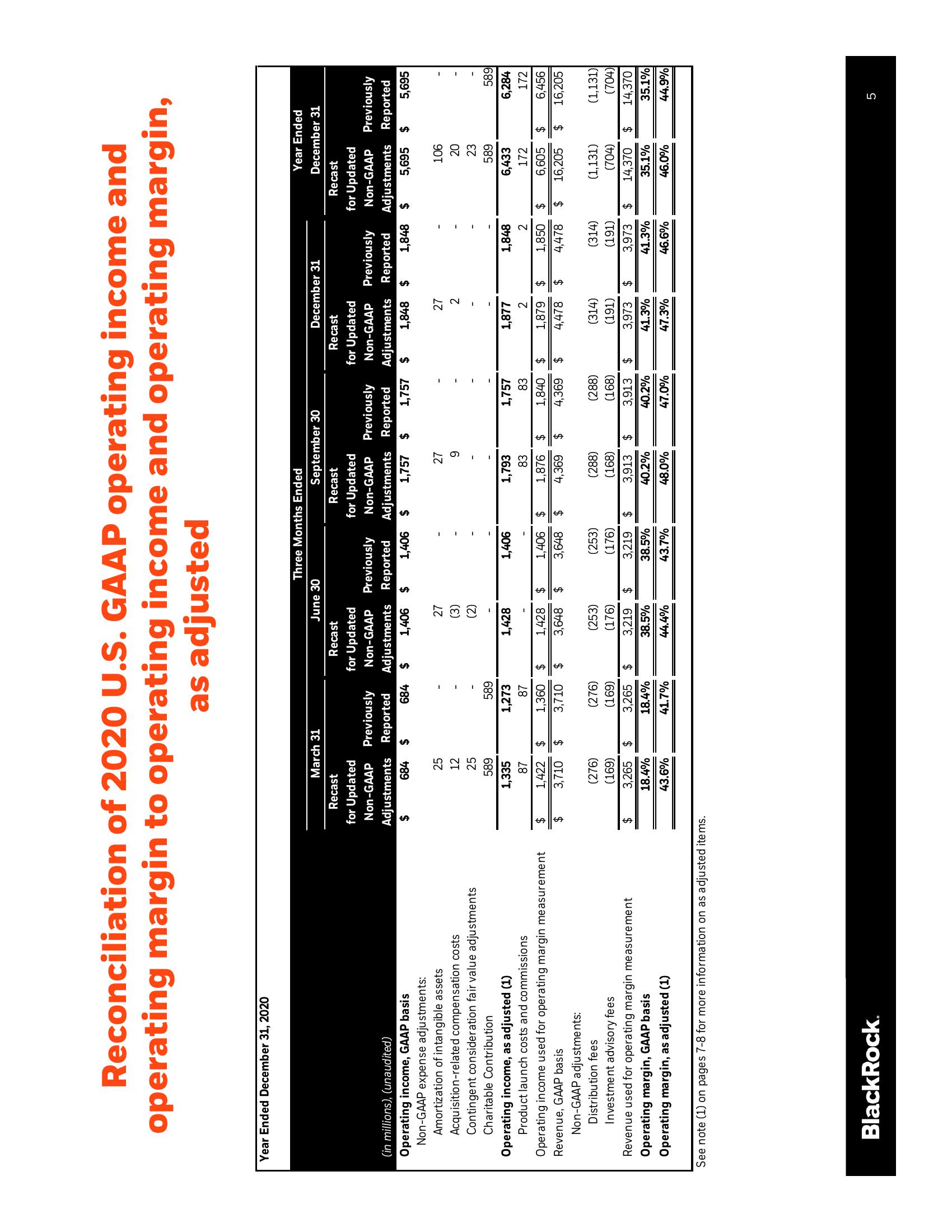

Reconciliation of 2020 U.S. GAAP operating income and

operating margin to operating income and operating margin,

as adjusted

Year Ended December 31, 2020

(in millions), (unaudited)

Operating income, GAAP basis

Non-GAAP expense adjustments:

Amortization of intangible assets

Acquisition-related compensation costs

Contingent consideration fair value adjustments

Charitable Contribution

Operating income, as adjusted (1)

Product launch costs and commissions

Operating income used for operating margin measurement

Revenue, GAAP basis

Non-GAAP adjustments:

Distribution fees

Investment advisory fees

Revenue used for operating margin measurement

Operating margin, GAAP basis

Operating margin, as adjusted (1)

BlackRock.

Recast

for Updated

Non-GAAP Previously

Adjustments Reported

684 $

$

$

$

$

See note (1) on pages 7-8 for more information on as adjusted items.

March 31

25

12

25

589

1,335

87

1,422 $

3,710 $

(276)

(169)

3,265

18.4%

43.6%

$

589

1,273

87

1,360 $

3,710 $

(276)

(169)

3,265

18.4%

41.7%

$

June 30

Recast

Recast

Recast

for Updated

for Updated

for Updated

Non-GAAP Previously

Non-GAAP Previously Non-GAAP Previously

Adjustments Reported

Adjustments Reported Adjustments Reported

684 $ 1,406 $ 1,406 $ 1,757 $ 1,757 $ 1,848 $ 1,848 $ 5,695 $ 5,695

27

(3)

(2)

1,428

1,428 $

3,648 $

(253)

(176)

Three Months Ended

3,219

38.5%

44.4%

$

1,406

1,406

3,648

(253)

(176)

3,219

38.5%

43.7%

Recast

for Updated

Non-GAAP Previously

Adjustments Reported

$

September 30

$

$

27

9

1,793

83

1,876 $

4,369 $

(288)

(168)

3,913

40.2%

48.0%

$

1,757

83

1,840 $

4,369

$

December 31

(288)

(168)

3,913 $

40.2%

47.0%

27

2

1,877

2

1,879 $

4,478

$

(314)

(191)

3,973

41.3%

47.3%

$

1,848

2

1,850 $

4,478 $

(314)

(191)

Year Ended

December 31

3,973

41.3%

46.6%

106

20

23

589

6,433

172

6,284

172

6,605 $ 6,456

16,205 $ 16,205

(1,131)

(704)

589

(1,131)

(704)

$ 14,370 $ 14,370

35.1%

35.1%

46.0%

44.9%

5View entire presentation