Zegna Results Presentation Deck

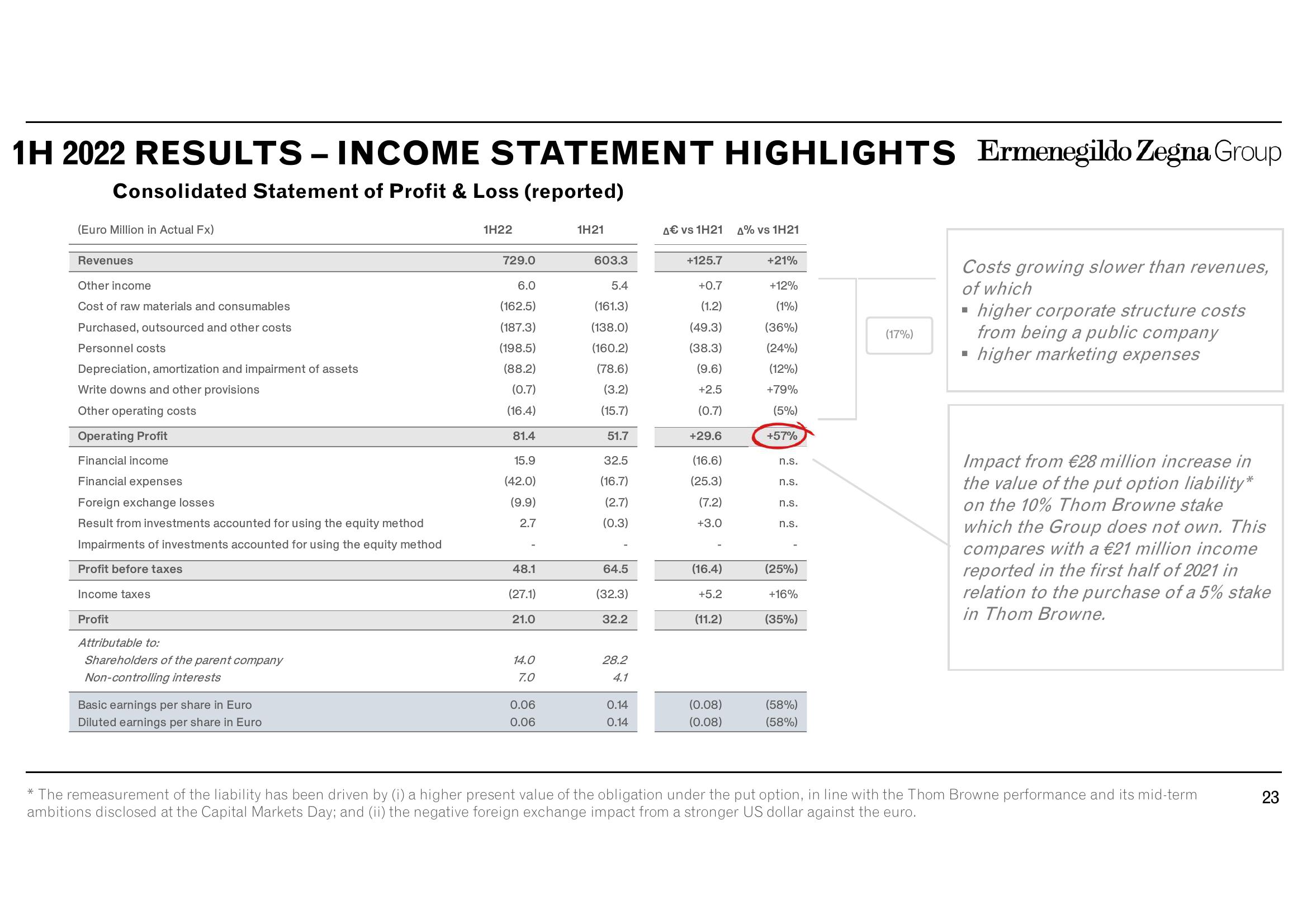

1H 2022 RESULTS -INCOME STATEMENT HIGHLIGHTS Ermenegildo Zegna Group

Consolidated Statement of Profit & Loss (reported)

(Euro Million in Actual Fx)

Revenues

Other income

Cost of raw materials and consumables

Purchased, outsourced and other costs

Personnel costs

Depreciation, amortization and impairment of assets

Write downs and other provisions

Other operating costs

Operating Profit

Financial income

Financial expenses

Foreign exchange losses

Result from investments accounted for using the equity method

Impairments of investments accounted for using the equity method

Profit before taxes

Income taxes

Profit

Attributable to:

Shareholders of the parent company

Non-controlling interests

Basic earnings per share in Euro

Diluted earnings per share in Euro

1H22

729.0

6.0

(162.5)

(187.3)

(198.5)

(88.2)

(0.7)

(16.4)

81.4

15.9

(42.0)

(9.9)

2.7

48.1

(27.1)

21.0

14.0

7.0

0.06

0.06

1H21

603.3

5.4

(161.3)

(138.0)

(160.2)

(78.6)

(3.2)

(15.7)

51.7

32.5

(16.7)

(2.7)

(0.3)

64.5

(32.3)

32.2

28.2

4.1

0.14

0.14

4€ vs 1H21

+125.7

+0.7

(1.2)

(49.3)

(38.3)

(9.6)

+2.5

(0.7)

+29.6

(16.6)

(25.3)

(7.2)

+3.0

(16.4)

+5.2

(11.2)

(0.08)

(0.08)

4% vs 1H21

+21%

+12%

(1%)

(36%)

(24%)

(12%)

+79%

(5%)

+57%

n.s.

n.s.

n.s.

n.s.

(25%)

+16%

(35%)

(58%)

(58%)

(17%)

Costs growing slower than revenues,

of which

higher corporate structure costs

from being a public company

higher marketing expenses

H

Impact from €28 million increase in

the value of the put option liability*

on the 10% Thom Browne stake

which the Group does not own. This

compares with a €21 million income

reported in the first half of 2021 in

relation to the purchase of a 5% stake

in Thom Browne.

* The remeasurement of the liability has been driven by (i) a higher present value of the obligation under the put option, in line with the Thom Browne performance and its mid-term

ambitions disclosed at the Capital Markets Day; and (ii) the negative foreign exchange impact from a stronger US dollar against the euro.

23View entire presentation