Investor Presentation

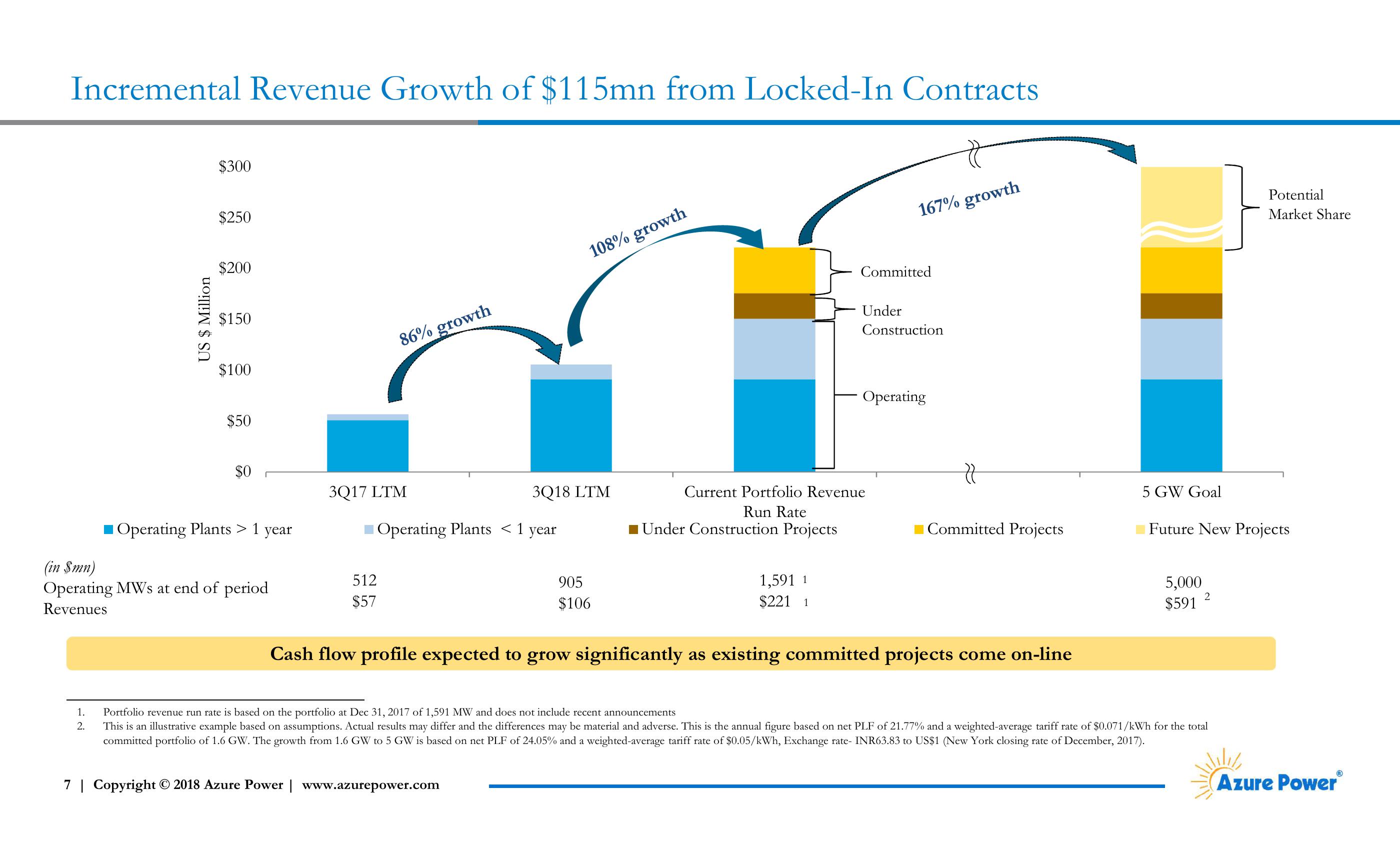

Incremental Revenue Growth of $115mn from Locked-In Contracts

US $ Million

$300

$250

$200

108% growth

$150

$100

86% growth

$50

$0

167% growth

Committed

Under

Construction

Operating

3Q17 LTM

3Q18 LTM

Current Portfolio Revenue

5 GW Goal

(in $mn)

Operating Plants > 1 year

Operating Plants < 1 year

Run Rate

Under Construction Projects

Committed Projects

Future New Projects

512

Operating MWs at end of period

$57

Revenues

905

$106

1,591 1

$221 1

5,000

$591 2

Cash flow profile expected to grow significantly as existing committed projects come on-line

1.

2.

Portfolio revenue run rate is based on the portfolio at Dec 31, 2017 of 1,591 MW and does not include recent announcements

This is an illustrative example based on assumptions. Actual results may differ and the differences may be material and adverse. This is the annual figure based on net PLF of 21.77% and a weighted-average tariff rate of $0.071/kWh for the total

committed portfolio of 1.6 GW. The growth from 1.6 GW to 5 GW is based on net PLF of 24.05% and a weighted-average tariff rate of $0.05/kWh, Exchange rate- INR63.83 to US$1 (New York closing rate of December, 2017).

7 | Copyright © 2018 Azure Power | www.azurepower.com

Potential

Market Share

Azure PowerView entire presentation