LionTree Investment Banking Pitch Book

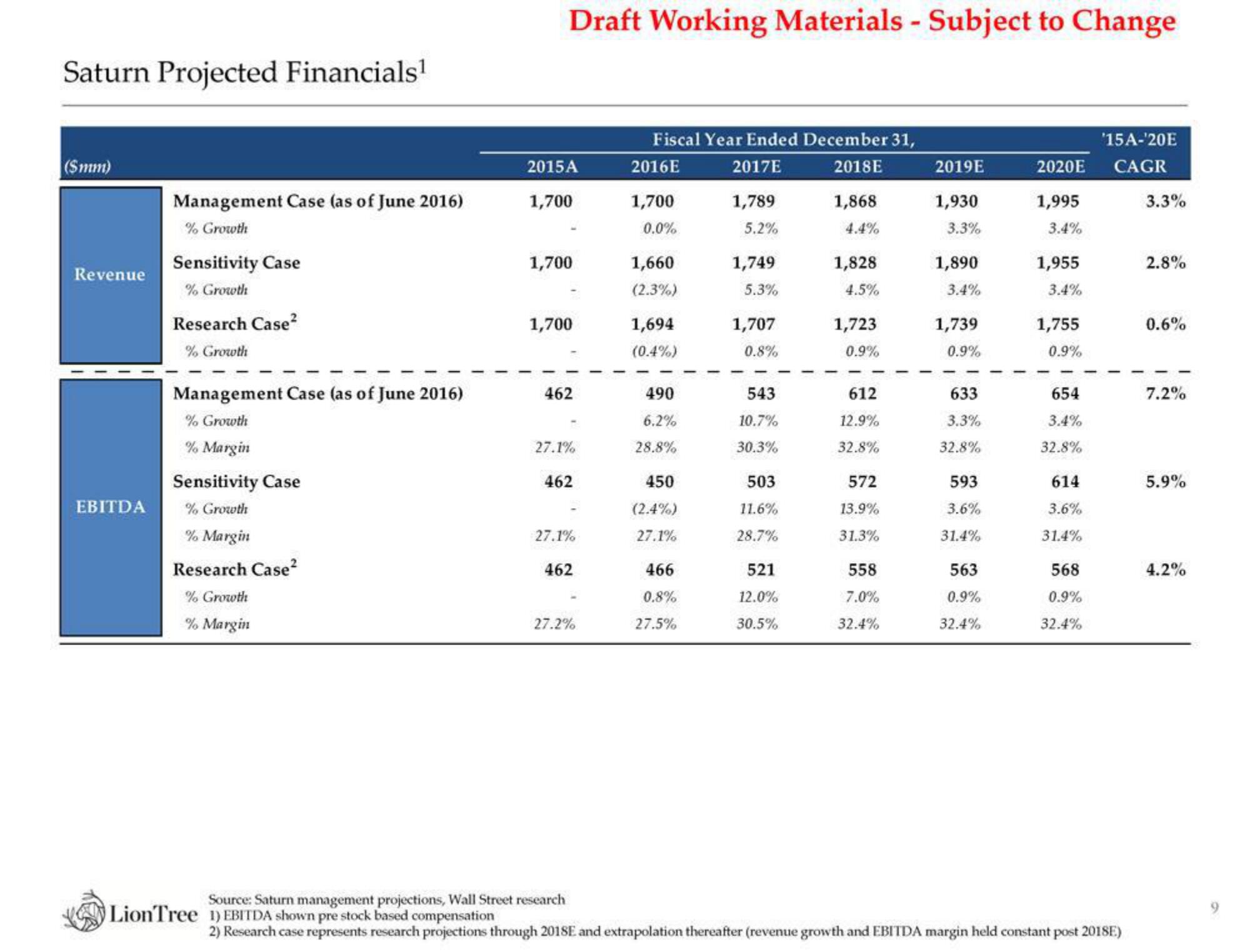

Saturn Projected Financials¹

($mm)

Revenue

EBITDA

Management Case (as of June 2016)

% Growth

Sensitivity Case

% Growth

Research Case²

% Growth

Management Case (as of June 2016)

% Growth

% Margin

Sensitivity Case

% Growth

% Margin

Research Case²

% Growth

% Margin

Draft Working Materials - Subject to Change

2015A

1,700

1,700

1,700

462

27.1%

462

27.1%

462

27.2%

Source: Saturn management projections, Wall Street research

LionTree 1) EBITDA shown pre stock based compensation

Fiscal Year Ended December 31,

2016E

2017E

2018E

1,700

0.0%

1,660

(2.3%)

1,694

(0.4%)

490

6.2%

28.8%

450

(2.4%)

27.1%

466

0.8%

27.5%

1,789

5.2%

1,749

5.3%

1,707

0.8%

543

10.7%

30.3%

503

11.6%

28.7%

521

12.0%

30.5%

1,868

4.4%

1,828

4.5%

1,723

0.9%

612

12.9%

32.8%

572

13.9%

31.3%

558

7.0%

32.4%

2019E

1,930

3.3%

1,890

3.4%

1,739

0.9%

633

3.3%

32.8%

593

3.6%

31.4%

563

0.9%

32.4%

'15A-¹20E

2020E CAGR

1,995

3.4%

1,955

3.4%

1,755

0.9%

654

3.4%

32.8%

614

3.6%

31.4%

568

0.9%

32.4%

2) Research case represents research projections through 2018E and extrapolation thereafter (revenue growth and EBITDA margin held constant post 2018E)

3.3%

2.8%

0.6%

7.2%

5.9%

4.2%View entire presentation