Vertical Aerospace SPAC Presentation Deck

$mm

Annual Aircraft Production (# Aircraft)

Aircraft Sales

Aircraft Services

Total Revenue

YOY Growth %

Aircraft Sales

Aircraft Services

Gross Profit

Gross Margin %

Operating Expenses

EBITDA

EBITDA Margin %

Less: Taxes

Less: Change in NWC

Less: Capex

Free Cash Flow¹

LONG TERM

BUSINESS PLAN

Source: Company estimates. 1. Calculated as EBITDA less taxes, capex and change in net working capital.

INVESTOR DECK 2021

2024E

50

180

12

192

98

2

100

52%

(109)

(9)

(5%)

1

(5)

(40)

(52)

2025E

250

846

85

931

384%

436

17

453

49%

(183)

270

29%

(63)

(18)

(63)

127

2026E

1,000

3,181

385

3,566

283%

1,543

77

1,620

45%

(264)

1,357

38%

(329)

(57)

(198)

772

2027E

1,500

4,485

939

5,424

52%

2,230

PRIVATE & CONFIDENTIAL

188

2,418

45%

(346)

2,072

38%

(503)

(94)

(212)

1,263

2028E

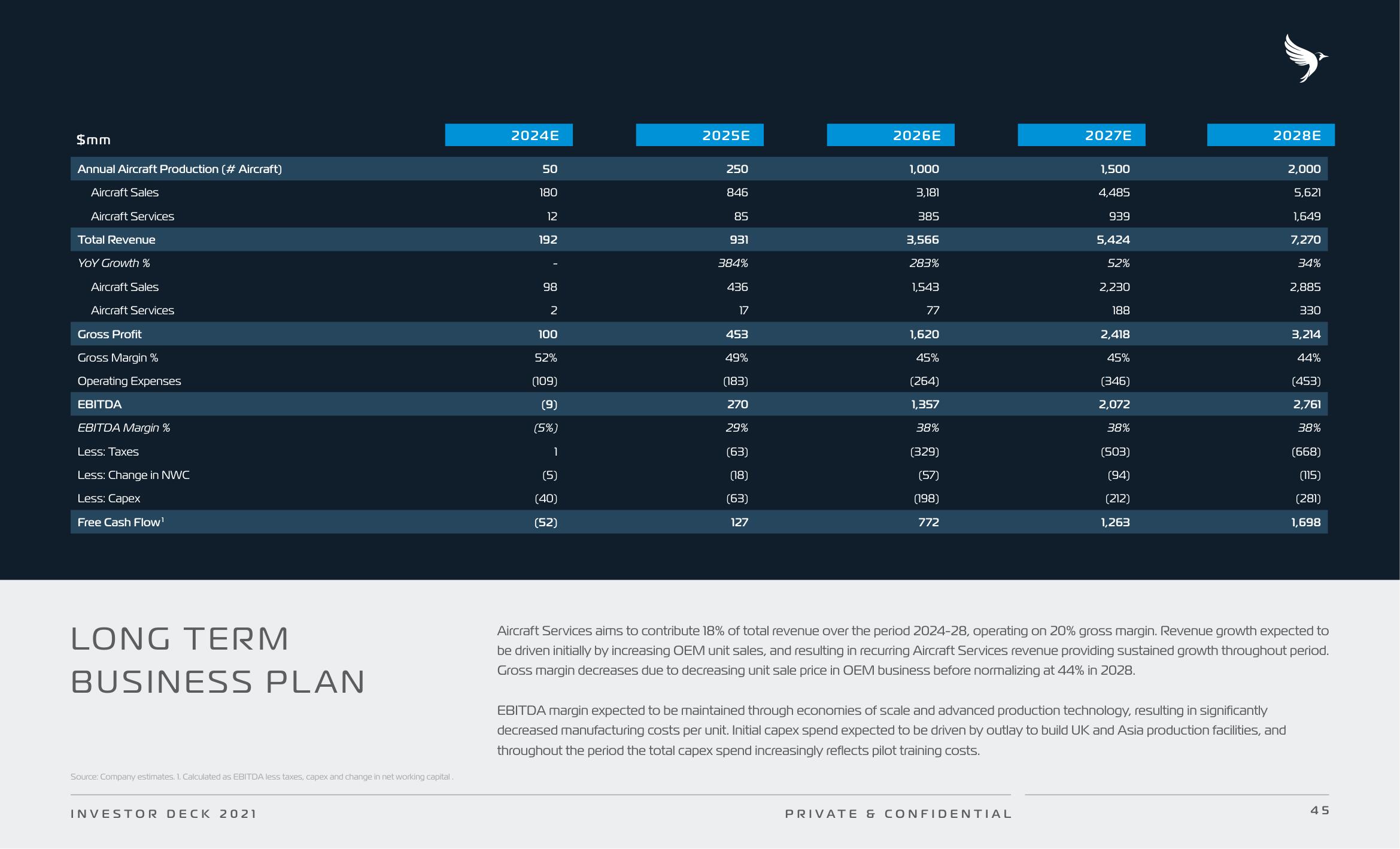

EBITDA margin expected to be maintained through economies of scale and advanced production technology, resulting in significantly

decreased manufacturing costs per unit. Initial capex spend expected to be driven by outlay to build UK and Asia production facilities, and

throughout the period the total capex spend increasingly reflects pilot training costs.

2,000

5,621

1,649

7,270

34%

2,885

330

3,214

44%

(453)

2,761

38%

Aircraft Services aims to contribute 18% of total revenue over the period 2024-28, operating on 20% gross margin. Revenue growth expected to

be driven initially by increasing OEM unit sales, and resulting in recurring Aircraft Services revenue providing sustained growth throughout period.

Gross margin decreases due to decreasing unit sale price in OEM business before normalizing at 44% in 2028.

(668)

(115)

(281)

1,698

45View entire presentation