Oaktree Real Estate Opportunities Fund VII, L.P.

Purchases

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

Resolution and

Securitization

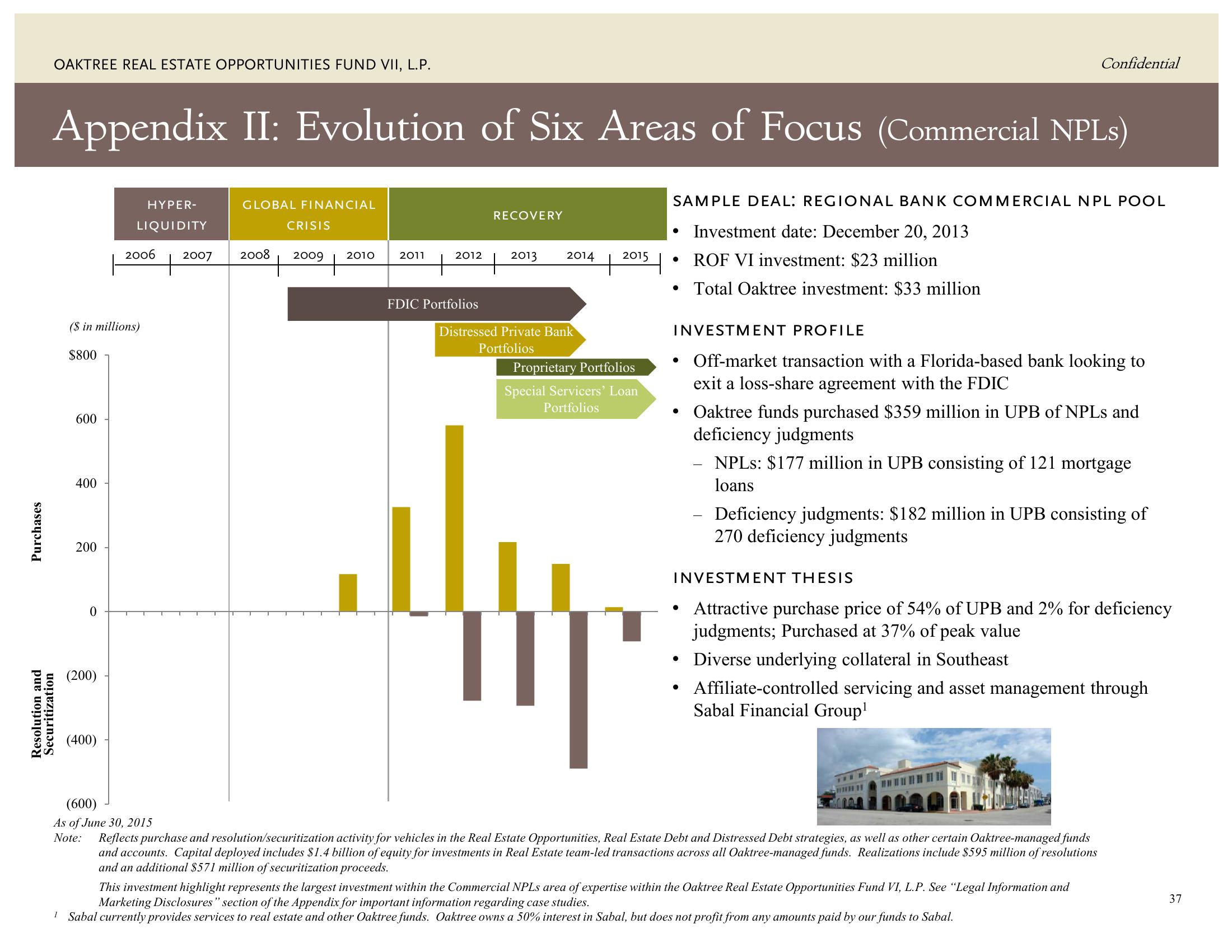

Appendix II: Evolution of Six Areas of Focus (Commercial NPLs)

600

($ in millions)

$800

400

200

0

(200)

HYPER-

LIQUIDITY

(400)

2006

2007

GLOBAL FINANCIAL

CRISIS

2008 2009

+

2010

2011

2012

FDIC Portfolios

RECOVERY

2013

Distressed Private Bank

Portfolios

2014

HL

IT

2015

Proprietary Portfolios

Special Servicers' Loan

Portfolios

+

SAMPLE DEAL: REGIONAL BANK COMMERCIAL NPL POOL

• Investment date: December 20, 2013

• ROF VI investment: $23 million

Total Oaktree investment: $33 million

●

INVESTMENT PROFILE

Off-market transaction with a Florida-based bank looking to

exit a loss-share agreement with the FDIC

●

Confidential

• Oaktree funds purchased $359 million in UPB of NPLs and

deficiency judgments

●

●

NPLs: $177 million in UPB consisting of 121 mortgage

loans

INVESTMENT THESIS

Attractive purchase price of 54% of UPB and 2% for deficiency

judgments; Purchased at 37% of peak value

Diverse underlying collateral in Southeast

Affiliate-controlled servicing and asset management through

Sabal Financial Group¹

Deficiency judgments: $182 million in UPB consisting of

270 deficiency judgments

(600)

As of June 30, 2015

Note:

Reflects purchase and resolution/securitization activity for vehicles in the Real Estate Opportunities, Real Estate Debt and Distressed Debt strategies, as well as other certain Oaktree-managed funds

and accounts. Capital deployed includes $1.4 billion of equity for investments in Real Estate team-led transactions across all Oaktree-managed funds. Realizations include $595 million of resolutions

and an additional $571 million of securitization proceeds.

This investment highlight represents the largest investment within the Commercial NPLs area of expertise within the Oaktree Real Estate Opportunities Fund VI, L.P. See “Legal Information and

Marketing Disclosures" section of the Appendix for important information regarding case studies.

1 Sabal currently provides services to real estate and other Oaktree funds. Oaktree owns a 50% interest in Sabal, but does not profit from any amounts paid by our funds to Sabal.

37View entire presentation