OppFi Results Presentation Deck

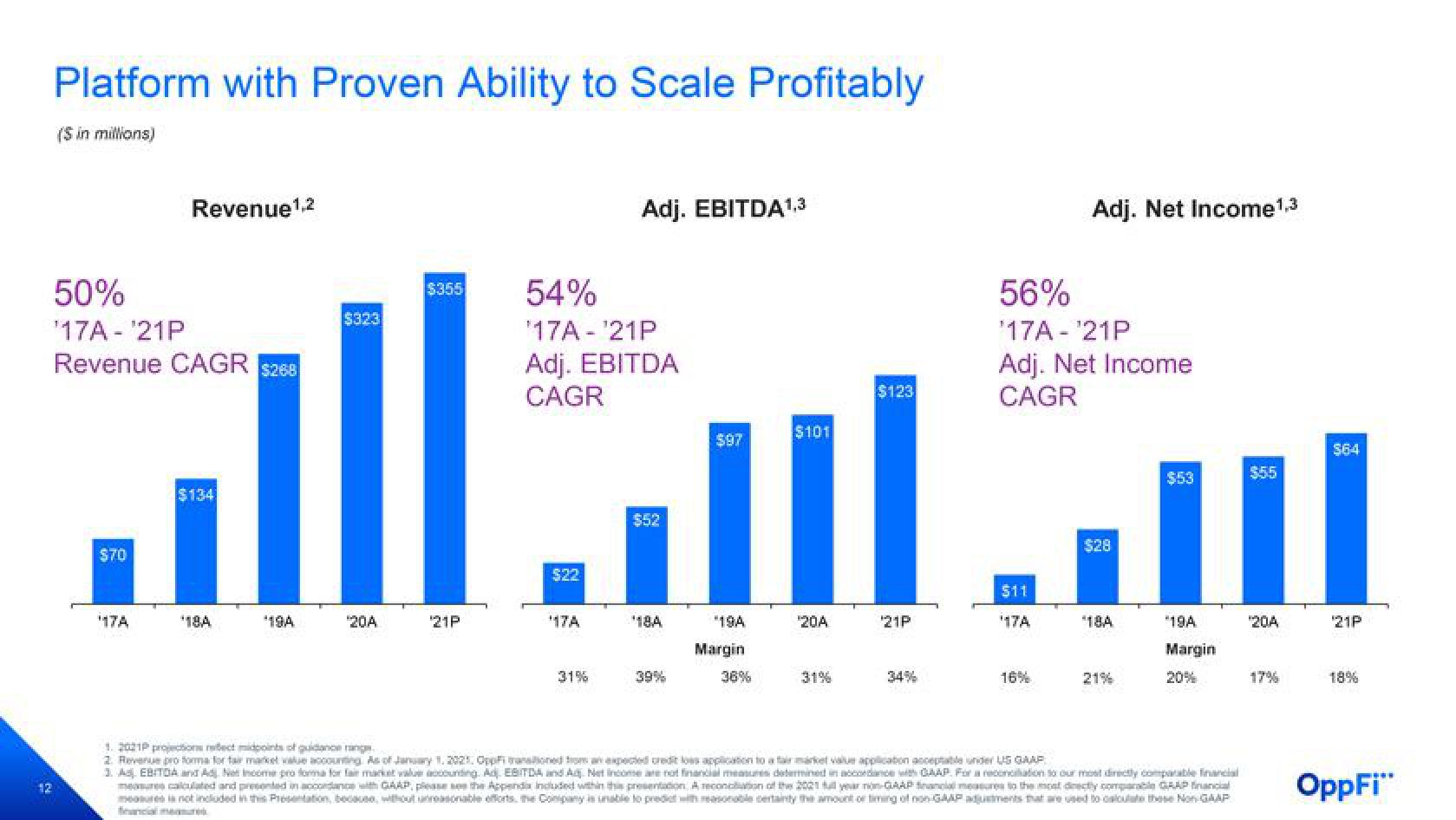

Platform with Proven Ability to Scale Profitably

($ in millions)

50%

¹17A-21P

Revenue CAGR $268

$70

Revenue ¹,2

¹17A

$134

'18A

*19A

$323

¹20A

$355

21P

54%

17A-¹21P

Adj. EBITDA

CAGR

$22

¹17A

Adj. EBITDA¹,3

31%

$52

¹18A

39%

$97

*19A

Margin

36%

$101

¹20A

31%

$123

¹21P

34%

56%

¹17A-¹21P

Adj. Net Income

CAGR

$11

¹17A

Adj. Net Income ¹.3

16%

$28

*18A

21%

$53

*19A

Margin

20%

1. 2021P projections refect doints of guidance range

2 Revenue proforma for tar market value accounting As of January 1, 2025, Oppfi transitioned from an expected credit les application to a fair market value application acceptable under US GAAP

3. As EBITDA and Ad Not Income pro forma forfait market value accounting. Ad. EBITDA and Ad. Net Income are not financial measures determined in accordance with CAP. For a conciliation to our most directly compatible financial

measures calculated and presented in accordance with GAAP, please see the Appendia included within this presentation. A reconciation of the 2021 full year non-GAAP financial measures to the most directly comparable GAAP financial

$55

¹20A

17%

$64

21P

18%

OppFi"View entire presentation