Innovid SPAC Presentation Deck

TRANSACTION OVERVIEW

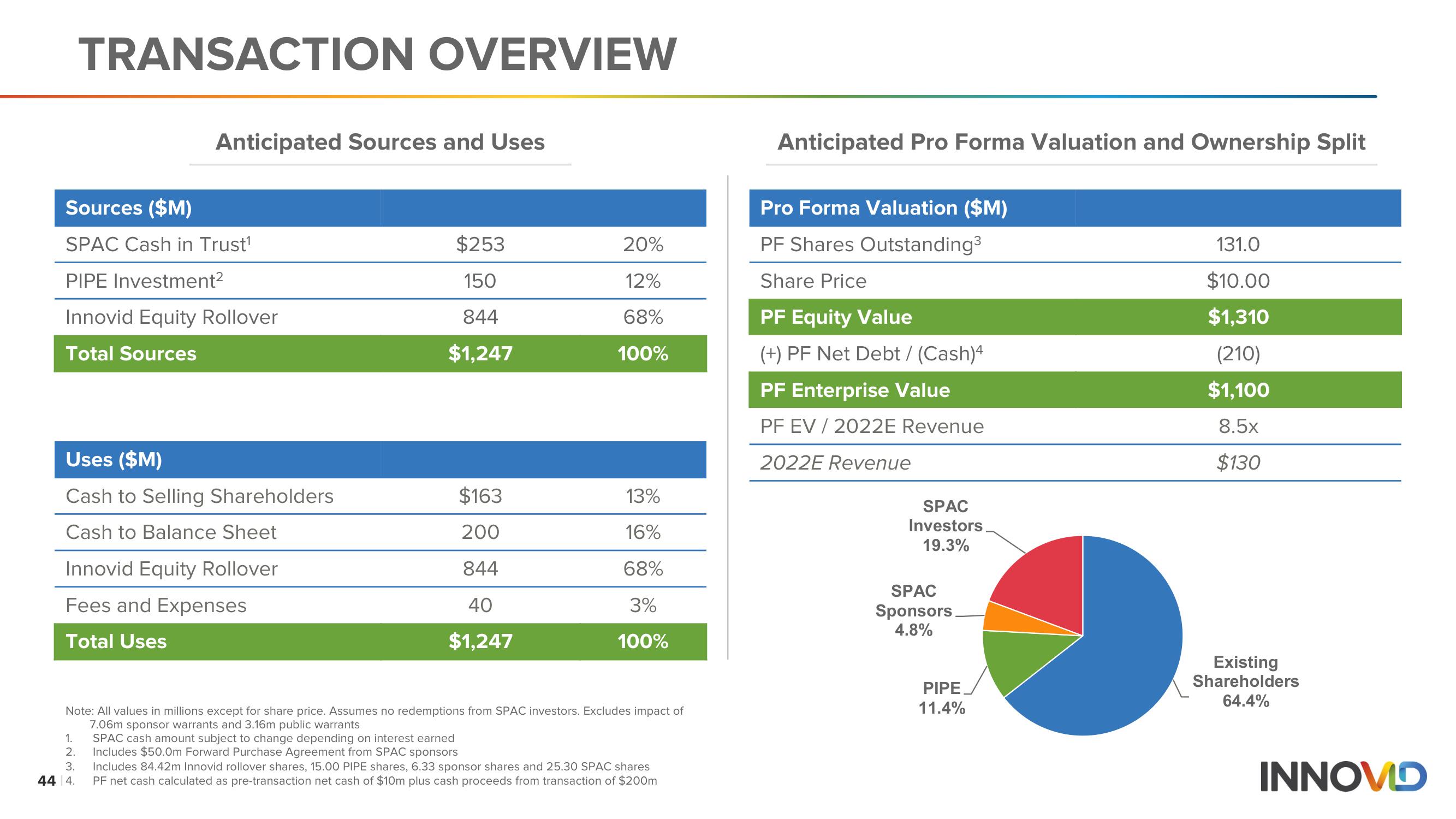

Sources ($M)

SPAC Cash in Trust¹

PIPE Investment²

Innovid Equity Rollover

Total Sources

Anticipated Sources and Uses

Uses ($M)

Cash to Selling Shareholders

Cash to Balance Sheet

Innovid Equity Rollover

Fees and Expenses

Total Uses

1.

2.

3.

44 4.

$253

150

844

$1,247

$163

200

844

40

$1,247

20%

12%

68%

100%

Note: All values in millions except for share price. Assumes no redemptions from SPAC investors. Excludes impact of

7.06m sponsor warrants and 3.16m public warrants

SPAC cash amount subject to change depending on interest earned

Includes $50.0m Forward Purchase Agreement from SPAC sponsors

13%

16%

68%

3%

100%

Includes 84.42m Innovid rollover shares, 15.00 PIPE shares, 6.33 sponsor shares and 25.30 SPAC shares

PF net cash calculated as pre-transaction net cash of $10m plus cash proceeds from transaction of $200m

Anticipated Pro Forma Valuation and Ownership Split

Pro Forma Valuation ($M)

PF Shares Outstanding³

Share Price

PF Equity Value

(+) PF Net Debt / (Cash)4

PF Enterprise Value

PF EV / 2022E Revenue

2022E Revenue

SPAC

Investors

19.3%

SPAC

Sponsors

4.8%

PIPE

11.4%

131.0

$10.00

$1,310

(210)

$1,100

8.5x

$130

Existing

Shareholders

64.4%

INNOVDView entire presentation