Melrose Results Presentation Deck

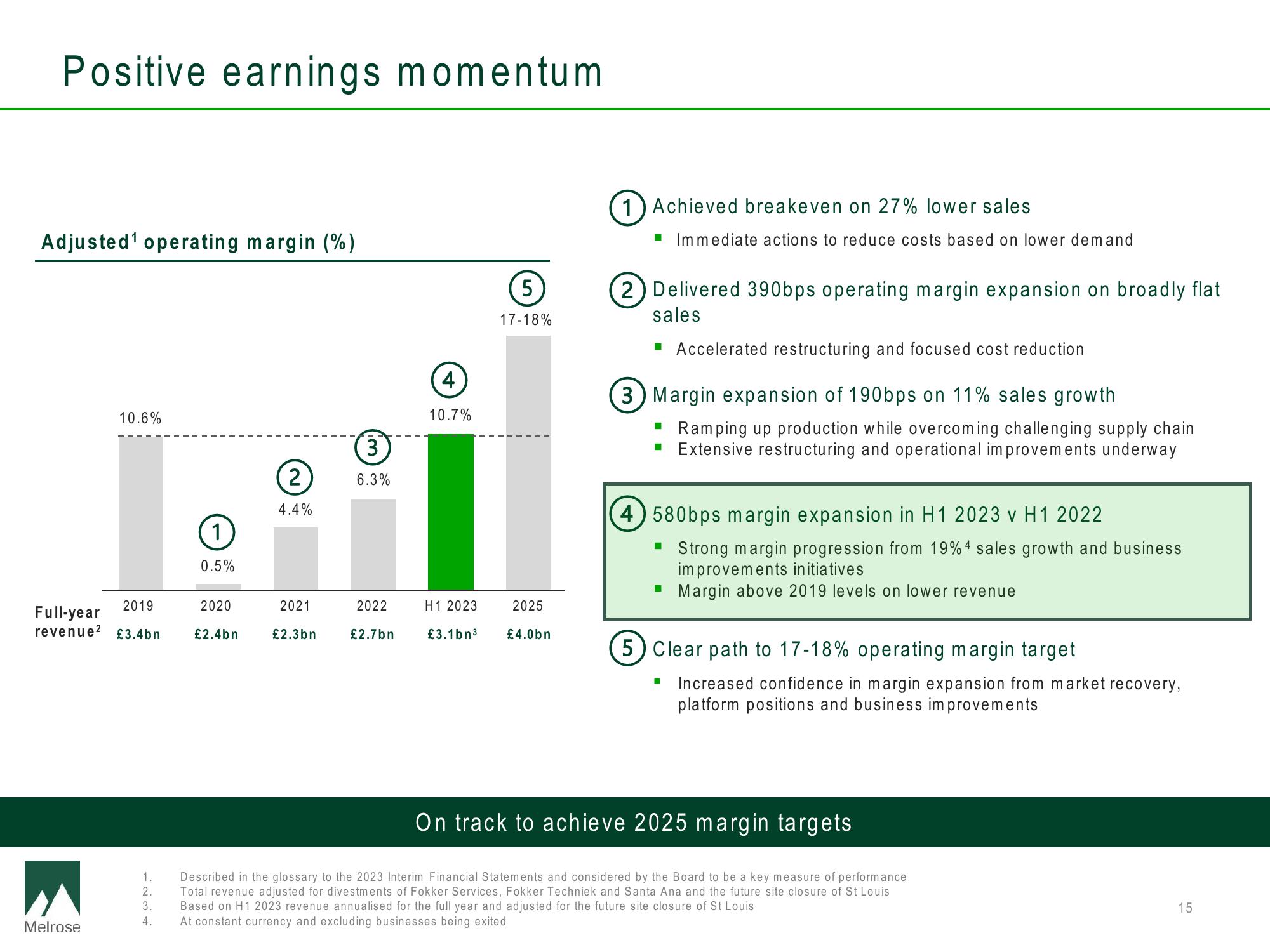

Positive earnings momentum

Adjusted ¹ operating margin (%)

10.6%

2019

Full-year

revenue2 £3.4bn

Melrose

1234

0.5%

4.

2020

£2.4bn

(2)

4.4%

2021

£2.3bn

3

6.3%

2022

£2.7bn

4

10.7%

5

17-18%

H1 2023

£3.1bn³ £4.0bn

2025

1) Achieved breakeven on 27% lower sales

■ Immediate actions to reduce costs based on lower demand

2 Delivered 390bps operating margin expansion on broadly flat

sales

▪ Accelerated restructuring and focused cost reduction

3) Margin expansion of 190bps on 11% sales growth

■

Ramping up production while overcoming challenging supply chain

Extensive restructuring and operational improvements underway

4) 580bps margin expansion in H1 2023 v H1 2022

▪ Strong margin progression from 19% 4 sales growth and business

improvements initiatives

▪ Margin above 2019 levels on lower revenue

5) Clear path to 17-18% operating margin target

I

On track to achieve 2025 margin targets

1. Described in the glossary to the 2023 Interim Financial Statements and considered by the Board to be a key measure of performance

2. Total revenue adjusted for divestments of Fokker Services, Fokker Techniek and Santa Ana and the future site closure of St Louis

Based on H1 2023 revenue annualised for the full year and adjusted for the future site closure of St Louis

At constant currency and excluding businesses being exited

Increased confidence in margin expansion from market recovery,

platform positions and business improvements

15View entire presentation