J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

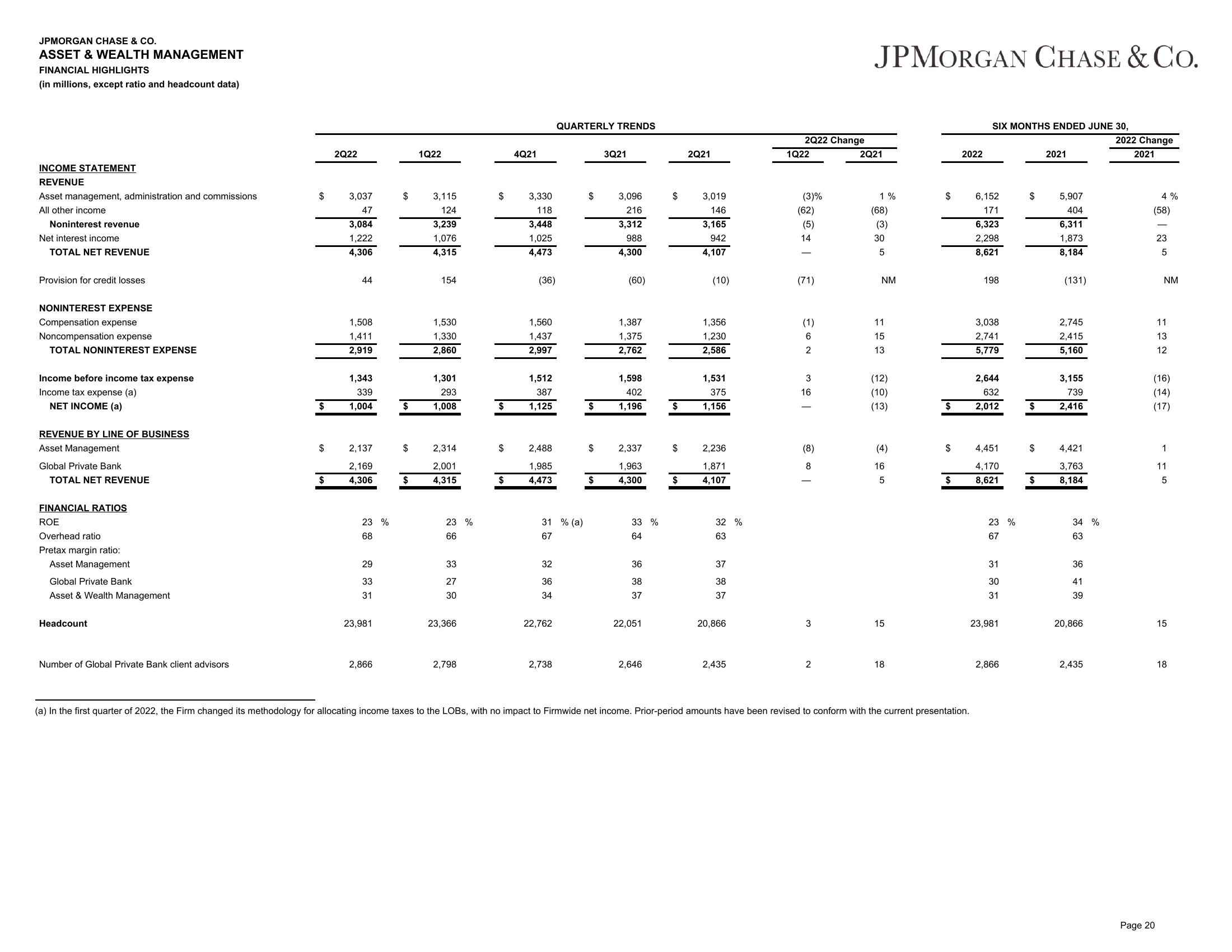

ASSET & WEALTH MANAGEMENT

FINANCIAL HIGHLIGHTS

(in millions, except ratio and headcount data)

INCOME STATEMENT

REVENUE

Asset management, administration and commissions

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense (a)

NET INCOME (a)

REVENUE BY LINE OF BUSINESS

Asset Management

Global Private Bank

TOTAL NET REVENUE

FINANCIAL RATIOS

ROE

Overhead ratio

Pretax margin ratio:

Asset Management

Global Private Bank

Asset & Wealth Management

Headcount

Number of Global Private Bank client advisors

$

$

$

$

2Q22

3,037

47

3,084

1,222

4,306

44

1,508

1,411

2,919

1,343

339

1,004

2,137

2,169

4,306

23 %

68

29

33

31

23,981

2,866

$

$

1Q22

3,115

124

3,239

1,076

4,315

154

1,530

1,330

2,860

1,301

293

1,008

2,314

2,001

$ 4,315

23 %

66

33

27

30

23,366

2,798

$

$

$

$

4Q21

3,330

118

3,448

1,025

4,473

(36)

1,560

1,437

2,997

1,512

387

1,125

2,488

1,985

4,473

31 % (a)

67

32

36

34

22,762

QUARTERLY TRENDS

2,738

$

$

$

$

3Q21

3,096

216

3,312

988

4,300

(60)

1,387

1,375

2,762

1,598

402

1,196

2,337

1,963

4,300

33 %

64

36

38

37

22,051

2,646

$

$

$

$

2Q21

3,019

146

3,165

942

4,107

(10)

1,356

1,230

2,586

1,531

375

1,156

2,236

1,871

4,107

32 %

63

37

37

20,866

2,435

2Q22 Change

1Q22

(3)%

(62)

(5)

14

(71)

(1)

6

2

16

I

(8)

8

ය |

3

2

JPMORGAN CHASE & CO.

2Q21

1%

(68)

(3)

30

5

NM

11

15

13

(12)

(10)

(13)

(4)

16

5

15

18

$

$

$

$

2022

(a) In the first quarter of 2022, the Firm changed its methodology for allocating income taxes to the LOBS, with no impact to Firmwide net income. Prior-period amounts have been revised to conform with the current presentation.

SIX MONTHS ENDED JUNE 30,

6,152

171

6,323

2,298

8,621

198

3,038

2,741

5,779

2,644

632

2,012

4,451

4,170

8,621

23 %

67

31

30

31

23,981

2,866

$

$

$

$

2021

5,907

404

6,311

1,873

8,184

(131)

2,745

2,415

5,160

3,155

739

2,416

4,421

3,763

8,184

34 %

63

36

41

39

20,866

2,435

2022 Change

2021

4%

(58)

Page 20

23

5

NM

11

13

12

(16)

(14)

(17)

1

11

5

15

18View entire presentation