Cadre Holdings IPO Presentation Deck

3021 FLASH RESULTS

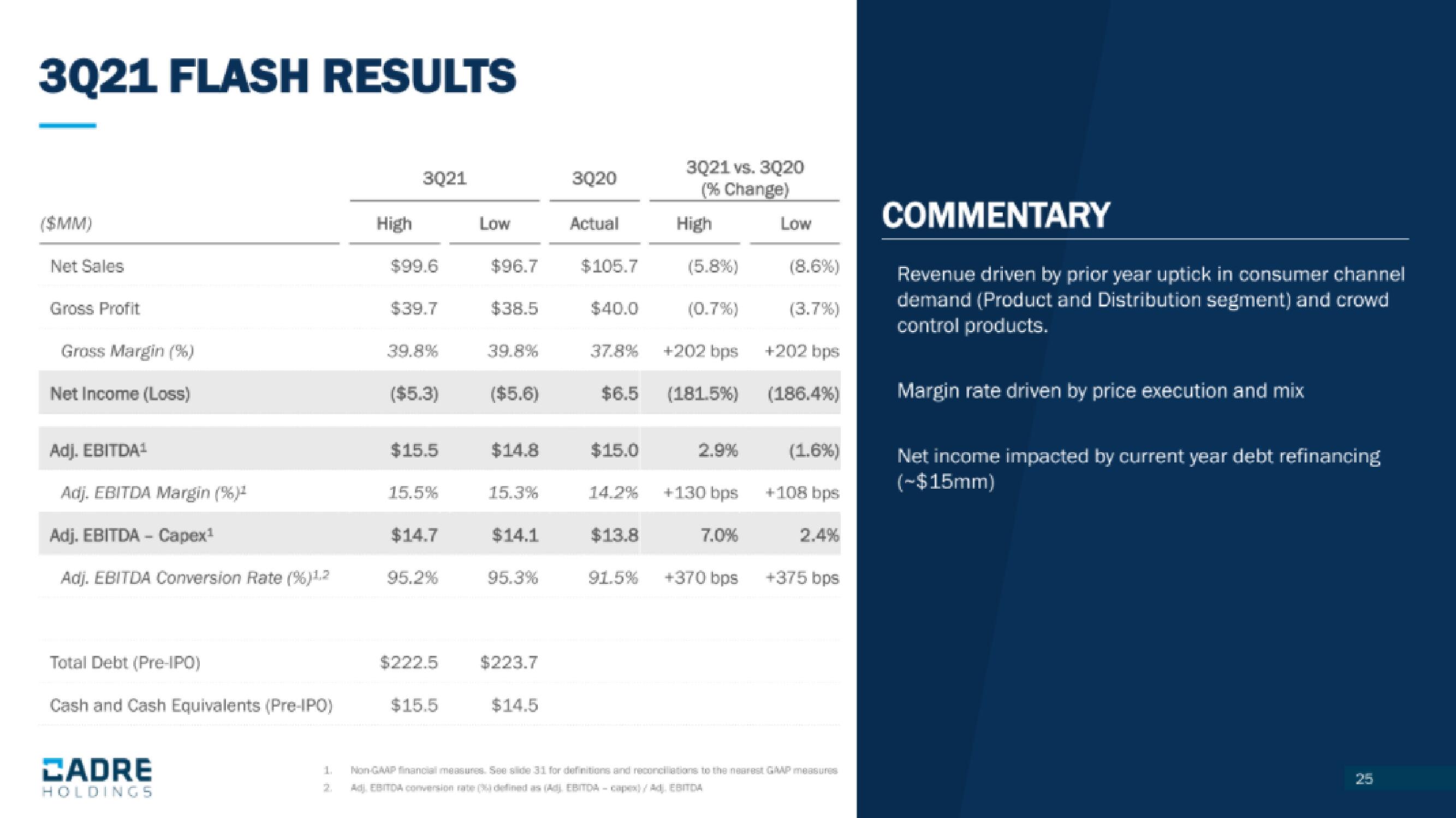

($MM)

Net Sales

Gross Profit

Gross Margin (%)

Net Income (Loss)

Adj. EBITDA¹

Adj. EBITDA Margin (%)¹

Adj. EBITDA-Capex¹

Adj. EBITDA Conversion Rate (%)1.2

Total Debt (Pre-IPO)

Cash and Cash Equivalents (Pre-IPO)

CADRE

HOLDINGS

1

High

3Q21

$99.6

$39.7

39.8%

($5.3)

$15.5

15.5%

$14.7

95.2%

$222.5

$15.5

Low

$96.7

$38.5

39.8%

($5.6)

$14.8

15.3%

$14.1

95.3%

$223.7

$14.5

3Q20

Actual

$105.7

$40.0

37.8%

$6.5

$15.0

14.2%

$13.8

91.5%

3021 vs. 3020

(% Change)

High

(5.8%)

(0.7%)

+202 bps

(181.5%)

2.9%

+130 bps

7.0%

Low

(8.6%)

(3.7%)

+202 bps

(186.4%)

(1.6%)

+108 bps

2.4%

+370 bps +375 bps

Non-GAAP financial measures. See slide 31 for definitions and reconciliations to the nearest GAAP measures

Adj. EBITDA conversion rate (36) defined as (Adj. EBITDA-capex) / A. EBITDA

COMMENTARY

Revenue driven by prior year uptick in consumer channel

demand (Product and Distribution segment) and crowd

control products.

Margin rate driven by price execution and mix

Net income impacted by current year debt refinancing

(-$15mm)View entire presentation