Covalto SPAC Presentation Deck

6

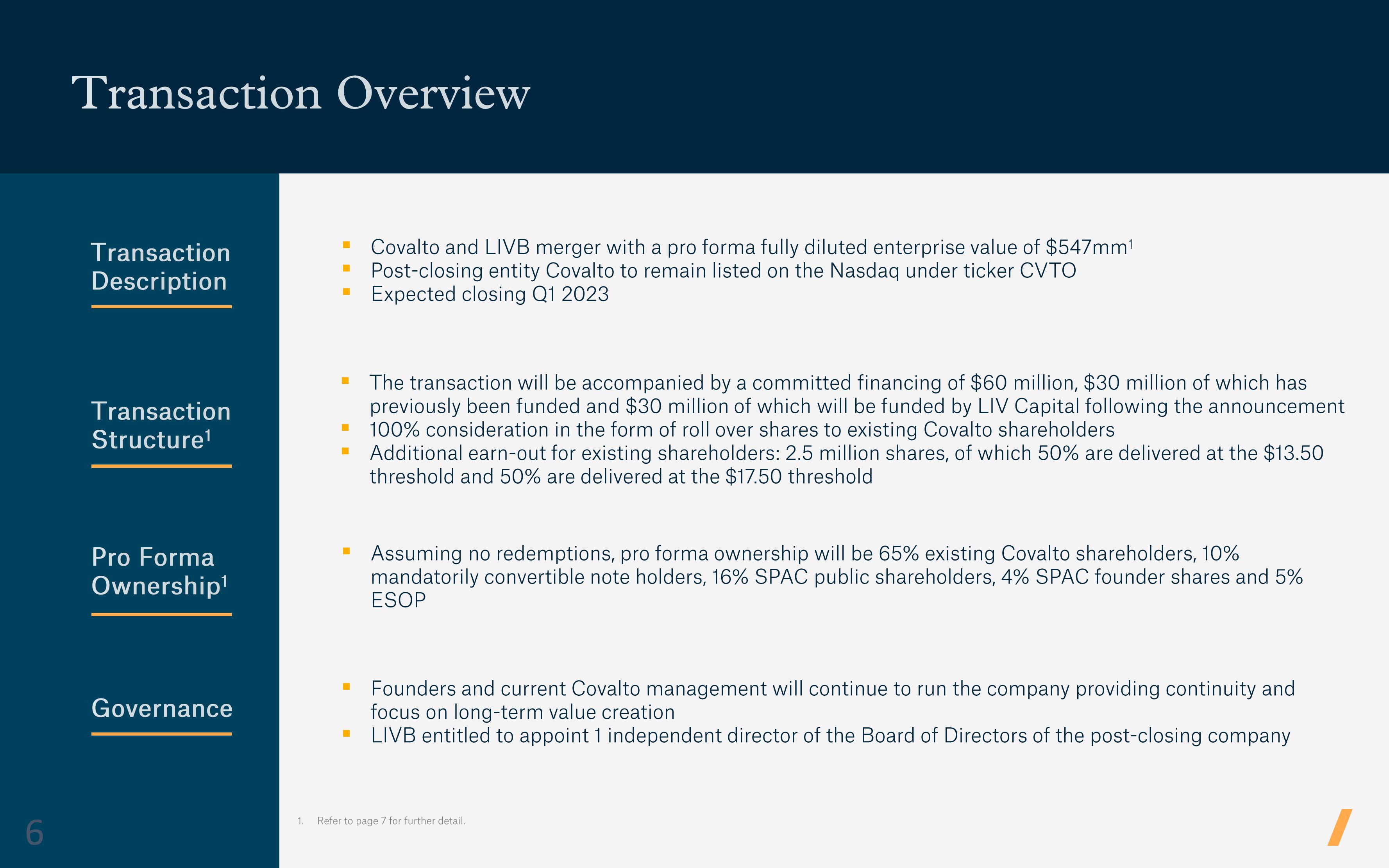

Transaction Overview

Transaction

Description

Transaction

Structure¹

Pro Forma

Ownership¹

Governance

■

■

■

■

■

■

■

■

Covalto and LIVB merger with a pro forma fully diluted enterprise value of $547mm¹

Post-closing entity Covalto to remain listed on the Nasdaq under ticker CVTO

Expected closing Q1 2023

The transaction will be accompanied by a committed financing of $60 million, $30 million of which has

previously been funded and $30 million of which will be funded by LIV Capital following the announcement

100% consideration in the form of roll over shares to existing Covalto shareholders

Additional earn-out for existing shareholders: 2.5 million shares, of which 50% are delivered at the $13.50

threshold and 50% are delivered at the $17.50 threshold

Assuming no redemptions, pro forma ownership will be 65% existing Covalto shareholders, 10%

mandatorily convertible note holders, 16% SPAC public shareholders, 4% SPAC founder shares and 5%

ESOP

Founders and current Covalto management will continue to run the company providing continuity and

focus on long-term value creation

LIVB entitled to appoint 1 independent director of the Board of Directors of the post-closing company

1. Refer to page 7 for further detail.View entire presentation