J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

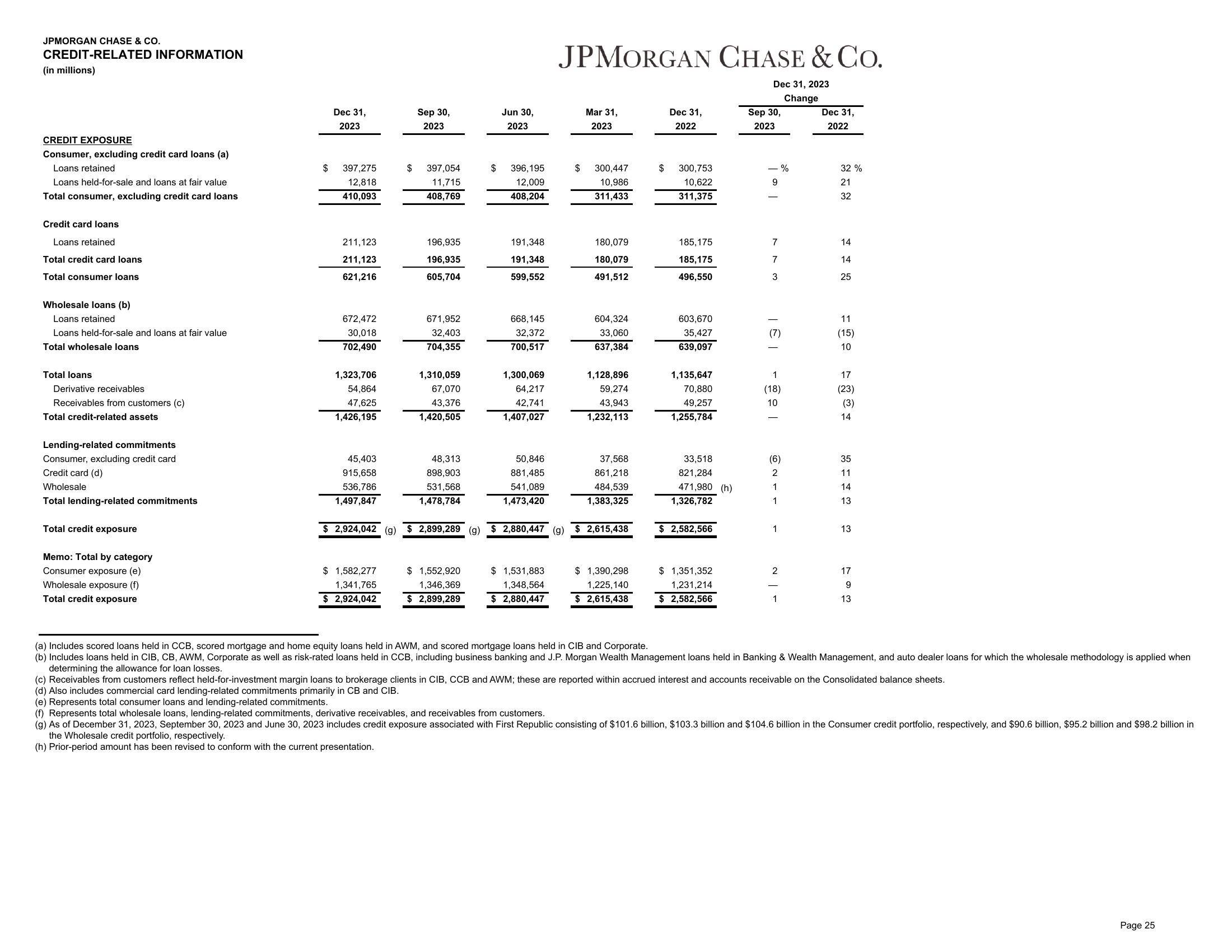

CREDIT-RELATED INFORMATION

(in millions)

CREDIT EXPOSURE

Consumer, excluding credit card loans (a)

Loans retained

Loans held-for-sale and loans at fair value

Total consumer, excluding credit card loans

Credit card loans

Loans retained

Total credit card loans

Total consumer loans

Wholesale loans (b)

Loans retained

Loans held-for-sale and loans at fair value

Total wholesale loans

Total loans

Derivative receivables

Receivables from customers (c)

Total credit-related assets

Lending-related commitments

Consumer, excluding credit card

Credit card (d)

Wholesale

Total lending-related commitments

Total credit exposure

Memo: Total by category

Consumer exposure (e)

Wholesale exposure (f)

Total credit exposure

Dec 31,

2023

$ 397,275

12,818

410,093

211,123

211,123

621,216

672,472

30,018

702,490

1,323,706

54,864

47,625

1,426,195

45,403

915,658

536,786

1,497,847

$ 2,924,042 (g)

$ 1,582,277

1,341,765

$ 2,924,042

Sep 30,

2023

$ 397,054

11,715

408,769

196,935

196,935

605,704

671,952

32,403

704,355

1,310,059

67,070

43,376

1,420,505

48,313

898,903

531,568

1,478,784

$

$ 1,552,920

1,346,369

$ 2,899,289

Jun 30,

2023

396, 195

12,009

408,204

191,348

191,348

599,552

668,145

32,372

700,517

1,300,069

64,217

42,741

1,407,027

50,846

881,485

541,089

1,473,420

2,899,289 (g) $2,880,447 (g)

JPMORGAN CHASE & CO.

Dec 31, 2023

Change

$1,531,883

1,348,564

$ 2,880,447

Mar 31,

2023

$ 300,447

10,986

311,433

180,079

180,079

491,512

604,324

33,060

637,384

1,128,896

59,274

43,943

1,232,113

37,568

861,218

484,539

1,383,325

2,615,438

$ 1,390,298

1,225,140

$ 2,615,438

$

Dec 31,

2022

300,753

10,622

311,375

185,175

185,175

496,550

603,670

35,427

639,097

1,135,647

70,880

49,257

1,255,784

33,518

821,284

471,980 (h)

1,326,782

$ 2,582,566

$1,351,352

1,231,214

$ 2,582,566

Sep 30,

2023

- %

9

773

(7)

1

(18)

10

(6)

2

1

1

1

2

1

Dec 31,

2022

32%

21

32

14

14

25

11

(15)

10

17

(23)

(3)

14

35

11

14

13

13

17

9

13

(a) Includes scored loans held in CCB, scored mortgage and home equity loans held in AWM, and scored mortgage loans held in CIB and Corporate.

(b) Includes loans held in CIB, CB, AWM, Corporate as well as risk-rated loans held in CCB, including business banking and J.P. Morgan Wealth Management loans held in Banking & Wealth Management, and auto dealer loans for which the wholesale methodology is applied when

determining the allowance for loan losses.

(c) Receivables from customers reflect held-for-investment margin loans to brokerage clients in CIB, CCB and AWM; these are reported within accrued interest and accounts receivable on the Consolidated balance sheets.

(d) Also includes commercial card lending-related commitments primarily in CB and CIB.

(e) Represents total consumer loans and lending-related commitments.

(f) Represents total wholesale loans, lending-related commitments, derivative receivables, and receivables from customers.

(g) As of December 31, 2023, September 30, 2023 and June 30, 2023 includes credit exposure associated with First Republic consisting of $101.6 billion, $103.3 billion and $104.6 billion in the Consumer credit portfolio, respectively, and $90.6 billion, $95.2 billion and $98.2 billion in

the Wholesale credit portfolio, respectively.

(h) Prior-period amount has been revised to conform with the current presentation.

Page 25View entire presentation