AngloAmerican Results Presentation Deck

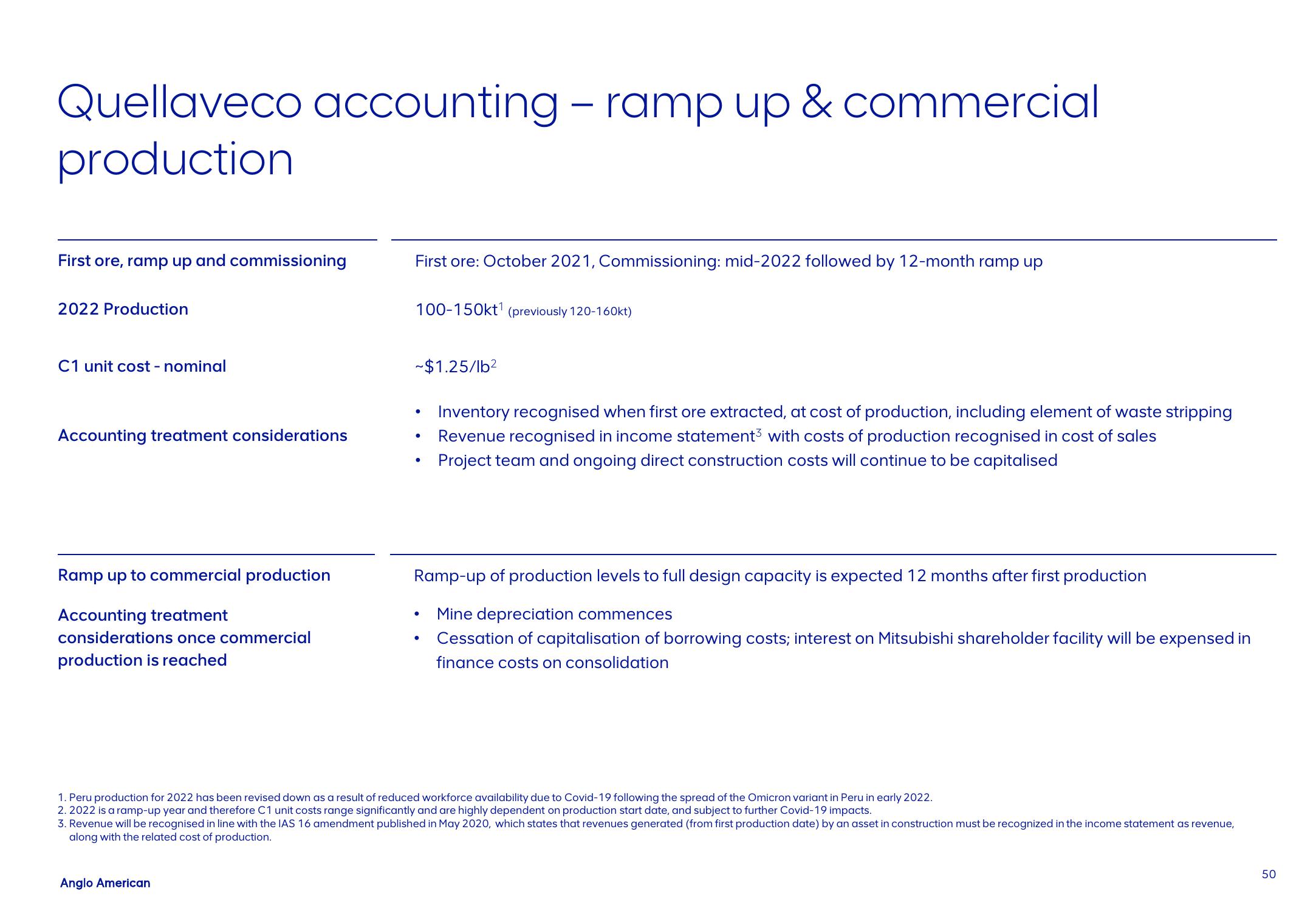

Quellaveco accounting - ramp up & commercial

production

First ore, ramp up and commissioning

2022 Production

C1 unit cost - nominal

Accounting treatment considerations

Ramp up to commercial production

Accounting treatment

considerations once commercial

production is reached

First ore: October 2021, Commissioning: mid-2022 followed by 12-month ramp up

Anglo American

100-150kt¹ (previously 120-160kt)

~$1.25/lb²

●

●

●

Ramp-up of production levels to full design capacity is expected 12 months after first production

Mine depreciation commences

Cessation of capitalisation of borrowing costs; interest on Mitsubishi shareholder facility will be expensed in

finance costs on consolidation

●

Inventory recognised when first ore extracted, at cost of production, including element of waste stripping

Revenue recognised in income statement with costs of production recognised in cost of sales

Project team and ongoing direct construction costs will continue to be capitalised

●

1. Peru production for 2022 has been revised down as a result of reduced workforce availability due to Covid-19 following the spread of the Omicron variant in Peru in early 2022.

2. 2022 is a ramp-up year and therefore C1 unit costs range significantly and are highly dependent on production start date, and subject to further Covid-19 impacts.

3. Revenue will be recognised in line with the IAS 16 amendment published in May 2020, which states that revenues generated (from first production date) by an asset in construction must be recognized in the income statement as revenue,

along with the related cost of production.

50View entire presentation