Informatica Investor Presentation Deck

37

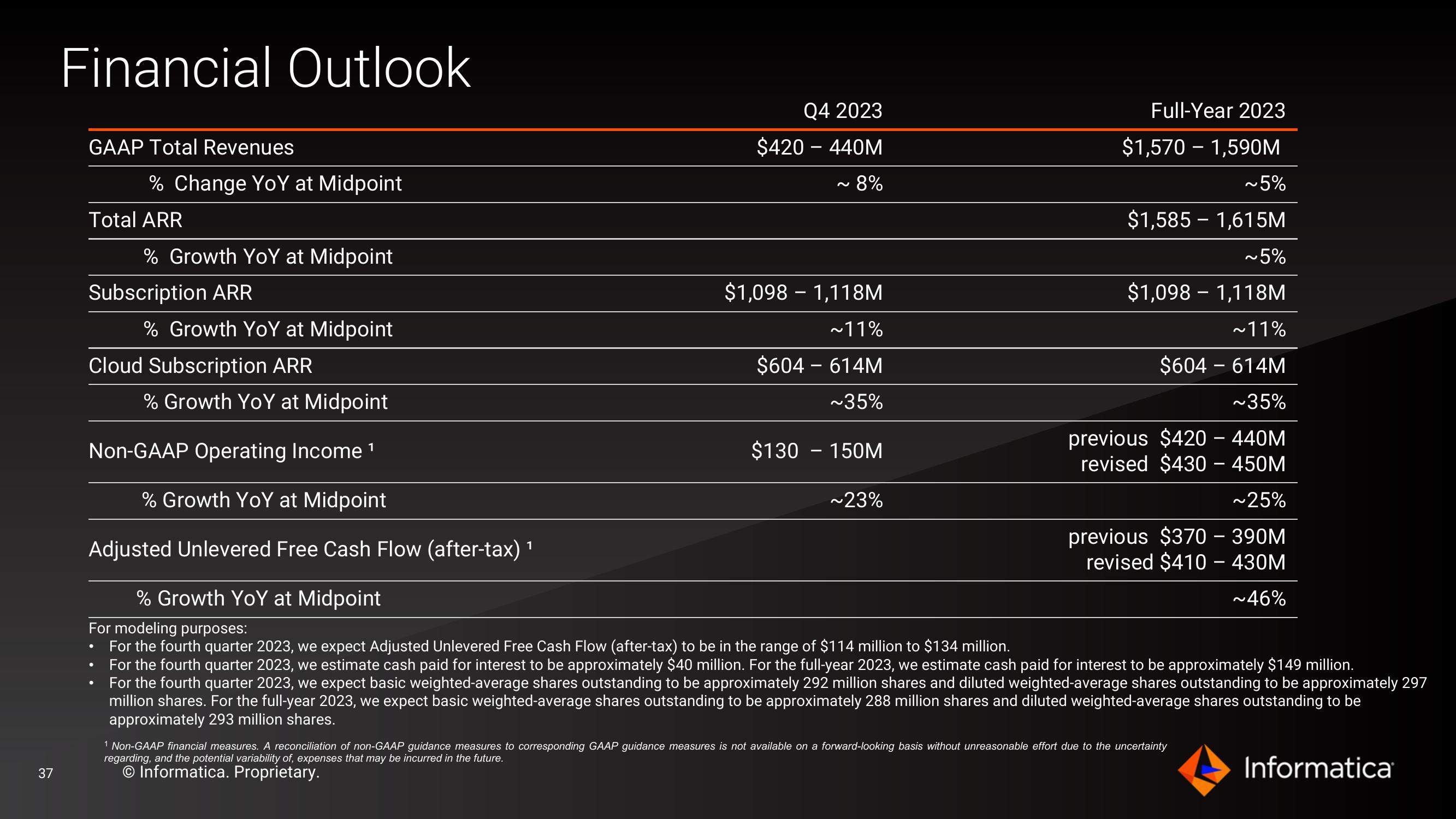

Financial Outlook

GAAP Total Revenues

Total ARR

% Growth YoY at Midpoint

Subscription ARR

% Growth YoY at Midpoint

Cloud Subscription ARR

% Change YoY at Midpoint

Non-GAAP Operating Income ¹

% Growth YoY at Midpoint

1

Adjusted Unlevered Free Cash Flow (after-tax) ¹

●

●

% Growth YoY at Midpoint

●

% Growth YoY at Midpoint

Q4 2023

$420 – 440M

~8%

~

$1,098 1,118M

~11%

$604-614M

~35%

$130 - 150M

~23%

Full-Year 2023

$1,570 1,590M

~5%

$1,585 1,615M

~5%

$1,098 1,118M

~11%

-

$604-614M

For modeling purposes:

For the fourth quarter 2023, we expect Adjusted Unlevered Free Cash Flow (after-tax) to be in the range of $114 million to $134 million.

For the fourth quarter 2023, we estimate cash paid for interest to be approximately $40 million. For the full-year 2023, we estimate cash paid for interest to be approximately $149 million.

For the fourth quarter 2023, we expect basic weighted-average shares outstanding to be approximately 292 million shares and diluted weighted-average shares outstanding to be approximately 297

million shares. For the full-year 2023, we expect basic weighted-average shares outstanding to be approximately 288 million shares and diluted weighted-average shares outstanding to be

approximately 293 million shares.

~35%

previous $420 - 440M

revised $430 - 450M

~25%

previous $370 - 390M

revised $410 - 430M

~46%

1 Non-GAAP financial measures. A reconciliation of non-GAAP guidance measures to corresponding GAAP guidance measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty

regarding, and the potential variability of, expenses that may be incurred in the future.

Informatica. Proprietary.

InformaticaView entire presentation