SmileDirectClub Investor Presentation Deck

Balance sheet highlights.

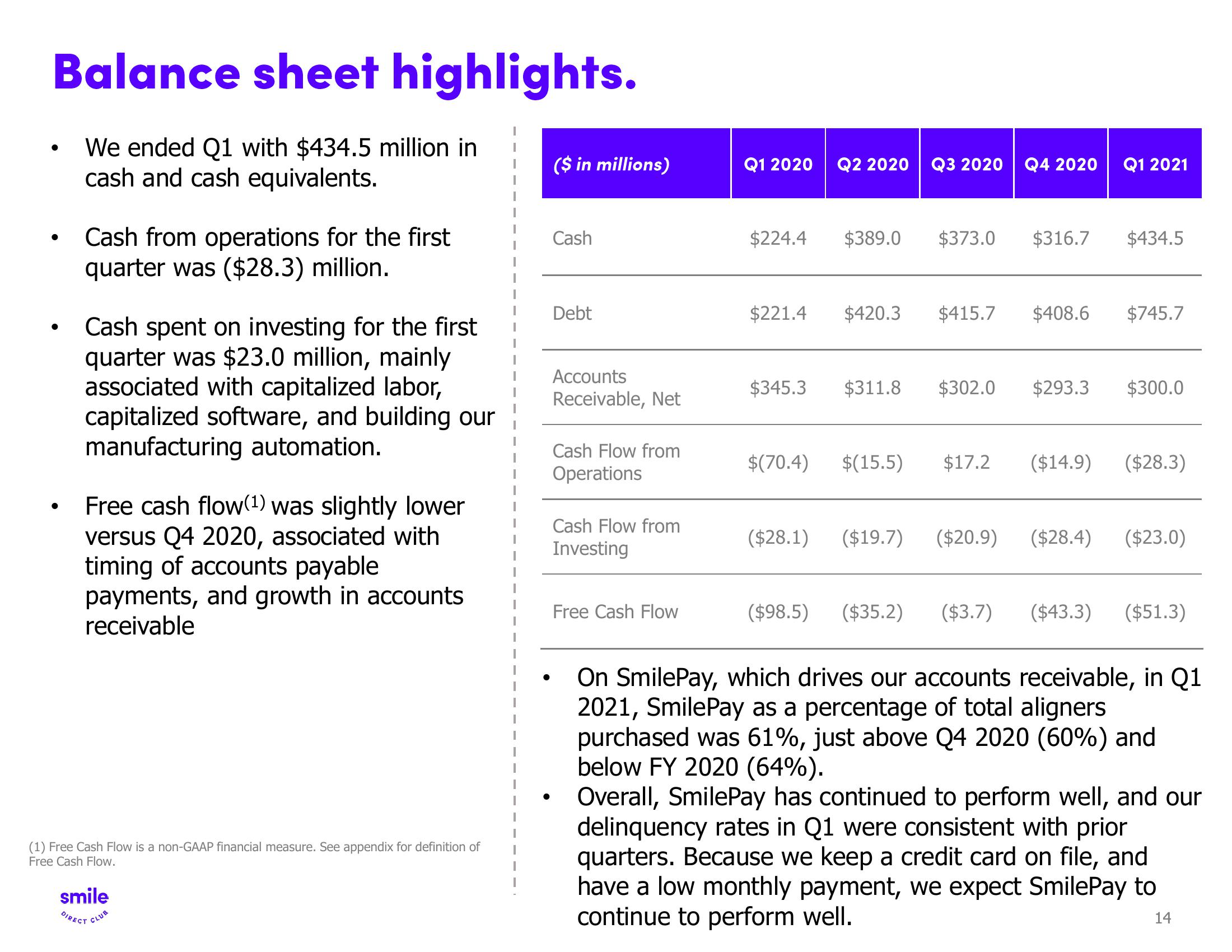

We ended Q1 with $434.5 million in

cash and cash equivalents.

●

●

●

Cash from operations for the first

quarter was ($28.3) million.

Cash spent on investing for the first

quarter was $23.0 million, mainly

associated with capitalized labor,

capitalized software, and building our

manufacturing automation.

Free cash flow(1) was slightly lower

versus Q4 2020, associated with

timing of accounts payable

payments, and growth in accounts

receivable

(1) Free Cash Flow is a non-GAAP financial measure. See appendix for definition of

Free Cash Flow.

smile

DIRECT CLUB

($ in millions)

Cash

Debt

Accounts

Receivable, Net

Cash Flow from

Operations

Cash Flow from

Investing

Free Cash Flow

Q1 2020

$224.4

$221.4

Q2 2020

$389.0

$420.3

Q3 2020 Q4 2020

$373.0 $316.7

$415.7 $408.6

$345.3 $311.8 $302.0 $293.3

Q1 2021

$434.5

$745.7

$300.0

$(70.4) $(15.5) $17.2 ($14.9) ($28.3)

($28.1) ($19.7) ($20.9) ($28.4) ($23.0)

($98.5) ($35.2) ($3.7) ($43.3) ($51.3)

On SmilePay, which drives our accounts receivable, in Q1

2021, SmilePay as a percentage of total aligners

purchased was 61%, just above Q4 2020 (60%) and

below FY 2020 (64%).

Overall, SmilePay has continued to perform well, and our

delinquency rates in Q1 were consistent with prior

quarters. Because we keep a credit card on file, and

have a low monthly payment, we expect SmilePay to

continue to perform well.

14View entire presentation