Evercore Investment Banking Pitch Book

Soda Ash Market Background

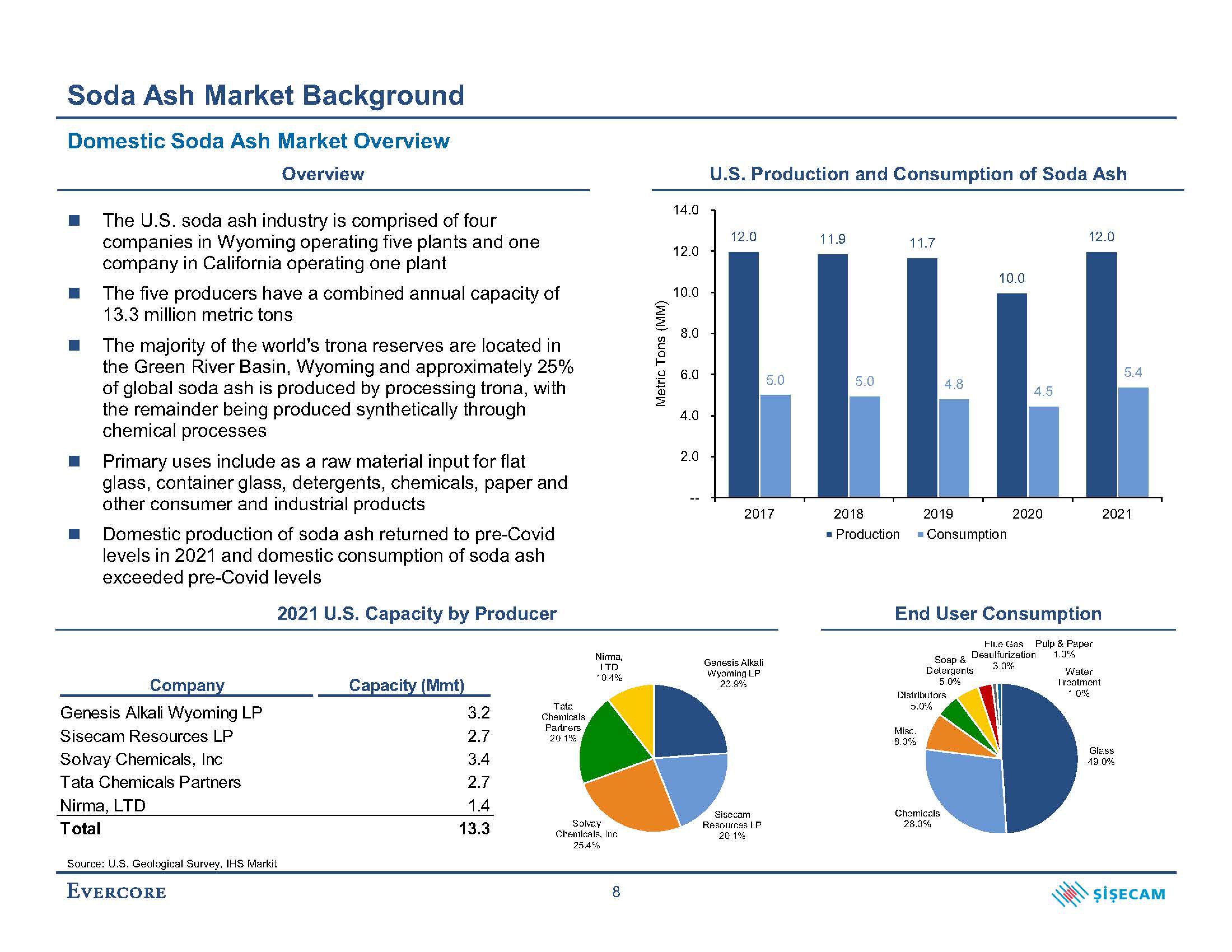

Domestic Soda Ash Market Overview

Overview

The U.S. soda ash industry is comprised of four

companies in Wyoming operating five plants and one

company in California operating one plant

The five producers have a combined annual capacity of

13.3 million metric tons

The majority of the world's trona reserves are located in

the Green River Basin, Wyoming and approximately 25%

of global soda ash is produced by processing trona, with

the remainder being produced synthetically through

chemical processes

Primary uses include as a raw material input for flat

glass, container glass, detergents, chemicals, paper and

other consumer and industrial products

Domestic production of soda ash returned to pre-Covid

levels in 2021 and domestic consumption of soda ash

exceeded pre-Covid levels

2021 U.S. Capacity by Producer

Company

Genesis Alkali Wyoming LP

Sisecam Resources LP

Solvay Chemicals, Inc

Tata Chemicals Partners

Nirma, LTD

Total

Source: U.S. Geological Survey, IHS Markit

EVERCORE

Capacity (Mmt)

3.2

2.7

3.4

2.7

1.4

13.3

Tata

Chemicals

Partners

20.1%

Nirma,

LTD

10.4%

Solvay

Chemicals, Inc

25.4%

8

Metric Tons (MM)

14.0

12.0

10.0

8.0

6.0

4.0

2.0

U.S. Production and Consumption of Soda Ash

12.0

2017

Genesis Alkali

Wyoming LP

23.9%

5.0

Sisecam

Resources LP

20.1%

11.9

5.0

11.7

4.8

2018

2019

■ Production ■ Consumption

Misc.

8.0%

Soap &

Detergents

5.0%

Distributors

5.0%

10.0

Chemicals

28.0%

4.5

End User Consumption

Flue Gas Pulp & Paper

Desulfurization 1.0%

3.0%

2020

12.0

Water

Treatment.

1.0%

2021

5.4

Glass

49.0%

ŞİŞECAMView entire presentation