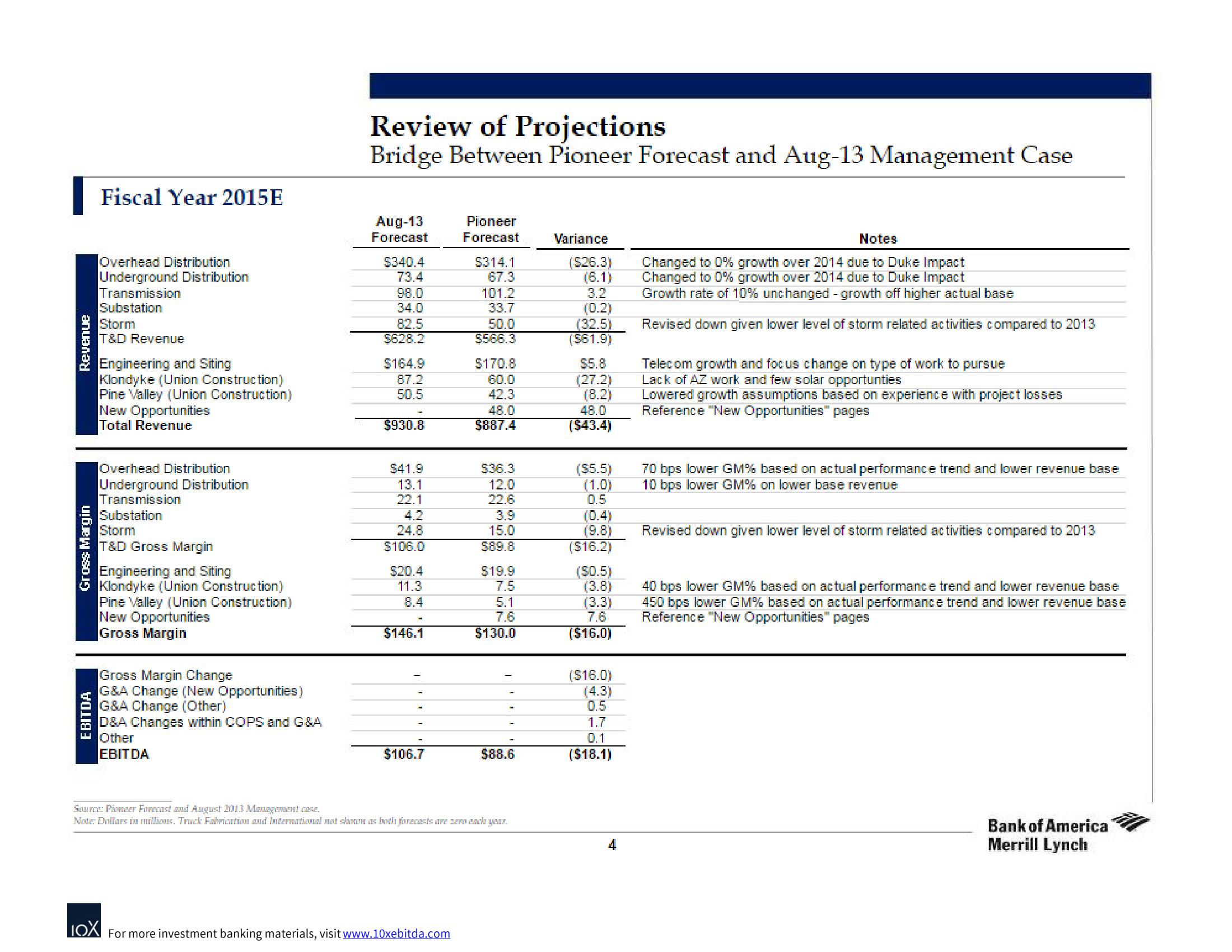

Bank of America Investment Banking Pitch Book

Revenue

Gross Margin

EBITDA

Fiscal Year 2015E

Overhead Distribution

Underground Distribution

Transmission

Substation

Storm

T&D Revenue

Engineering and Siting

Klondyke (Union Construction)

Pine Valley (Union Construction)

New Opportunities

Total Revenue

Overhead Distribution

Underground Distribution

Transmission

Substation

Storm

T&D Gross Margin

Engineering and Siting

Klondyke (Union Construction)

Pine Valley (Union Construction)

New Opportunities

Gross Margin

Gross Margin Change

G&A Change (New Opportunities)

G&A Change (Other)

D&A Changes within COPS and G&A

Other

EBITDA

Review of Projections

Bridge Between Pioneer Forecast and Aug-13 Management Case

Aug-13

Forecast

$340.4

73.4

98.0

34.0

82.5

$628.2

$164.9

87.2

50.5

$930.8

$41.9

13.1

22.1

24.8

$106.0

$20.4

11.3

$146.1

$106.7

Pioneer

Forecast

LOX For more investment banking materials, visit www.10xebitda.com

$314.1

67.3

101.2

33.7

50.0

$566.3

$170.8

60.0

42.3

48.0

$887.4

536.3

12.0

22.6

15.0

$89.8

$19.9

7.5

5.1

7.6

$130.0

$88.6

Source: Pioneer Forecast and August 2013 Management case.

Note: Dollars in millions. Track Fabrication and International not shown as both forecasts are zero each year..

Variance

($26.3)

(6.1)

3.2

(0.2)

(32.5)

($61.9)

$5.8

(27.2)

(8.2)

48.0

($43.4)

($5.5)

(1.0)

0.5

(0.4)

(9.8)

($16.2)

($0.5)

(3.8)

(3.3)

7.6

($16.0)

($16.0)

(4.3)

0.5

1.7

0.1

($18.1)

4

Notes

Changed to 0% growth over 2014 due to Duke Impact

Changed to 0% growth over 2014 due to Duke Impact

Growth rate of 10% unchanged - growth off higher actual base

Revised down given lower level of storm related activities compared to 2013

Telecom growth and focus change on type of work to pursue

Lack of Az work and few solar opportunties

Lowered growth assumptions based on experience with project losses

Reference "New Opportunities" pages

70 bps lower GM% based on actual performance trend and lower revenue base

10 bps lower GM% on lower base revenue

Revised down given lower level of storm related activities compared to 2013

40 bps lower GM% based on actual performance trend and lower revenue base

450 bps lower GM% based on actual performance trend and lower revenue base

Reference "New Opportunities" pages

Bank of America

Merrill LynchView entire presentation