WeWork Results Presentation Deck

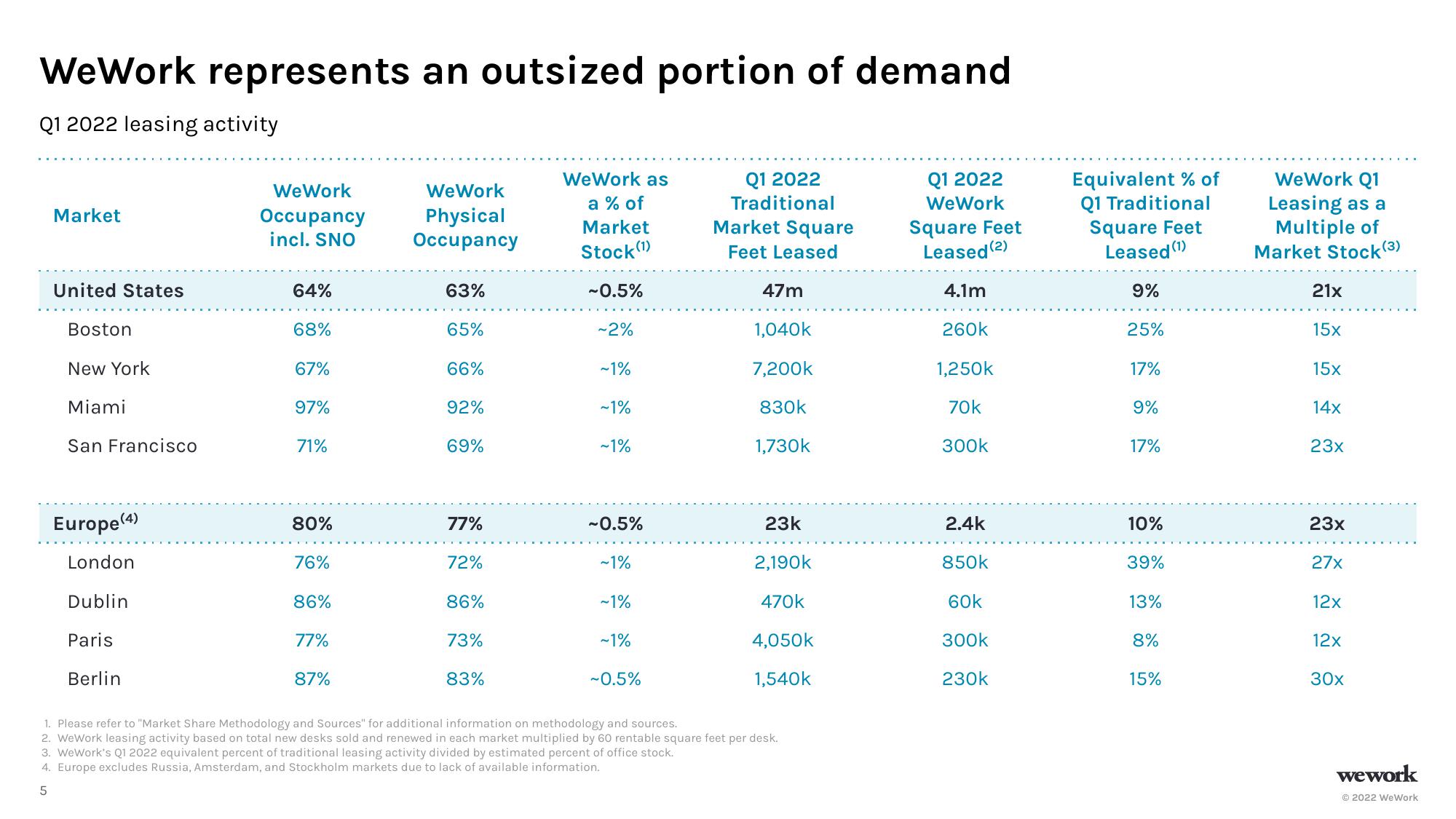

WeWork represents an outsized portion of demand

Q1 2022 leasing activity

Market

United States

Boston

New York

Miami

San Francisco

Europe (4)

London

Dublin

Paris

Berlin

WeWork

Occupancy

incl. SNO

64%

68%

67%

97%

71%

80%

76%

86%

77%

87%

WeWork

Physical

Occupancy

63%

65%

66%

92%

69%

77%

72%

86%

73%

83%

WeWork as

a % of

Market

Stock (1)

~0.5%

~2%

~1%

~1%

~1%

~0.5%

~1%

~1%

~1%

~0.5%

Q1 2022

Traditional

Market Square

Feet Leased

47m

1,040k

7,200k

830k

1,730k

23k

2,190K

470k

4,050k

1,540k

1. Please refer to "Market Share Methodology and Sources" for additional information on methodology and sources.

2. WeWork leasing activity based on total new desks sold and renewed in each market multiplied by 60 rentable square feet per desk.

3. WeWork's Q1 2022 equivalent percent of traditional leasing activity divided by estimated percent of office stock.

4. Europe excludes Russia, Amsterdam, and Stockholm markets due to lack of available information.

5

Q1 2022

WeWork

Square Feet

Leased (2)

4.1m

260k

1,250k

70k

300k

2.4k

850k

60k

300k

230k

Equivalent % of

Q1 Traditional

Square Feet

Leased (¹)

9%

25%

17%

9%

17%

10%

39%

13%

8%

15%

WeWork Q1

Leasing as a

Multiple of

Market Stock (3)

21x

15x

15x

14x

23x

23x

27x

12x

12x

30x

wework

Ⓒ2022 WeWorkView entire presentation