Butterfly SPAC Presentation Deck

Transaction Overview

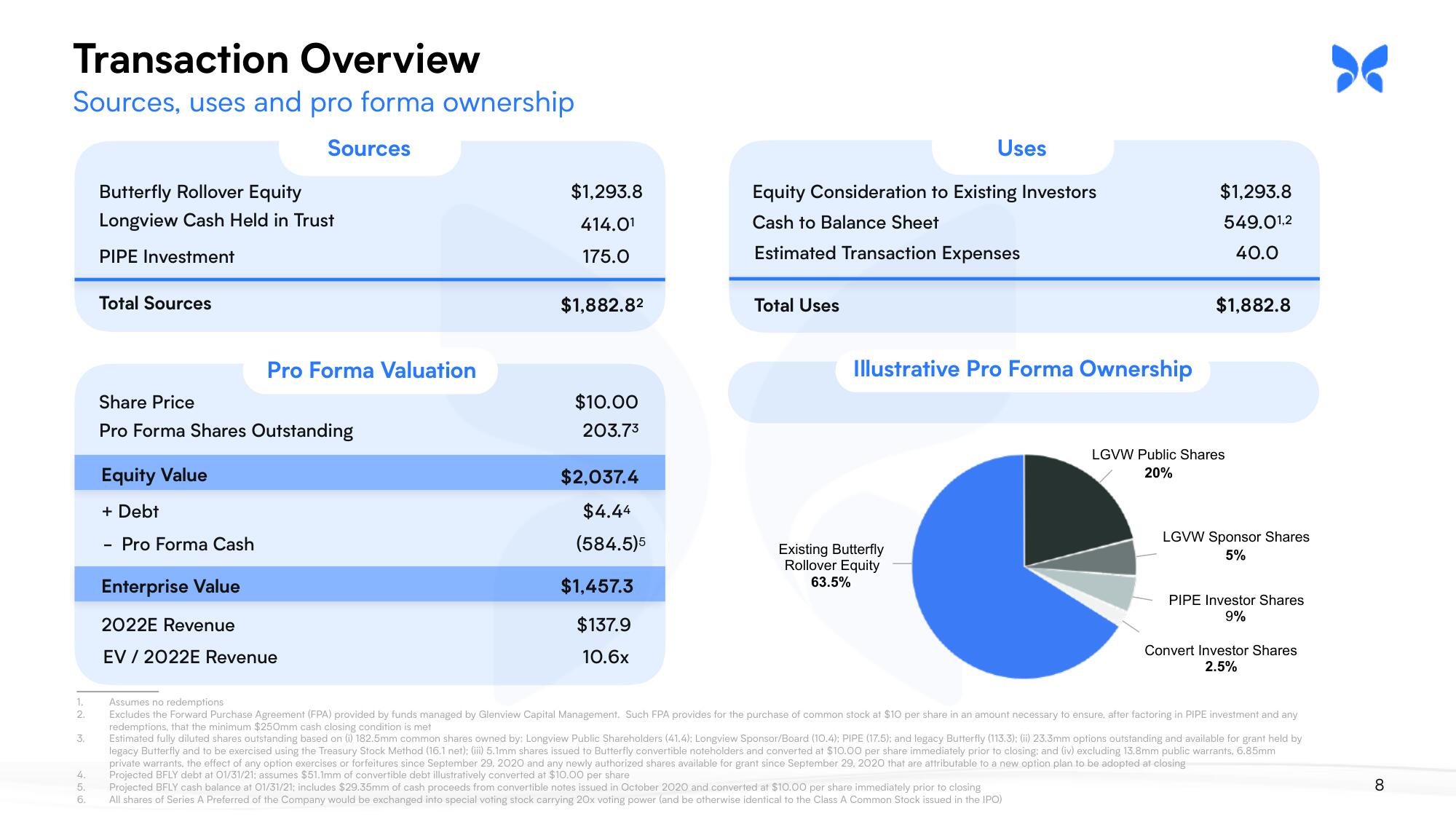

Sources, uses and pro forma ownership

Sources

1.

2.

3.

4.

5.

6.

Butterfly Rollover Equity

Longview Cash Held in Trust

PIPE Investment

Total Sources

Share Price

Pro Forma Shares Outstanding

Equity Value

+ Debt

Pro Forma Valuation

Pro Forma Cash

Enterprise Value

2022E Revenue

EV / 2022E Revenue

$1,293.8

414.0¹

175.0

$1,882.8²

$10.00

203.73

$2,037.4

$4.44

(584.5)5

$1,457.3

$137.9

10.6x

Equity Consideration to Existing Investors

Cash to Balance Sheet

Estimated Transaction Expenses

Total Uses

Uses

Illustrative Pro Forma Ownership

Existing Butterfly

Rollover Equity

63.5%

$1,293.8

549.01.2

40.0

$1,882.8

LGVW Public Shares

20%

LGVW Sponsor Shares

5%

PIPE Investor Shares

9%

Convert Investor Shares

2.5%

Assumes no redemptions

Excludes the Forward Purchase Agreement (FPA) provided by funds managed by Glenview Capital Management. Such FPA provides for the purchase of common stock at $10 per share in an amount necessary to ensure, after factoring in PIPE investment and any

redemptions, that the minimum $250mm cash closing condition is met

Estimated fully diluted shares outstanding based on (i) 182.5mm common shares owned by: Longview Public Shareholders (41.4); Longview Sponsor/Board (10.4); PIPE (17.5); and legacy Butterfly (113.3); (ii) 23.3mm options outstanding and available for grant held by

legacy Butterfly and to be exercised using the Treasury Stock Method (16.1 net); (iii) 5.1mm shares issued to Butterfly convertible noteholders and converted at $10.00 per share immediately prior to closing; and (iv) excluding 13.8mm public warrants, 6.85mm

private warrants, the effect of any option exercises or forfeitures since September 29, 2020 and any newly authorized shares available for grant since September 29, 2020 that are attributable to a new option plan to be adopted at closing

Projected BFLY debt at 01/31/21: assumes $51.1mm of convertible debt illustratively converted at $10.00 per share

Projected BFLY cash balance at 01/31/21; includes $29.35mm of cash proceeds from convertible notes issued in October 2020 and converted at $10.00 per share immediately prior to closing

All shares of Series A Preferred of the Company would be exchanged into special voting stock carrying 20x voting power (and be otherwise identical to the Class A Common Stock issued in the IPO)

8View entire presentation