Baird Investment Banking Pitch Book

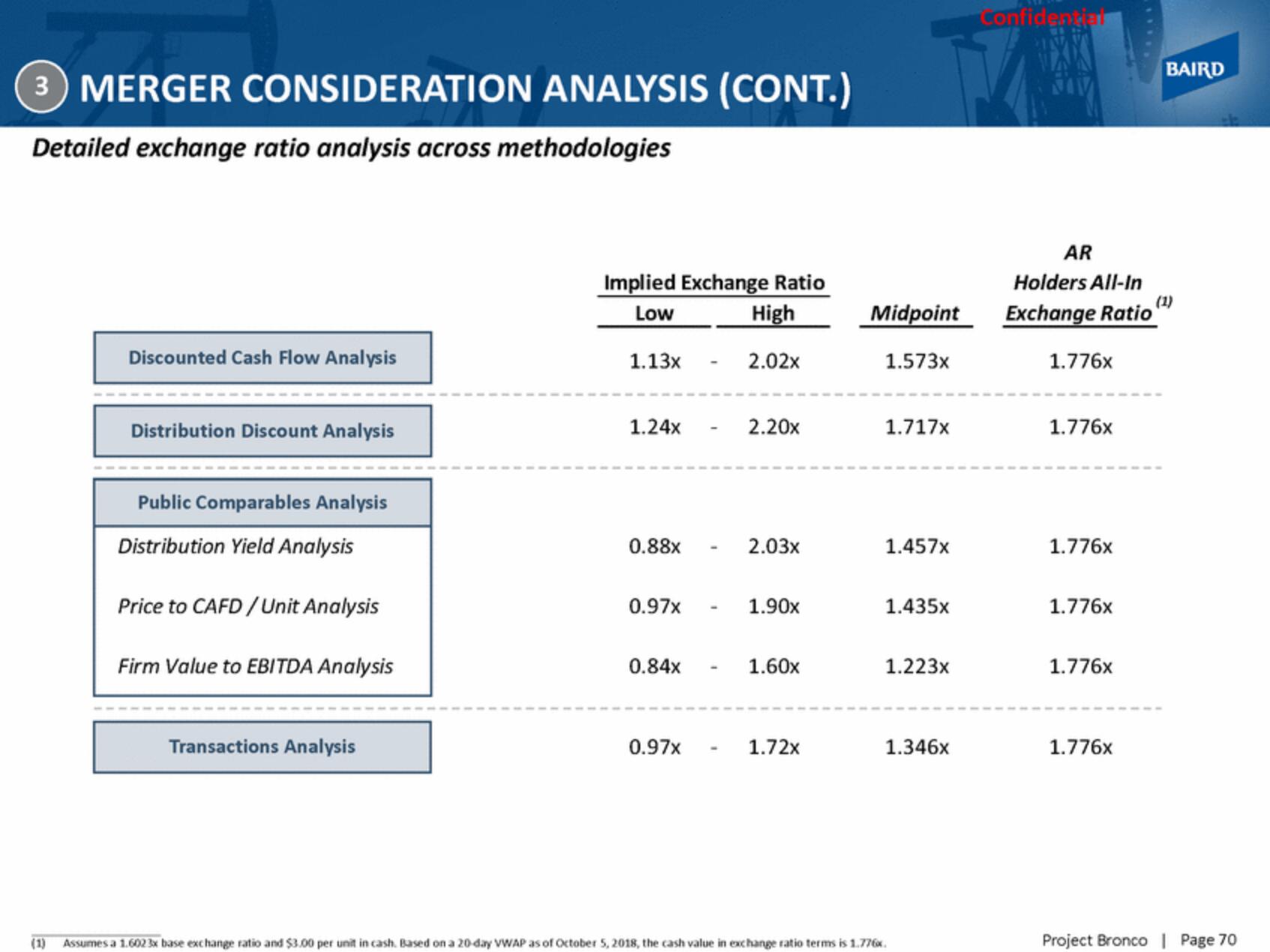

3 MERGER CONSIDERATION ANALYSIS (CONT.)

Detailed exchange ratio analysis across methodologies

(1)

Discounted Cash Flow Analysis

Distribution Discount Analysis

Public Comparables Analysis

Distribution Yield Analysis

Price to CAFD/Unit Analysis

Firm Value to EBITDA Analysis

Transactions Analysis

Implied Exchange Ratio

Low

High

2.02x

1.13x

1.24x

0.88x

0.97x

0.84x

0.97x

-

2.20x

2.03x

1.90x

1.60x

1.72x

Midpoint

1.573x

1.717x

1.457x

1.435x

1.223x

1.346x

Assumes a 1.602 3x base exchange ratio and $3.00 per unit in cash. Based on a 20-day VWAP as of October 5, 2018, the cash value in exchange ratio terms is 1.776.

Confidential

AR

Holders All-In

Exchange Ratio

1.776x

1.776x

1.776x

1.776x

1.776x

1.776x

BAIRD

(1)

Project Bronco | Page 70View entire presentation