Blend Results Presentation Deck

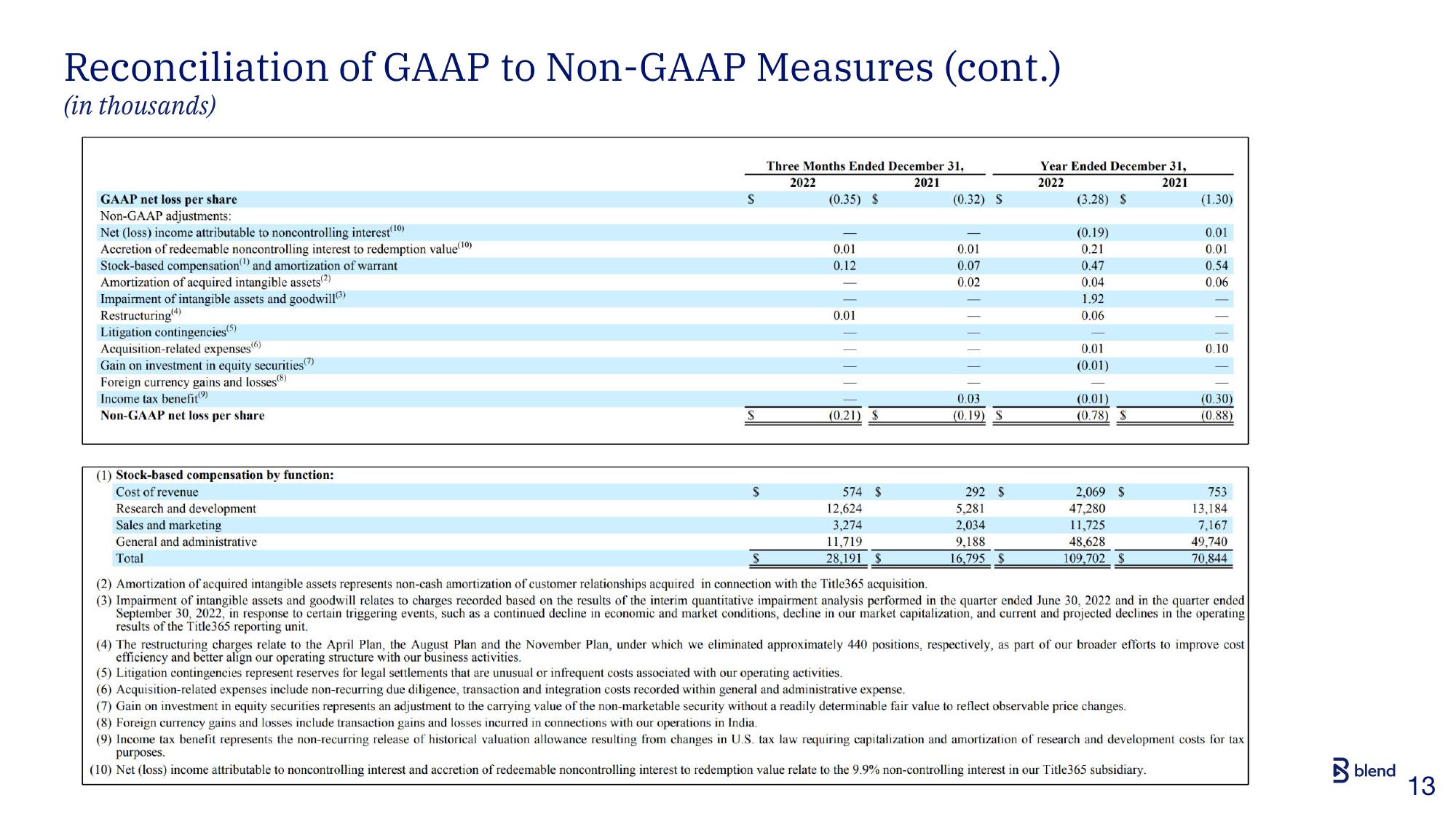

Reconciliation of GAAP to Non-GAAP Measures (cont.)

(in thousands)

GAAP net loss per share

Non-GAAP adjustments:

Net (loss) income attributable to noncontrolling interest (10)

Accretion of redeemable noncontrolling interest to redemption value (10)

Stock-based compensation and amortization of warrant

Amortization of acquired intangible assets(2)

Impairment of intangible assets and goodwill (3)

Restructuring (4)

Litigation contingencies (5)

Acquisition-related expenses(6)

Gain on investment in equity securities' (7)

Foreign currency gains and losses(8)

Income tax benefit (⁹)

Non-GAAP net loss per share

(1) Stock-based compensation by function:

Cost of revenue

Research and development

Sales and marketing

General and administrative

Total

$

Three Months Ended December 31,

2021

2022

(0.35) $

0.01

0.12

0.01

(0.21)

574 $

12,624

3,274

11,719

28,191 $

(0.32) S

0.01

0.07

0.02

0.03

(0.19) S

292 S

5,281

2,034

9,188

16,795 $

Year Ended December 31,

2022

2021

(3.28) $

(0.19)

0.21

0.47

0.04

1.92

0.06

0.01

(0.01)

(0.01)

(0.78) $

2,069 S

47,280

11,725

48,628

109,702

(1.30)

0.01

0.01

0.54

0.06

0.10

(0.30)

(0.88)

753

13,184

7,167

49,740

70,844

(2) Amortization of acquired intangible assets represents non-cash amortization of customer relationships acquired in connection with the Title365 acquisition.

(3) Impairment of intangible assets and goodwill relates to charges recorded based on the results of the interim quantitative impairment analysis performed in the quarter ended June 30, 2022 and in the quarter ended

September 30, 2022, in response to certain triggering events, such as a continued decline in economic and market conditions, decline in our market capitalization, and current and projected declines in the operating

results of the Title 365 reporting unit.

(4) The restructuring charges relate to the April Plan, the August Plan and the November Plan, under which we eliminated approximately 440 positions, respectively, as part of our broader efforts to improve cost

efficiency and better align our operating structure with our business activities.

(5) Litigation contingencies represent reserves for legal settlements that are unusual or infrequent costs associated with our operating activities.

(6) Acquisition-related expenses include non-recurring due diligence, transaction and integration costs recorded within general and administrative expense.

(7) Gain on investment in equity securities represents an adjustment to the carrying value of the non-marketable security without a readily determinable fair value to reflect observable price changes.

(8) Foreign currency gains and losses include transaction gains and losses incurred in connections with our operations in India.

(9) Income tax benefit represents the non-recurring release of historical valuation allowance resulting from changes in U.S. tax law requiring capitalization and amortization of research and development costs for tax

purposes.

(10) Net (loss) income attributable to noncontrolling interest and accretion of redeemable noncontrolling interest to redemption value relate to the 9.9% non-controlling interest in our Title365 subsidiary.

blend

13View entire presentation