Spirit Mergers and Acquisitions Presentation Deck

> 》》》

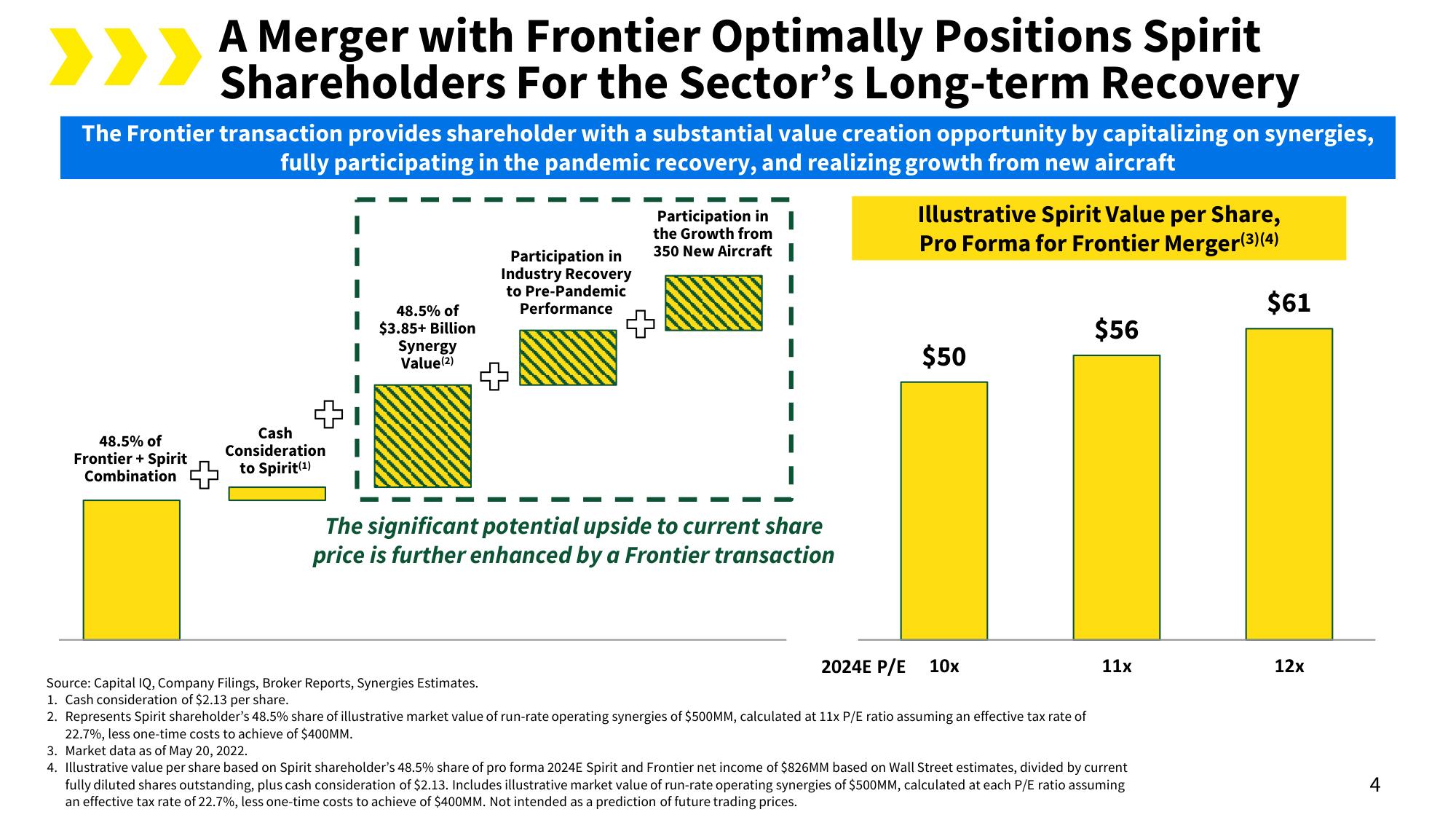

A Merger with Frontier Optimally Positions Spirit

Shareholders For the Sector's Long-term Recovery

The Frontier transaction provides shareholder with a substantial value creation opportunity by capitalizing on synergies,

fully participating in the pandemic recovery, and realizing growth from new aircraft

48.5% of

Frontier + Spirit

Combination

Cash

Consideration

to Spirit (¹)

1

48.5% of

$3.85+ Billion

Synergy

Value (2)

Participation in

Industry Recovery

to Pre-Pandemic

Performance

+

Participation in

the Growth from

350 New Aircraft |

The significant potential upside to current share

price is further enhanced by a Frontier transaction

Illustrative Spirit Value per Share,

Pro Forma for Frontier Merger(3) (4)

$61

$50

2024E P/E 10x

$56

11x

Source: Capital IQ, Company Filings, Broker Reports, Synergies Estimates.

1. Cash consideration of $2.13 per share.

2. Represents Spirit shareholder's 48.5% share of illustrative market value of run-rate operating synergies of $500MM, calculated at 11x P/E ratio assuming an effective tax rate of

22.7%, less one-time costs to achieve of $400MM.

3. Market data as of May 20, 2022.

4. Illustrative value per share based on Spirit shareholder's 48.5% share of pro forma 2024E Spirit and Frontier net income of $826MM based on Wall Street estimates, divided by current

fully diluted shares outstanding, plus cash consideration of $2.13. Includes illustrative market value of run-rate operating synergies of $500MM, calculated at each P/E ratio assuming

an effective tax rate of 22.7%, less one-time costs to achieve of $400MM. Not intended as a prediction of future trading prices.

12x

4View entire presentation