Atalaya Risk Management Overview

Consumer & Commercial Finance Market Opportunity

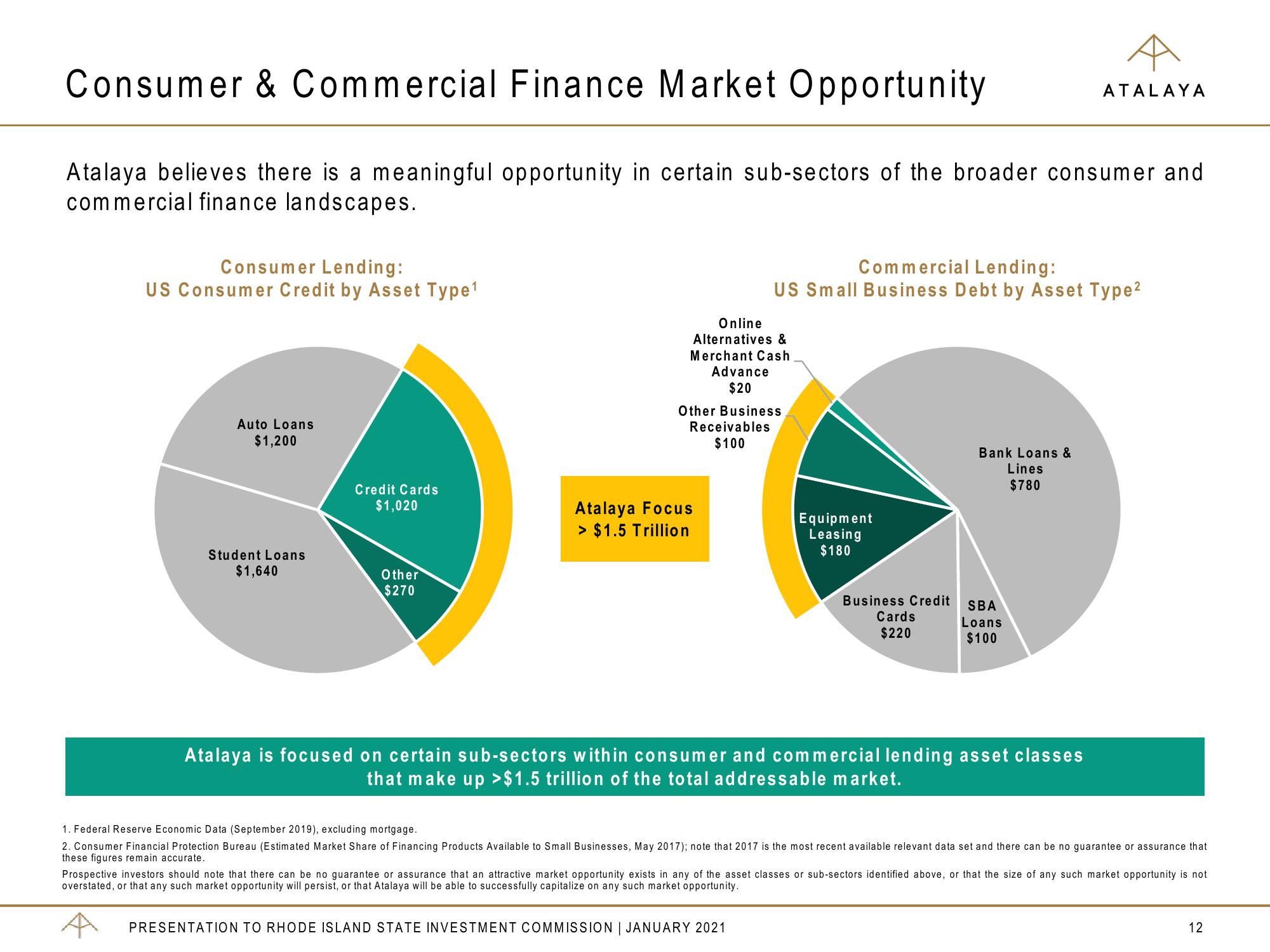

Atalaya believes there is a meaningful opportunity in certain sub-sectors of the broader consumer and

commercial finance landscapes.

Consumer Lending:

US Consumer Credit by Asset Type¹

Auto Loans

$1,200

Student

bans

$1,640

Credit Cards

$1,020

Other

$270

Online

Alternatives &

Merchant Cash

Advance

$20

Other Business

Receivables

$100

Atalaya Focus

> $1.5 Trillion

Commercial Lending:

US Small Business Debt by Asset Type²

Equipment

Leasing

$180

Business Credit

Cards

$220

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

Bank Loans &

Lines

$780

SBA

Loans

$100

Atalaya is focused on certain sub-sectors within consumer and commercial lending asset classes

that make up >$1.5 trillion of the total addressable market.

ATALAYA

1. Federal Reserve Economic Data (September 2019), excluding mortgage.

2. Consumer Financial Protection Bureau (Estimated Market Share of Financing Products Available to Small Businesses, May 2017); note that 2017 is the most recent available relevant data set and there can be no guarantee or assurance that

these figures remain accurate.

Prospective investors should note that there can be no guarantee or assurance that an attractive market opportunity exists in any of the asset classes or sub-sectors identified above, or that the size of any such market opportunity is not

overstated, or that any such market opportunity will persist, or that Atalaya will be able to successfully capitalize on any such market opportunity.

12View entire presentation