Lyft Results Presentation Deck

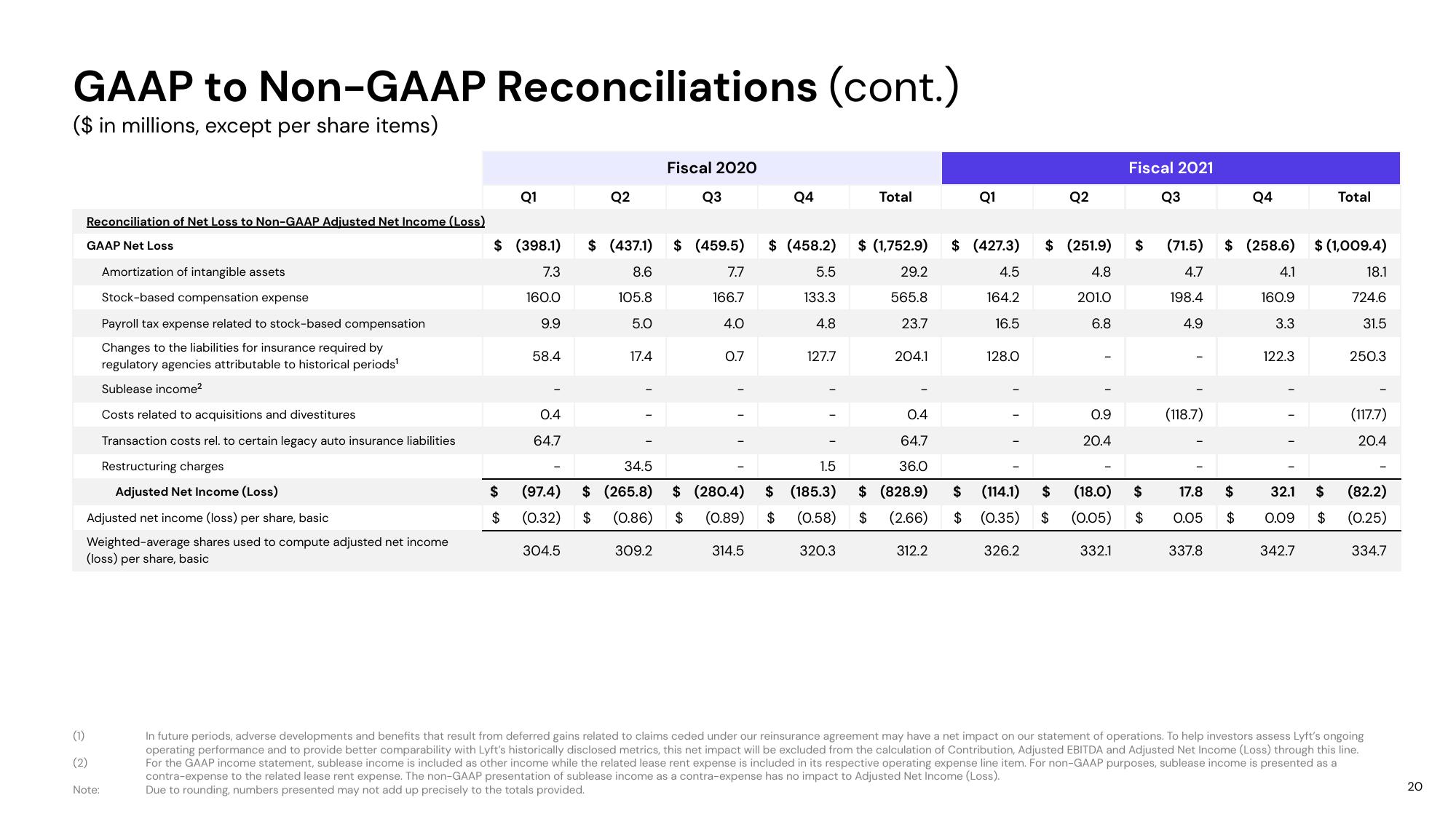

GAAP to Non-GAAP Reconciliations (cont.)

($ in millions, except per share items)

Reconciliation of Net Loss to Non-GAAP Adjusted Net Income (Loss)

GAAP Net Loss

Amortization of intangible assets

Stock-based compensation expense

Costs related to acquisitions and divestitures

Transaction costs rel. to certain legacy auto insurance liabilities

Restructuring charges

Adjusted Net Income (Loss)

Adjusted net income (loss) per share, basic

Weighted-average shares used to compute adjusted net income

(loss) per share, basic

(1)

(2)

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by

regulatory agencies attributable to historical periods¹

Sublease income²

Note:

$ (398.1)

7.3

160.0

9.9

$

Q1

$

58.4

0.4

64.7

Q2

304.5

Fiscal 2020

17.4

Q3

$ (437.1) $ (459.5)

8.6

105.8

5.0

7.7

166.7

4.0

0.7

Q4

314.5

$ (458.2)

5.5

133.3

4.8

127.7

0.4

64.7

34.5

1.5

36.0

(97.4) $ (265.8) $ (280.4) $ (185.3) $ (828.9)

(0.32) $ (0.86) $ (0.89) $ (0.58) $ (2.66)

309.2

Total

320.3

$ (1,752.9)

29.2

565.8

23.7

204.1

312.2

Q1

$ (427.3)

4.5

164.2

16.5

128.0

$ (114.1) $

$ (0.35) $

326.2

|

Q2

$ (251.9) $

4.8

201.0

6.8

0.9

20.4

(18.0)

(0.05)

Fiscal 2021

Q3

332.1

$

$

(71.5)

4.7

198.4

4.9

(118.7)

Q4

$ (258.6)

4.1

160.9

3.3

17.8 $

0.05 $

337.8

122.3

32.1 $

0.09 $

342.7

Total

$ (1,009.4)

18.1

724.6

31.5

250.3

(117.7)

20.4

(82.2)

(0.25)

334.7

In future periods, adverse developments and benefits that result from deferred gains related to claims ceded under our reinsurance agreement may have a net impact on our statement of operations. To help investors assess Lyft's ongoing

operating performance and to provide better comparability with Lyft's historically disclosed metrics, this net impact will be excluded from the calculation of Contribution, Adjusted EBITDA and Adjusted Net Income (Loss) through this line.

For the GAAP income statement, sublease income is included as other income while the related lease rent expense is included in its respective operating expense line item. For non-GAAP purposes, sublease income is presented as a

contra-expense to the related lease rent expense. The non-GAAP presentation of sublease income as a contra-expense has no impact to Adjusted Net Income (Loss).

Due to rounding, numbers presented may not add up precisely to the totals provided.

20View entire presentation