Tudor, Pickering, Holt & Co Investment Banking

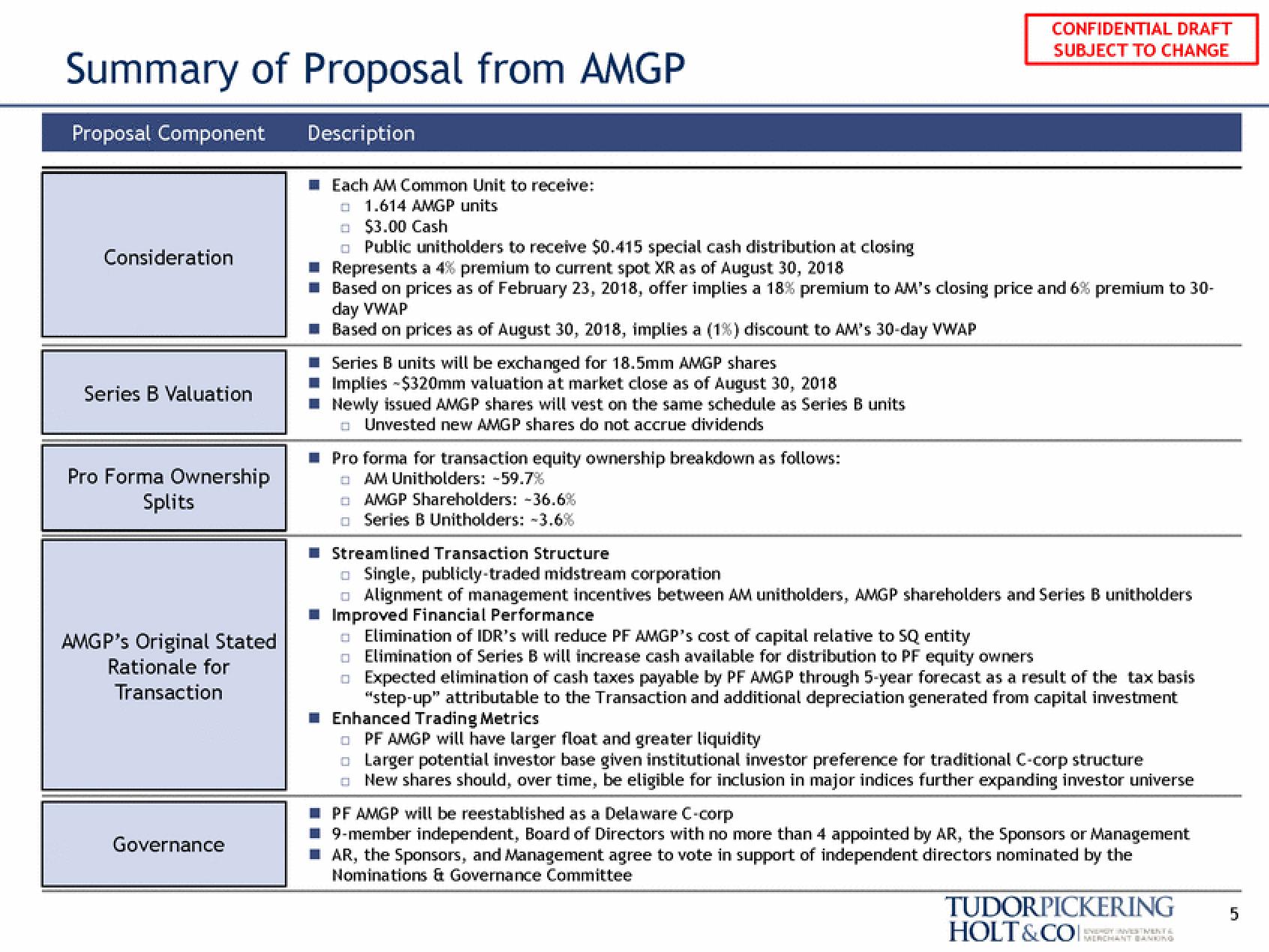

Summary of Proposal from AMGP

Description

Proposal Component

Consideration

Series B Valuation

Pro Forma Ownership

Splits

AMGP's Original Stated

Rationale for

Transaction

Governance

Each AM Common Unit to receive:

1.614 AMGP units

$3.00 Cash

Public unitholders to receive $0.415 special cash distribution at closing

■ Represents a 4% premium to current spot XR as of August 30, 2018

Based on prices as of February 23, 2018, offer implies a 18% premium to AM's closing price and 6% premium to 30-

day VWAP

Based on prices as of August 30, 2018, implies a (1%) discount to AM's 30-day VWAP

Series B units will be exchanged for 18.5mm AMGP shares

■ Implies -$320mm valuation at market close as of August 30, 2018

Newly issued AMGP shares will vest on the same schedule as Series B units

□ Unvested new AMGP shares do not accrue dividends

Pro forma for transaction equity ownership breakdown as follows:

AM Unitholders: -59.7%

AMGP Shareholders: -36.6%

Series B Unitholders: -3.6%

■ Streamlined Transaction Structure

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

Single, publicly-traded midstream corporation

□Alignment of management incentives between AM unitholders, AMGP shareholders and Series B unitholders

Improved Financial Performance

☐ Elimination of IDR's will reduce PF AMGP's cost of capital relative to SQ entity

Elimination of Serie

will increase cash available for distribution to PF equity owners

☐ Expected elimination of cash taxes payable by PF AMGP through 5-year forecast as a result of the tax basis

"step-up" attributable to the Transaction and additional depreciation generated from capital investment

Enhanced Trading Metrics

PF AMGP will have larger float and greater liquidity

Larger potential investor base given institutional investor preference for traditional C-corp structure

□New shares should, over time, be eligible for inclusion in major indices further expanding investor universe

■PF AMGP will be reestablished as a Delaware C-corp

9-member independent, Board of Directors with no more than 4 appointed by AR, the Sponsors or Management

■AR, the Sponsors, and Management agree to vote in support of independent directors nominated by the

Nominations & Governance Committee

TUDORPICKERING

HOLT&COCHANT BANKING

5View entire presentation