PJT Partners Investment Banking Pitch Book

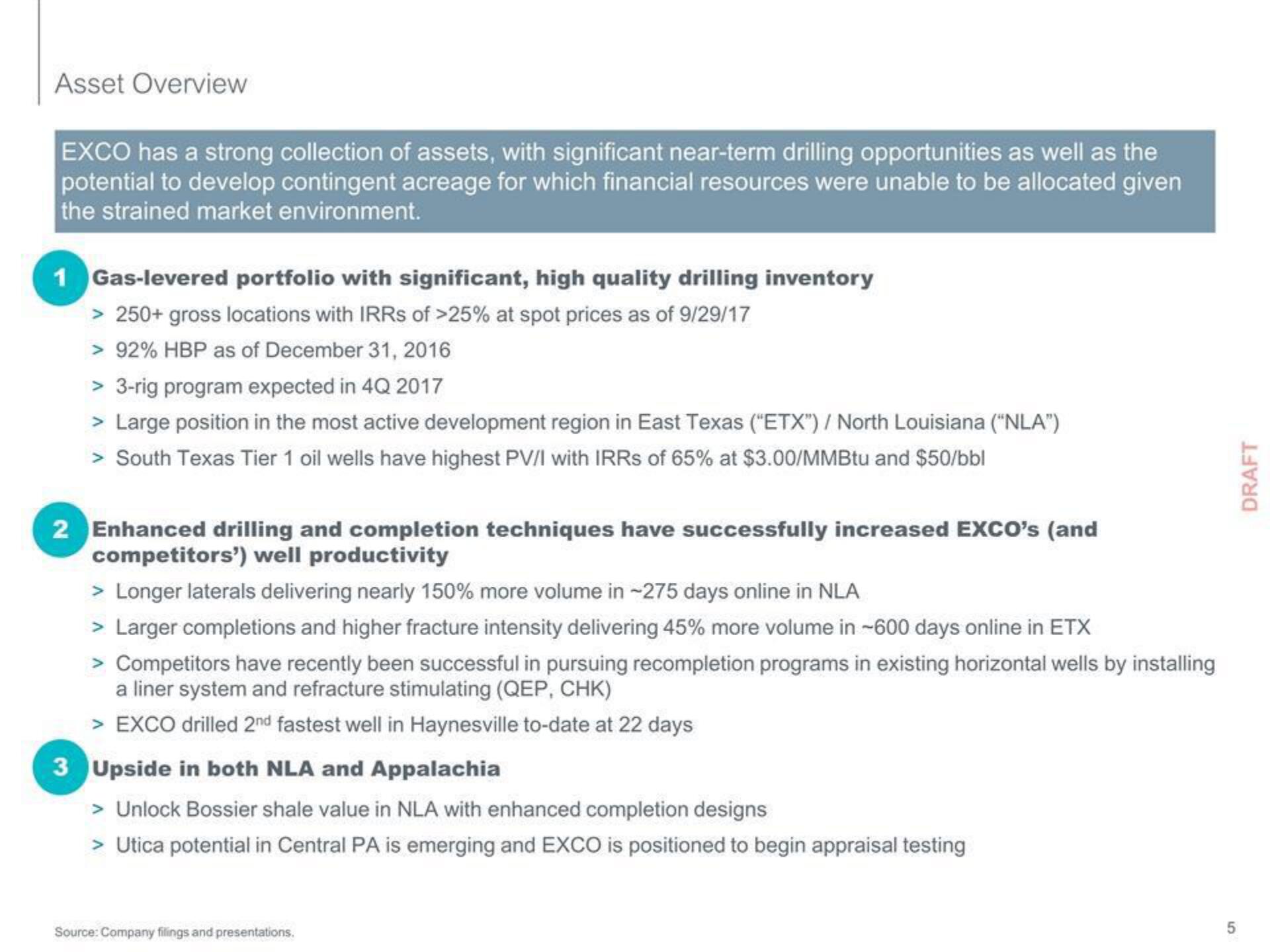

Asset Overview

EXCO has a strong collection of assets, with significant near-term drilling opportunities as well as the

potential to develop contingent acreage for which financial resources were unable to be allocated given

the strained market environment.

1 Gas-levered portfolio with significant, high quality drilling inventory

> 250+ gross locations with IRRs of >25% at spot prices as of 9/29/17

> 92% HBP as of December 31, 2016

> 3-rig program expected in 4Q 2017

> Large position in the most active development region in East Texas ("ETX") / North Louisiana ("NLA")

> South Texas Tier 1 oil wells have highest PV/I with IRRs of 65% at $3.00/MMBtu and $50/bbl

2 Enhanced drilling and completion techniques have successfully increased EXCO's (and

competitors') well productivity

> Longer laterals delivering nearly 150% more volume in -275 days online in NLA

> Larger completions and higher fracture intensity delivering 45% more volume in ~600 days online in ETX

> Competitors have recently been successful in pursuing recompletion programs in existing horizontal wells by installing

a liner system and refracture stimulating (QEP, CHK)

> EXCO drilled 2nd fastest well in Haynesville to-date at 22 days

3 Upside in both NLA and Appalachia

> Unlock Bossier shale value in NLA with enhanced completion designs

> Utica potential in Central PA is emerging and EXCO is positioned to begin appraisal testing

Source: Company filings and presentations.

5

DRAFTView entire presentation