Enact IPO Presentation Deck

Enact | Investor Presentation

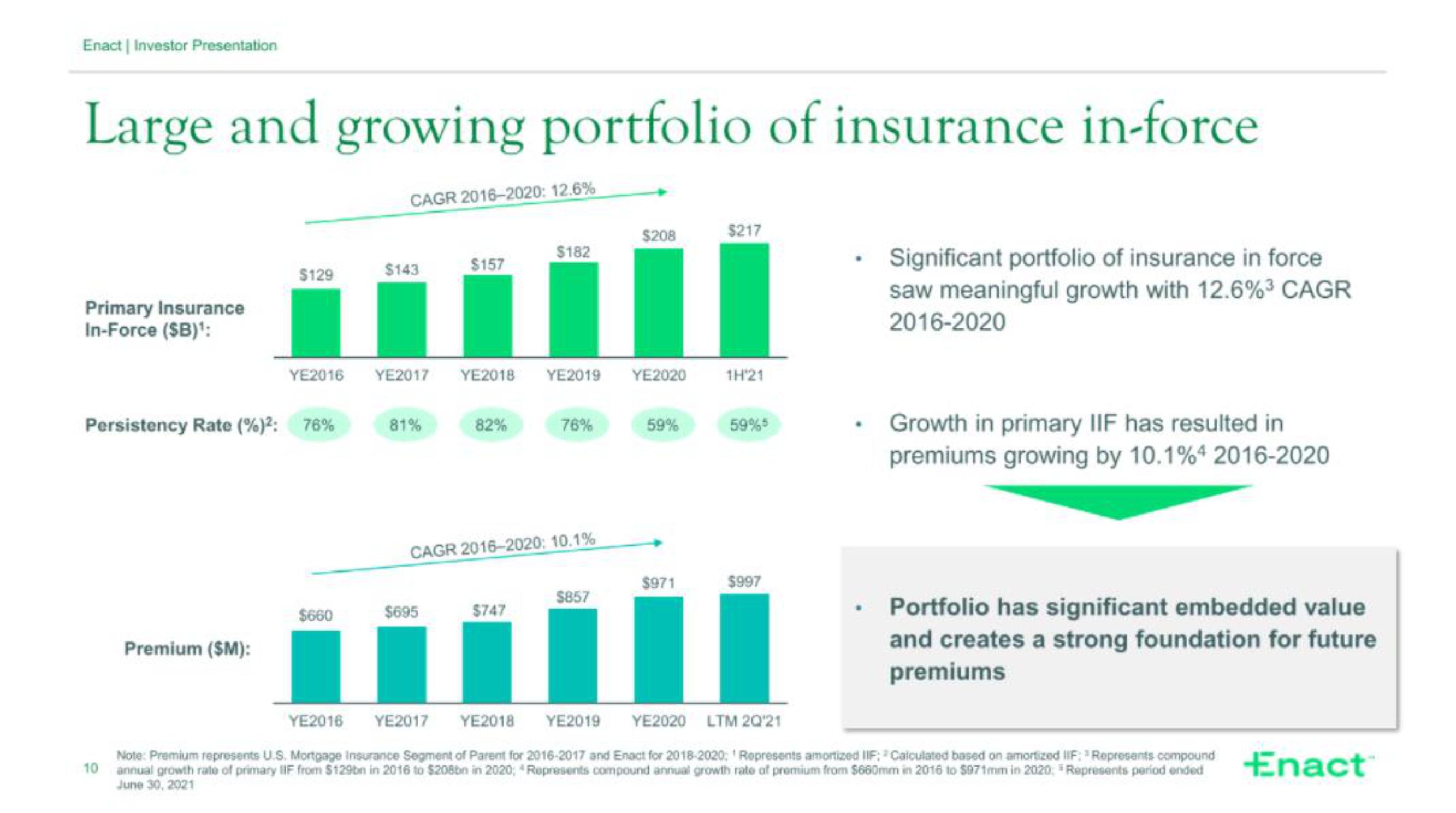

Large and growing portfolio of insurance in-force

Primary Insurance

In-Force (SB)¹:

10

$129

Persistency Rate (%)²: 76%

Premium ($M):

YE2016

$660

CAGR 2016-2020: 12.6%

$143

YE2017

81%

$157

$695

YE2018

82%

$182

$747

YE2019

CAGR 2016-2020: 10.1%

76%

$857

$208

YE2020 1H'21

59%

$217

$971

59%5

$997

.

Significant portfolio of insurance in force

saw meaningful growth with 12.6% ³ CAGR

2016-2020

Growth in primary IIF has resulted in

premiums growing by 10.1% 4 2016-2020

Portfolio has significant embedded value

and creates a strong foundation for future

premiums

YE2016 YE2017 YE2018 YE2019 YE2020 LTM 2Q¹21

Note: Premium represents U.S. Mortgage Insurance Segment of Parent for 2016-2017 and Enact for 2018-2020: Represents amortized IIF: Calculated based on amortized IIF: Represents compound

annual growth rate of primary IIF from $129bn in 2016 to $208bn in 2020; Represents compound annual growth rate of premium from $660mm in 2016 to $971mm in 2020: Represents period ended

June 30, 2021

EnactView entire presentation